The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their Citibank account. This process streamlines payments, ensuring that funds are available quickly and securely.

You can obtain the Citibank Direct Deposit form by visiting the Citibank website or by contacting your local Citibank branch. Additionally, many employers provide the form directly to employees as part of their payroll setup process.

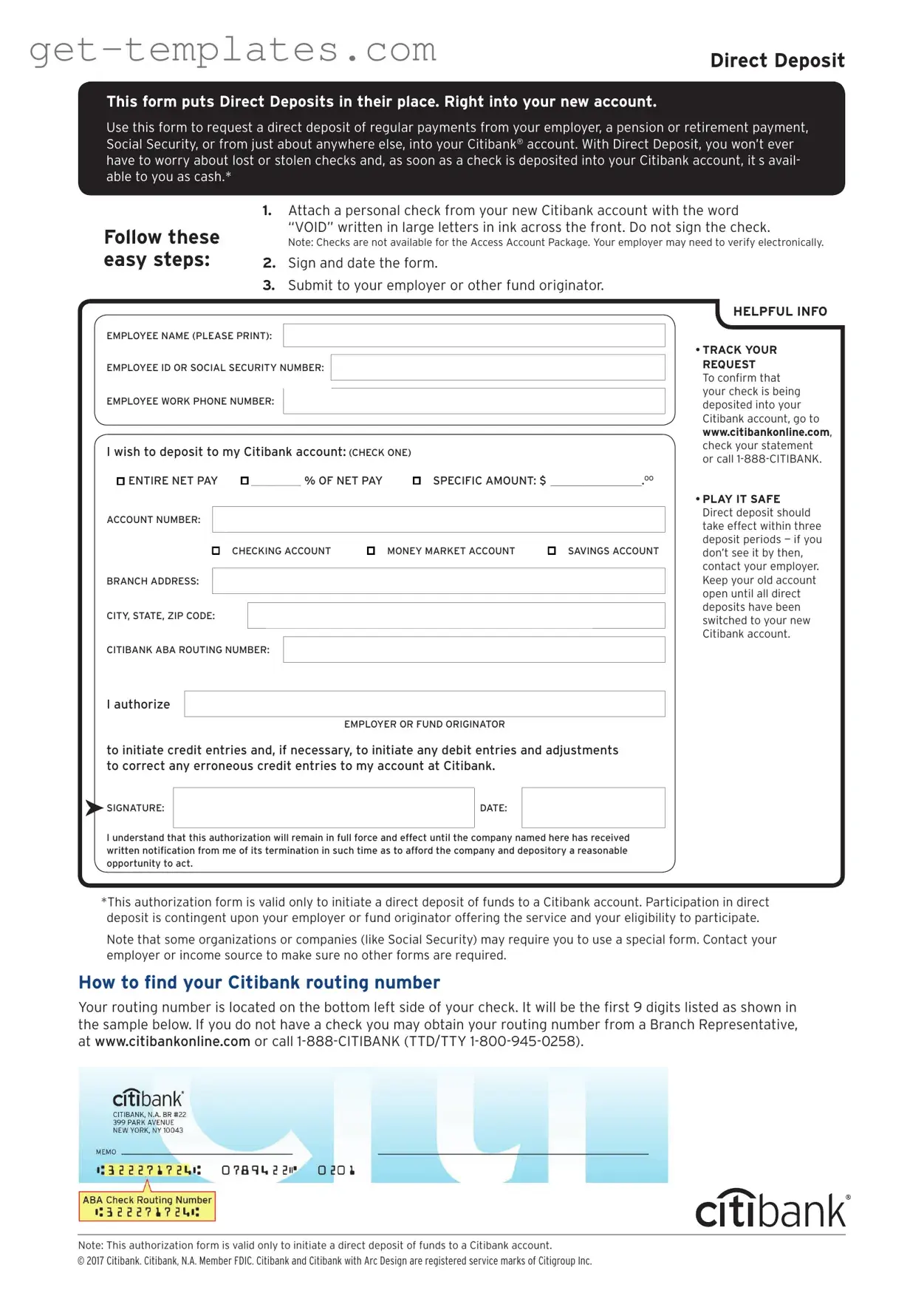

To complete the Citibank Direct Deposit form, you will typically need to provide the following information:

-

Your full name

-

Your Citibank account number

-

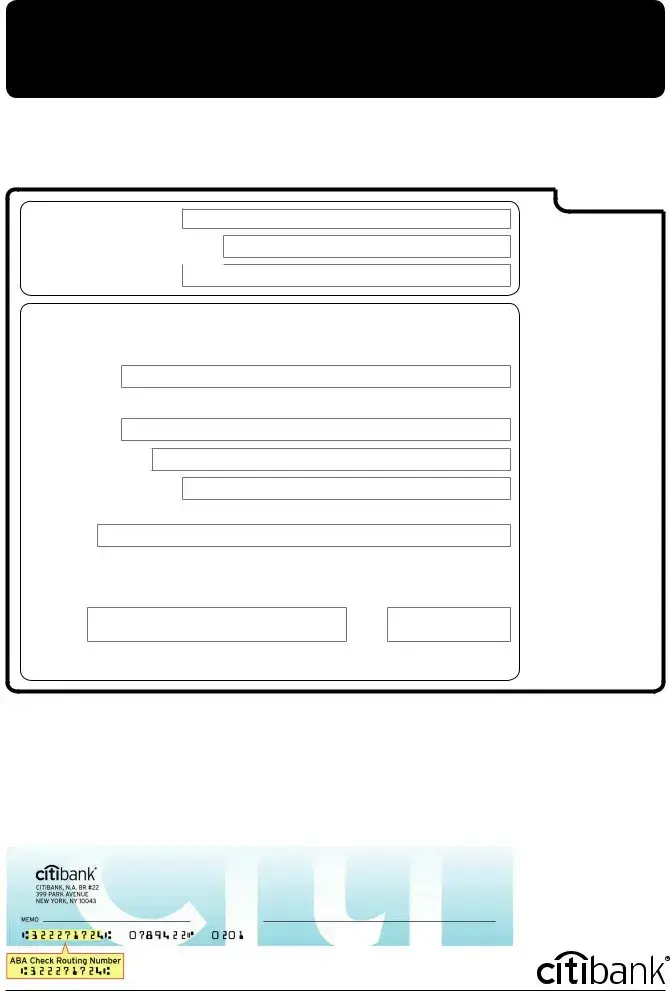

Your routing number

-

Your employer's name and address

-

Your signature and date

Once you have completed the form, submit it to your employer or the organization responsible for making the payments. Do not send it directly to Citibank unless specifically instructed to do so.

How long does it take for direct deposit to start?

The time it takes for direct deposit to begin can vary. Generally, it may take one to two pay cycles for the direct deposit to be fully processed and set up. Check with your employer for specific timelines.

Yes, you can change your direct deposit information at any time by submitting a new Citibank Direct Deposit form. Make sure to notify your employer or payer of any changes to ensure that future deposits go to the correct account.

What should I do if I encounter issues with my direct deposit?

If you experience problems with your direct deposit, first check with your employer to confirm that they have the correct information on file. If everything appears correct on their end, contact Citibank customer service for further assistance.

Is direct deposit safe?

Yes, direct deposit is generally considered a safe method of receiving payments. It reduces the risk of lost or stolen checks and provides a secure way for funds to be transferred directly to your bank account.

Can I use direct deposit for multiple accounts?

Yes, some employers allow employees to split their direct deposit between multiple accounts. You will need to provide the necessary account details for each account on the Citibank Direct Deposit form, if allowed by your employer.

What happens if I close my Citibank account?

If you close your Citibank account, you will need to provide your employer with new direct deposit information for your new account. Ensure that you do this before closing your account to avoid missed payments.

SIGNATURE:

SIGNATURE: