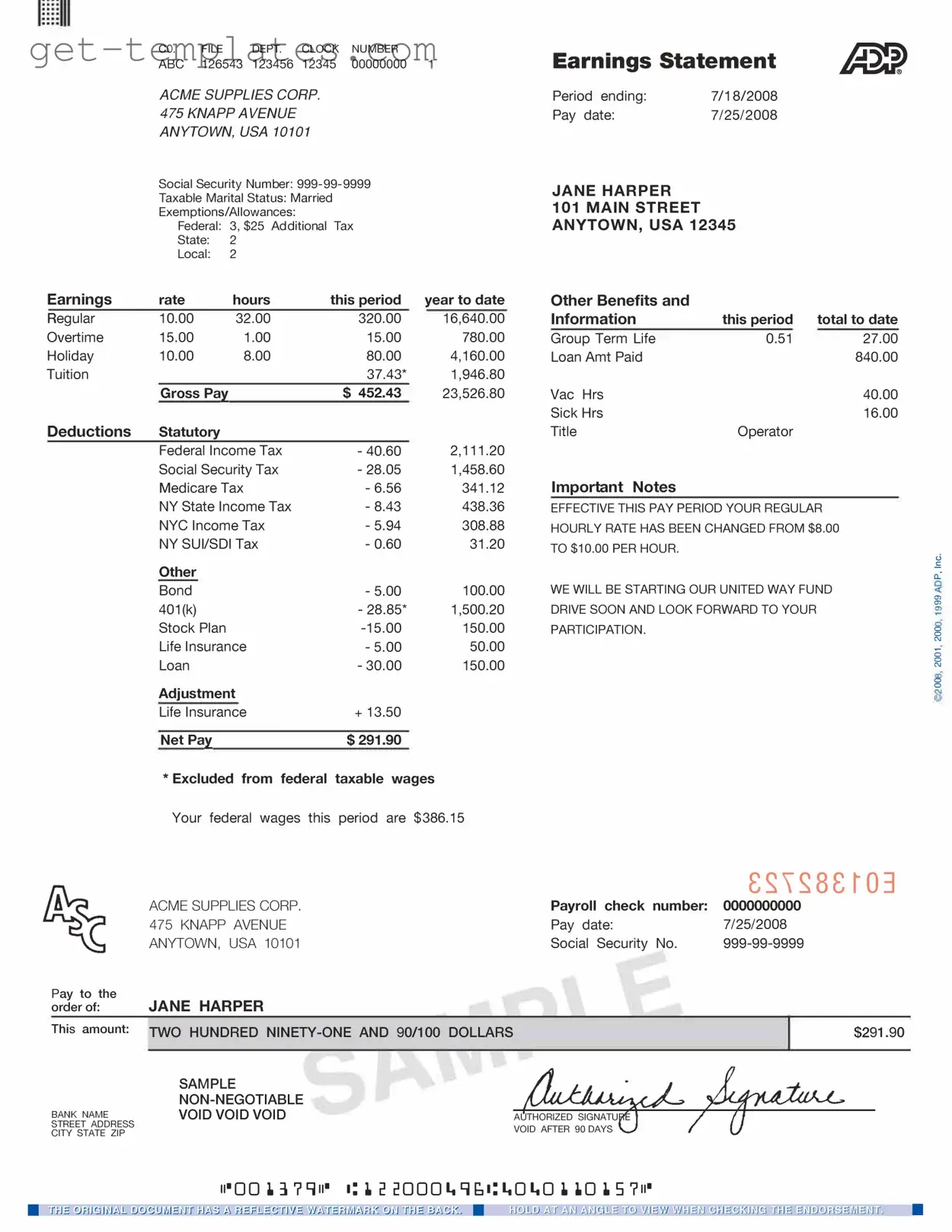

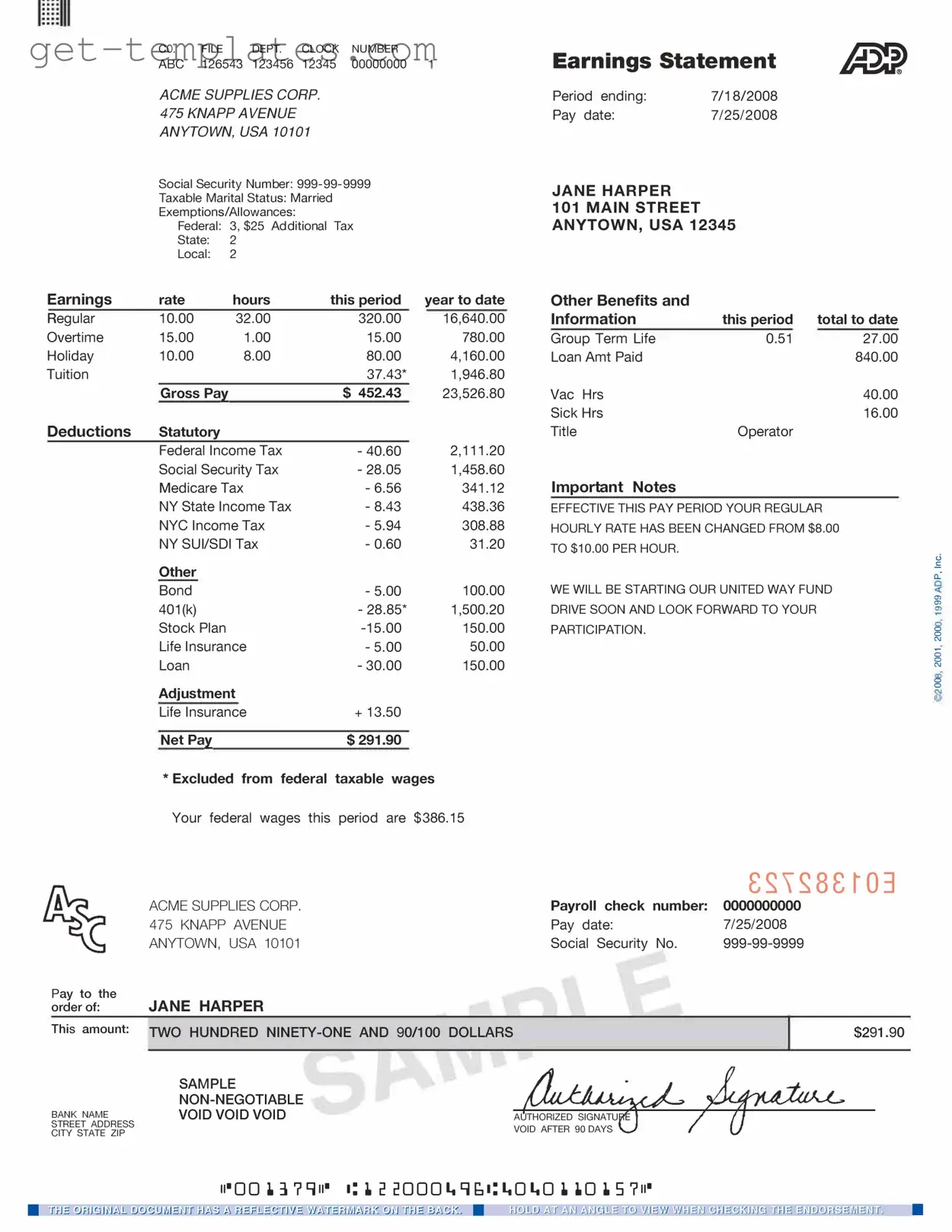

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It details gross pay, deductions, and net pay, allowing employees to understand their compensation and withholdings clearly.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. Simply log in using your credentials. If you are a first-time user, you may need to register for an account. Alternatively, your employer may provide physical copies of pay stubs upon request.

Your ADP Pay Stub includes several key pieces of information:

-

Employee name and identification number

-

Pay period dates

-

Gross earnings

-

Deductions (taxes, benefits, etc.)

-

Net pay

This information helps you verify your earnings and understand your deductions.

What should I do if I notice an error on my pay stub?

If you find an error, contact your employer's payroll department as soon as possible. They can assist you in resolving discrepancies. It is important to address these issues promptly to ensure accurate compensation.

How often are pay stubs issued?

Pay stubs are typically issued on a regular schedule, such as bi-weekly or monthly. Your employer will determine the frequency based on their payroll practices. Check with your HR department if you are unsure of the schedule.

Can I receive my pay stub electronically?

Yes, many employers offer electronic pay stubs through the ADP portal. This option allows for quick access and reduces paper usage. You can opt-in for electronic delivery by speaking with your HR representative.

What should I do if I cannot log into the ADP portal?

If you are having trouble logging in, first ensure you are using the correct username and password. If you have forgotten your password, use the password recovery option. If problems persist, contact ADP customer support for assistance.

Are pay stubs important for tax purposes?

Yes, pay stubs are essential for tax purposes. They provide a record of your earnings and withholdings throughout the year. You may need them when preparing your tax return or applying for loans and other financial services.

What should I do if I lose my pay stub?

If you lose your pay stub, you can retrieve it from the ADP portal if you have access. Alternatively, you can request a copy from your employer's payroll department. Keeping a digital or physical record of your pay stubs is advisable for future reference.