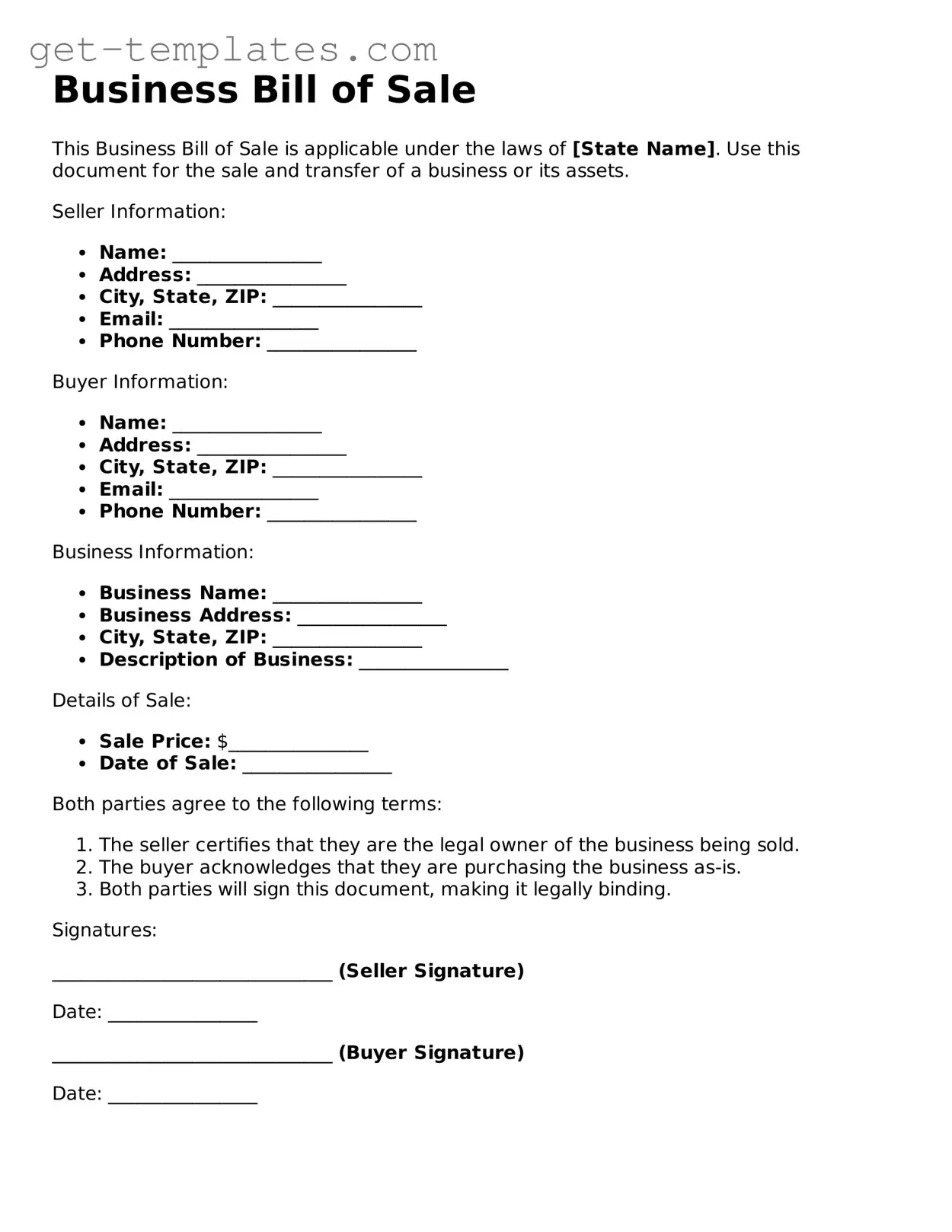

Attorney-Approved Business Bill of Sale Form

A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. This form serves as proof of the transaction, detailing the terms and conditions agreed upon by both the buyer and seller. Understanding its importance can help ensure a smooth transfer and protect both parties' interests.

Get Document Online

Attorney-Approved Business Bill of Sale Form

Get Document Online

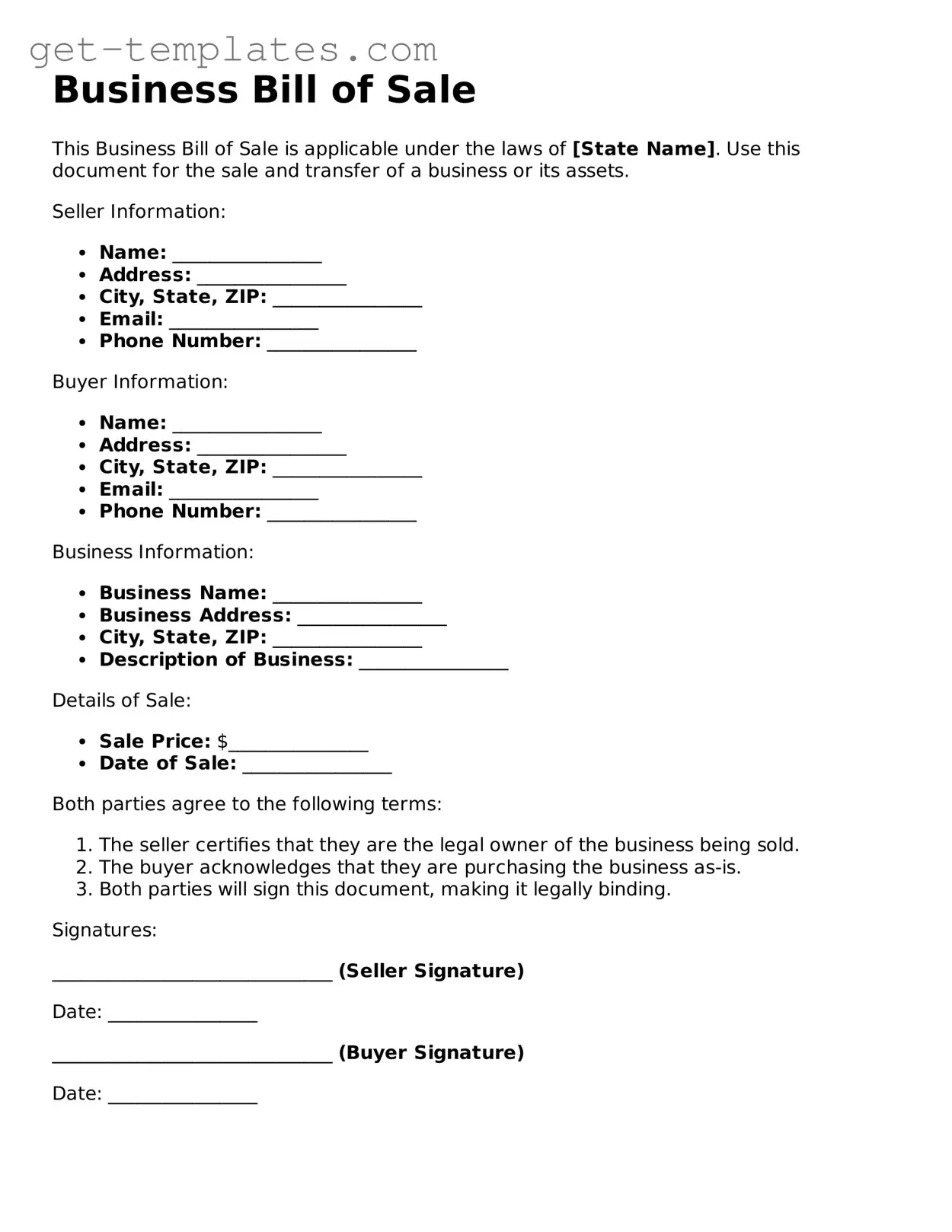

You’re halfway through — finish the form

Finish Business Bill of Sale online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form