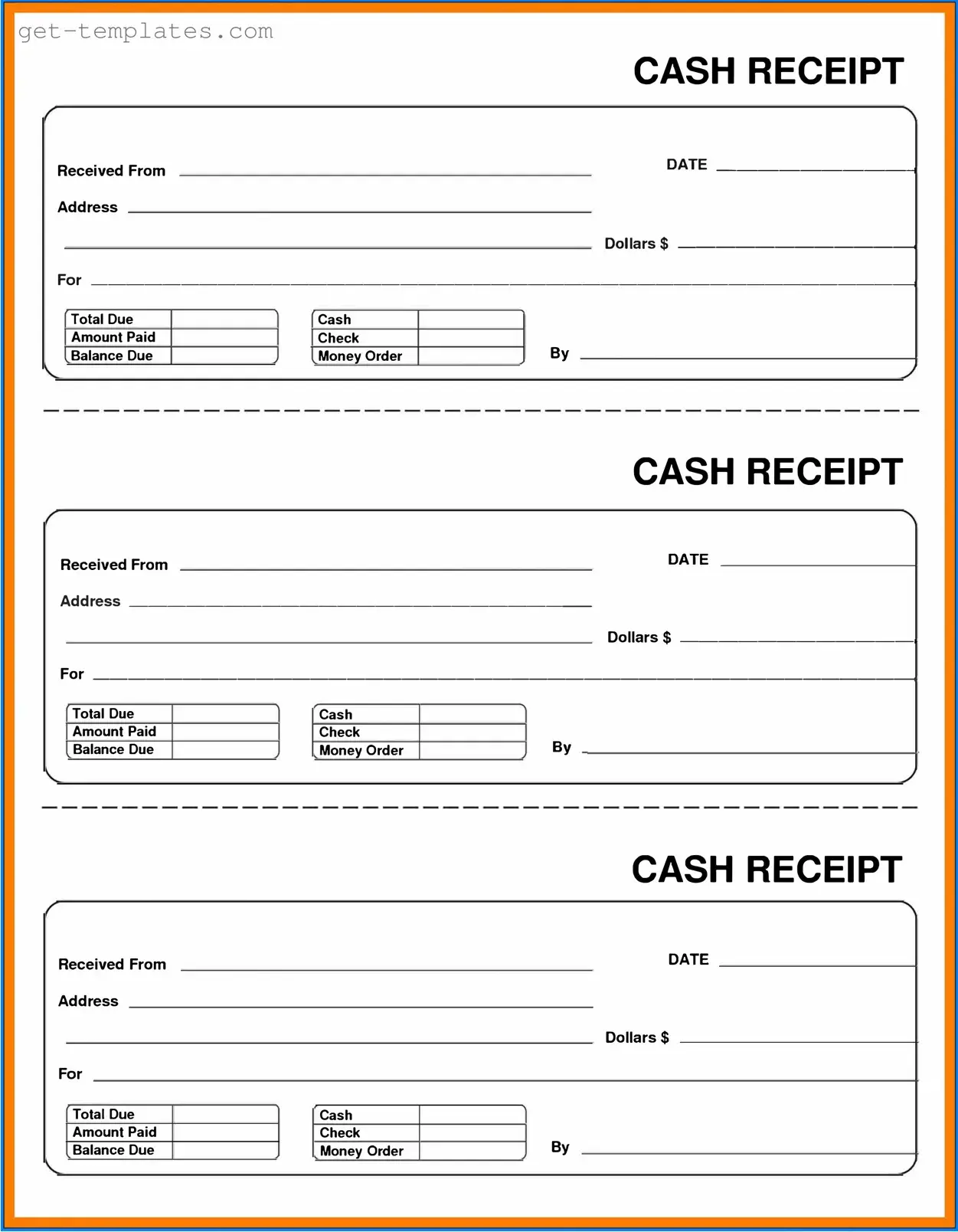

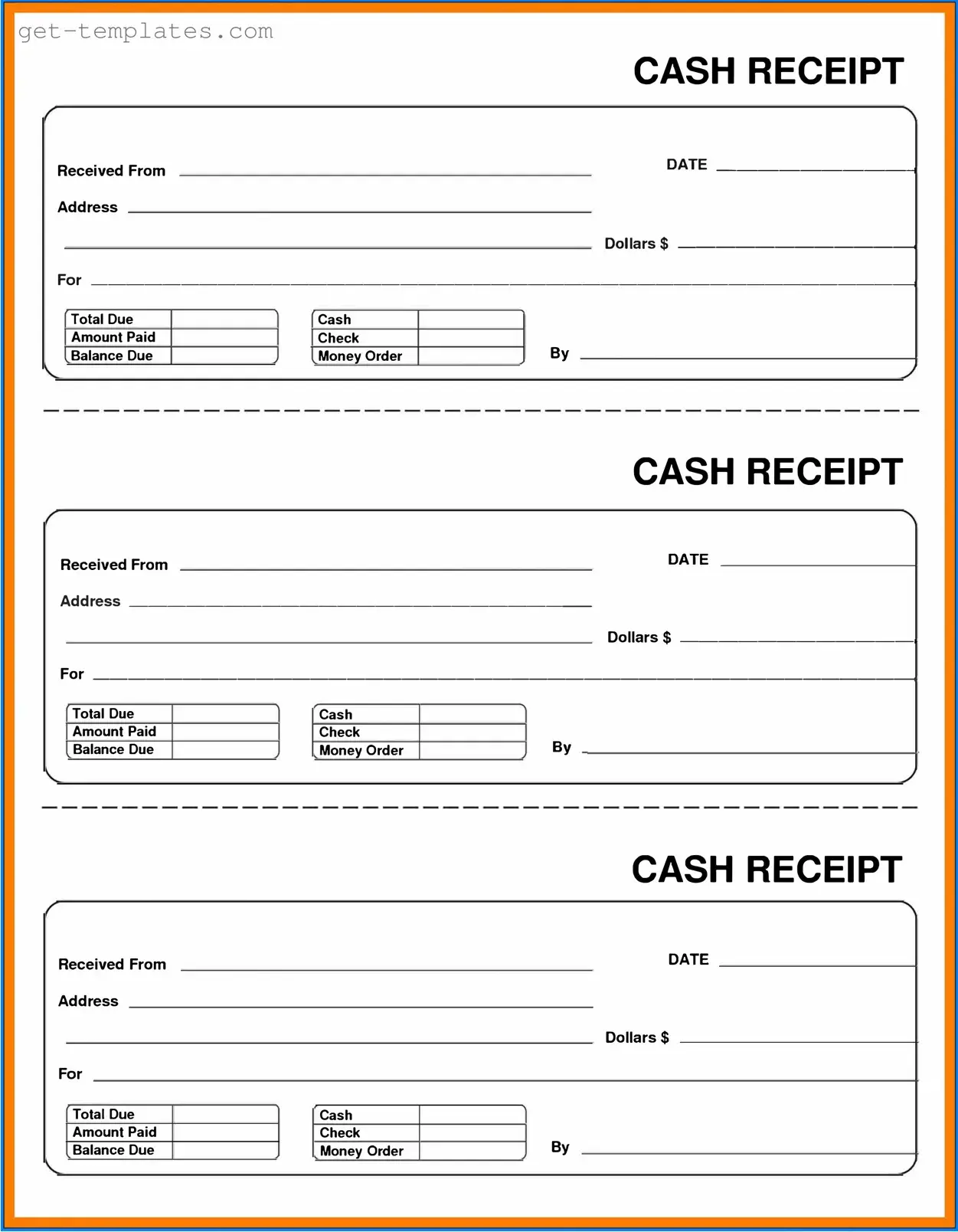

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof that a transaction has occurred and details the amount received, the payer, and the purpose of the payment. This form is essential for accurate financial record-keeping.

You should use a Cash Receipt form whenever cash is received, whether it's from a customer, client, or any other source. This includes payments for services, sales of products, or any other cash transactions. Using the form ensures that all cash inflows are documented properly.

The Cash Receipt form typically requires the following information:

-

Date of the transaction

-

Name of the payer

-

Amount received

-

Purpose of the payment

-

Method of payment (cash, check, etc.)

-

Signature of the person receiving the cash

To fill out a Cash Receipt form, follow these steps:

-

Enter the date of the transaction at the top of the form.

-

Write the name of the individual or business making the payment.

-

Indicate the total amount of cash received.

-

Specify the reason for the payment.

-

Note the payment method.

-

Sign the form to confirm receipt of the funds.

The Cash Receipt form should be signed by the individual who receives the cash. This signature acts as confirmation that the transaction took place and that the cash has been received. In some cases, it may also be helpful to have the payer sign the form.

Completed Cash Receipt forms should be stored securely to maintain confidentiality and ensure easy access for future reference. You can keep physical copies in a locked filing cabinet or store electronic versions in a secure digital format. It's important to organize them by date or transaction type for efficient retrieval.

No, a Cash Receipt form is specifically designed for cash transactions. If you receive payments through other methods, such as checks or credit cards, you should use the appropriate forms for those types of transactions. Each payment method may require different documentation.

If you make a mistake on a Cash Receipt form, do not attempt to erase or cross out the error. Instead, you should create a new form with the correct information. If the error is minor, you can add a note explaining the correction, but clarity is key to maintaining accurate records.

A Cash Receipt form serves as a record of a transaction, but it is not a legally binding contract. It provides evidence that payment was made, which can be useful in case of disputes. However, for more formal agreements, a contract should be used in conjunction with the Cash Receipt form.

You can obtain a Cash Receipt form from various sources. Many businesses create their own templates, or you can find printable versions online. Additionally, accounting software often includes a digital Cash Receipt form that can be customized to meet your needs.