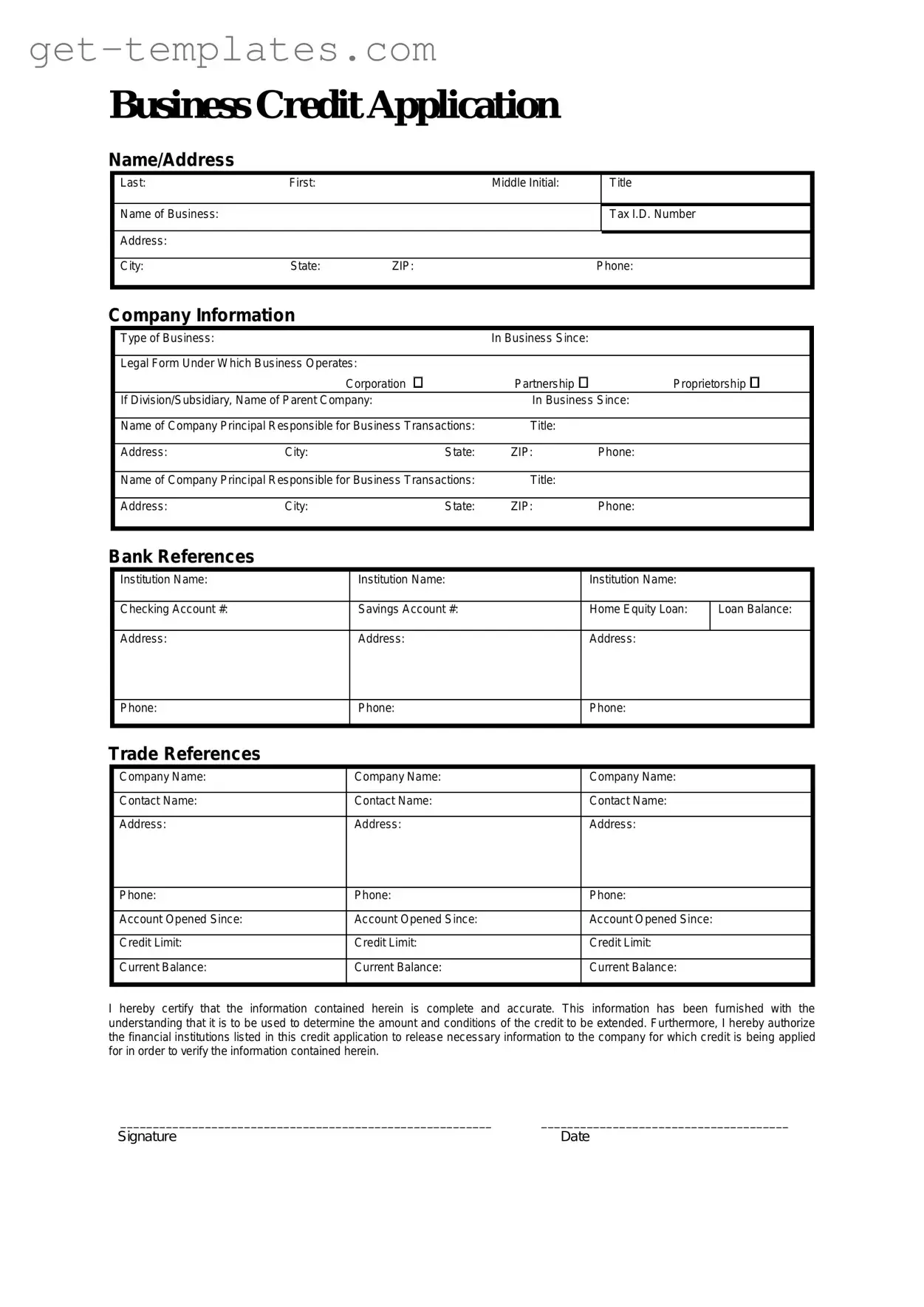

Fill in a Valid Business Credit Application Template

A Business Credit Application form is a document used by businesses to request credit from suppliers or lenders. This form typically includes essential information about the business, such as its financial history and creditworthiness. Completing this application accurately is crucial for obtaining favorable credit terms and establishing a trustworthy relationship with creditors.

Get Document Online

Fill in a Valid Business Credit Application Template

Get Document Online

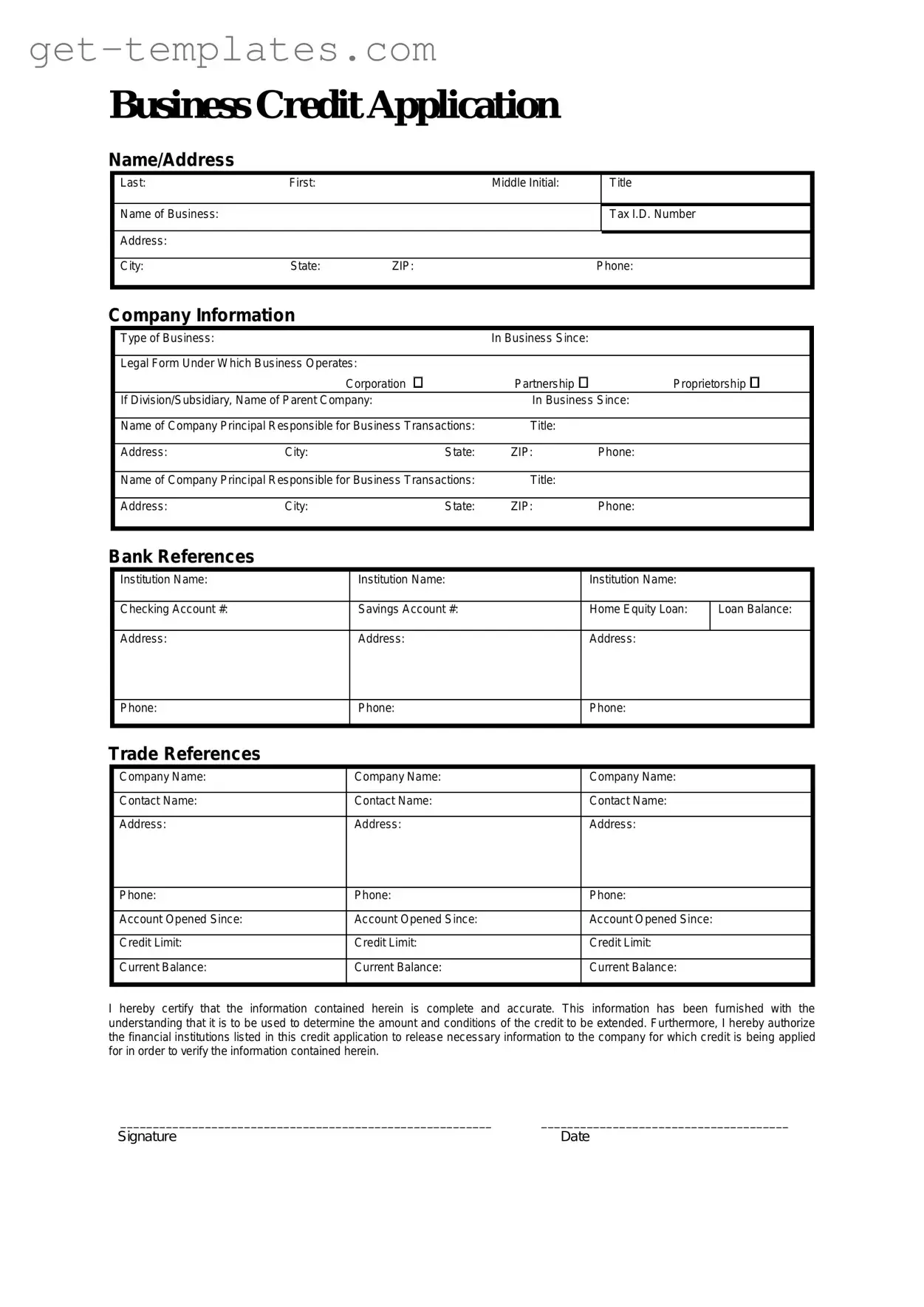

You’re halfway through — finish the form

Finish Business Credit Application online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form