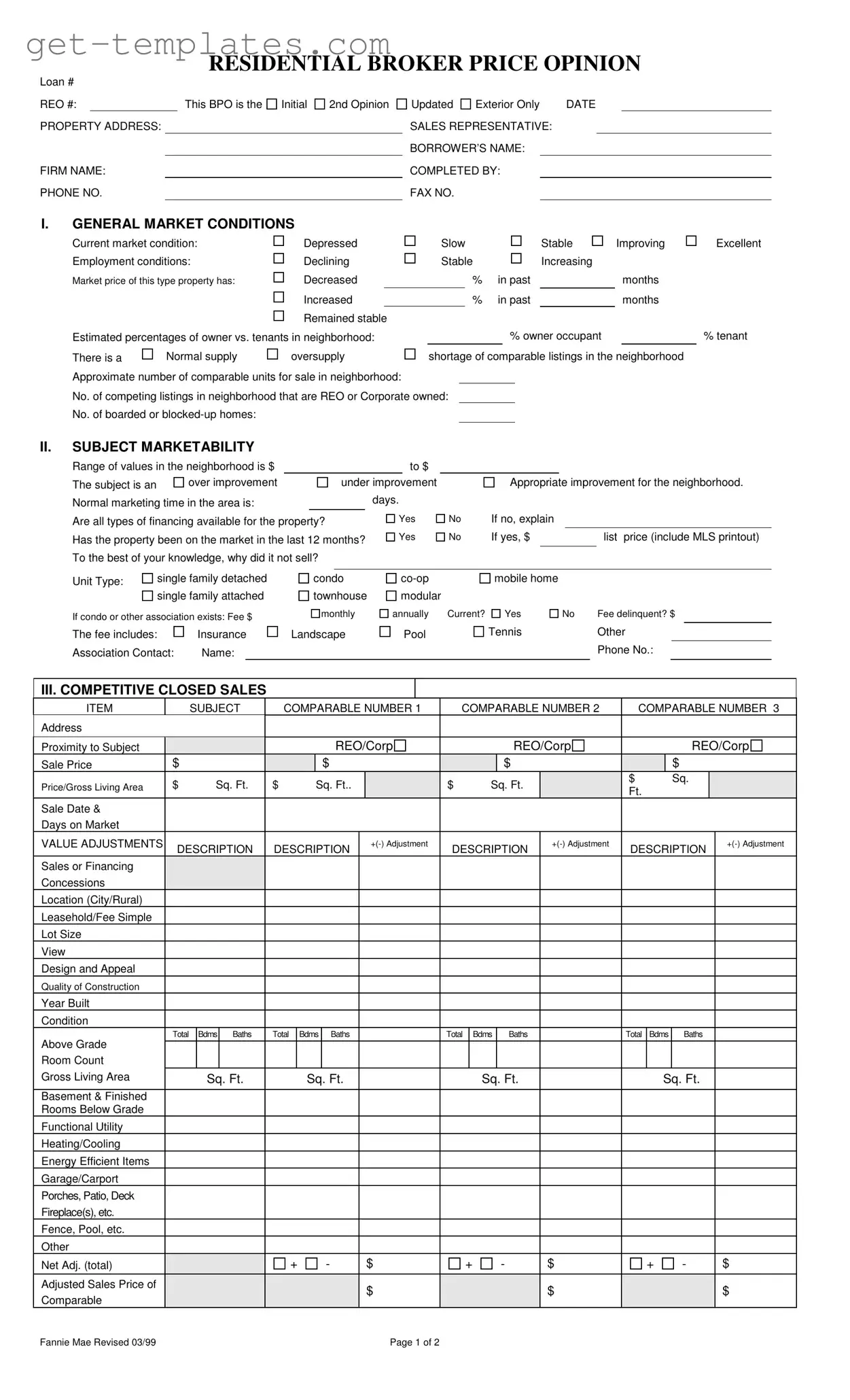

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is an estimate of the value of a property, typically provided by a licensed real estate broker. It is often used by lenders, banks, and other financial institutions to determine the market value of a property, especially in situations like foreclosures or short sales. The BPO takes into account various factors, including the property's condition, comparable sales, and current market conditions.

A BPO form typically includes several sections that cover general market conditions, the subject property's marketability, competitive closed sales, and marketing strategies. Specific details may include:

-

Property address and loan information

-

Current market conditions and employment status

-

Comparable sales data

-

Estimated repairs needed

-

Marketing strategy recommendations

How is the market value determined in a BPO?

The market value in a BPO is determined by analyzing recent sales of comparable properties in the area. Adjustments may be made based on differences in property features, condition, and market conditions. The BPO will also consider the overall market trends, including whether the market is stable, improving, or declining.

Who completes a Broker Price Opinion?

A licensed real estate broker or agent typically completes a Broker Price Opinion. They use their expertise and knowledge of the local market to provide an accurate estimate of the property's value. The broker may also take into account feedback from other agents and local market data.

How long does it take to complete a BPO?

The time it takes to complete a BPO can vary. Generally, it may take a few days to a week, depending on the complexity of the property and the availability of comparable sales data. Brokers often aim to provide a timely response to meet the needs of their clients.

Can a BPO be used in place of an appraisal?

A BPO cannot replace a formal appraisal. While both provide an estimate of property value, an appraisal is usually more detailed and follows strict guidelines set by regulatory bodies. Lenders may use a BPO for quick assessments, but an appraisal is often required for financing or legal purposes.

What factors can affect the accuracy of a BPO?

Several factors can affect the accuracy of a BPO, including:

-

Changes in market conditions that occur after the BPO is completed

-

The availability and accuracy of comparable sales data

-

The condition of the property at the time of the BPO

-

Subjective opinions of the broker completing the BPO

It is important to consider these factors when relying on a BPO for decision-making.

Unknown

Unknown

Investor

Investor