What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to settle their mortgage obligations without undergoing the lengthy and often stressful foreclosure process.

How does a Deed in Lieu of Foreclosure work?

In this process, the homeowner contacts their lender to discuss their financial difficulties. If both parties agree, the homeowner signs a deed transferring ownership of the property to the lender. In return, the lender typically agrees to forgive any remaining mortgage debt. The process can be quicker and less damaging to the homeowner's credit than a foreclosure.

What are the benefits of a Deed in Lieu of Foreclosure?

-

Less impact on credit score compared to foreclosure.

-

Quicker resolution of the mortgage obligation.

-

Possibility of negotiating relocation assistance from the lender.

-

Ability to avoid the public nature of foreclosure proceedings.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential downsides. The lender may not agree to the deed, and homeowners may still face tax implications on forgiven debt. Additionally, if the property has a second mortgage or other liens, those may complicate the process.

Who is eligible for a Deed in Lieu of Foreclosure?

Homeowners facing financial hardship, such as job loss or medical emergencies, may be eligible. However, lenders typically require that the homeowner has tried other options first, such as loan modifications or short sales. Each lender may have different criteria, so it’s essential to check with them directly.

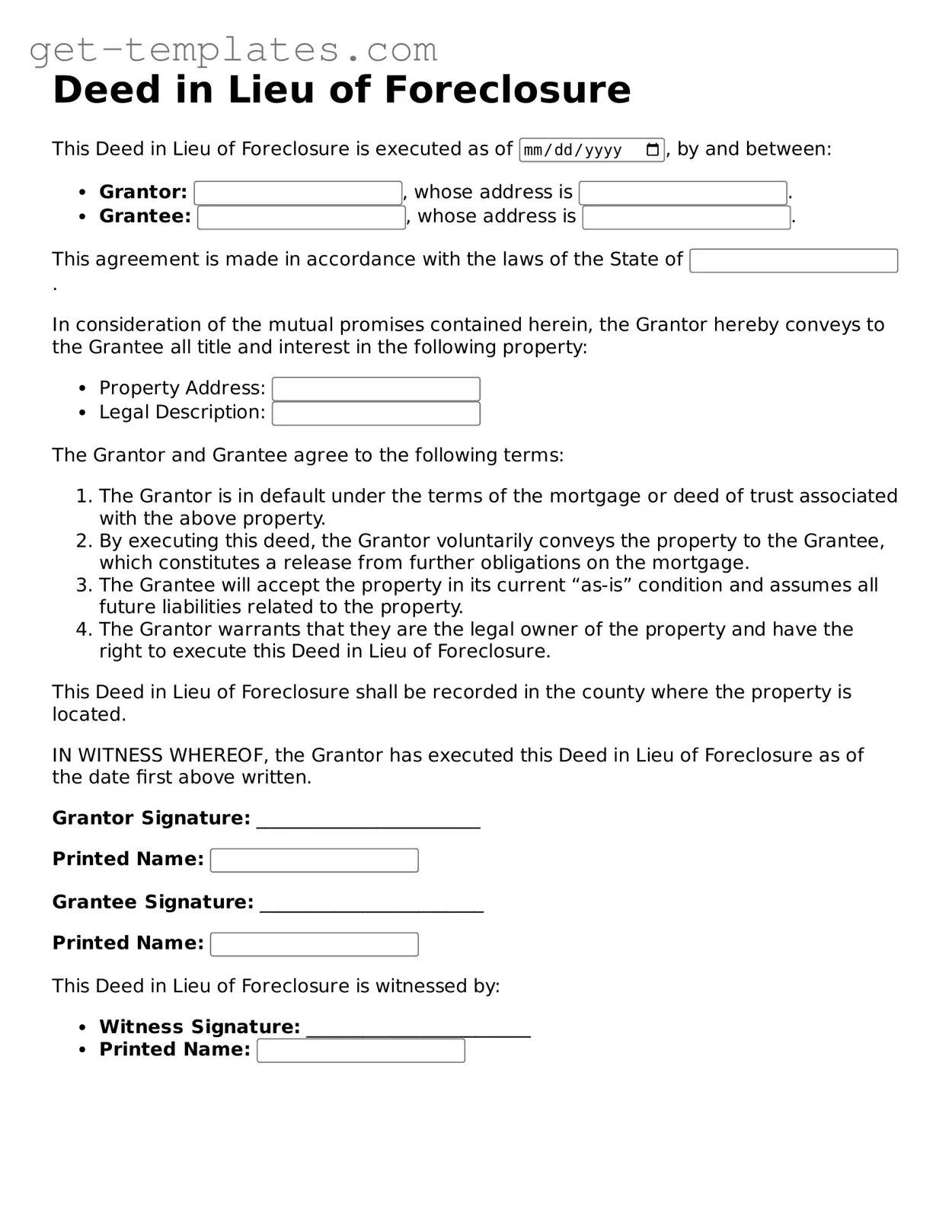

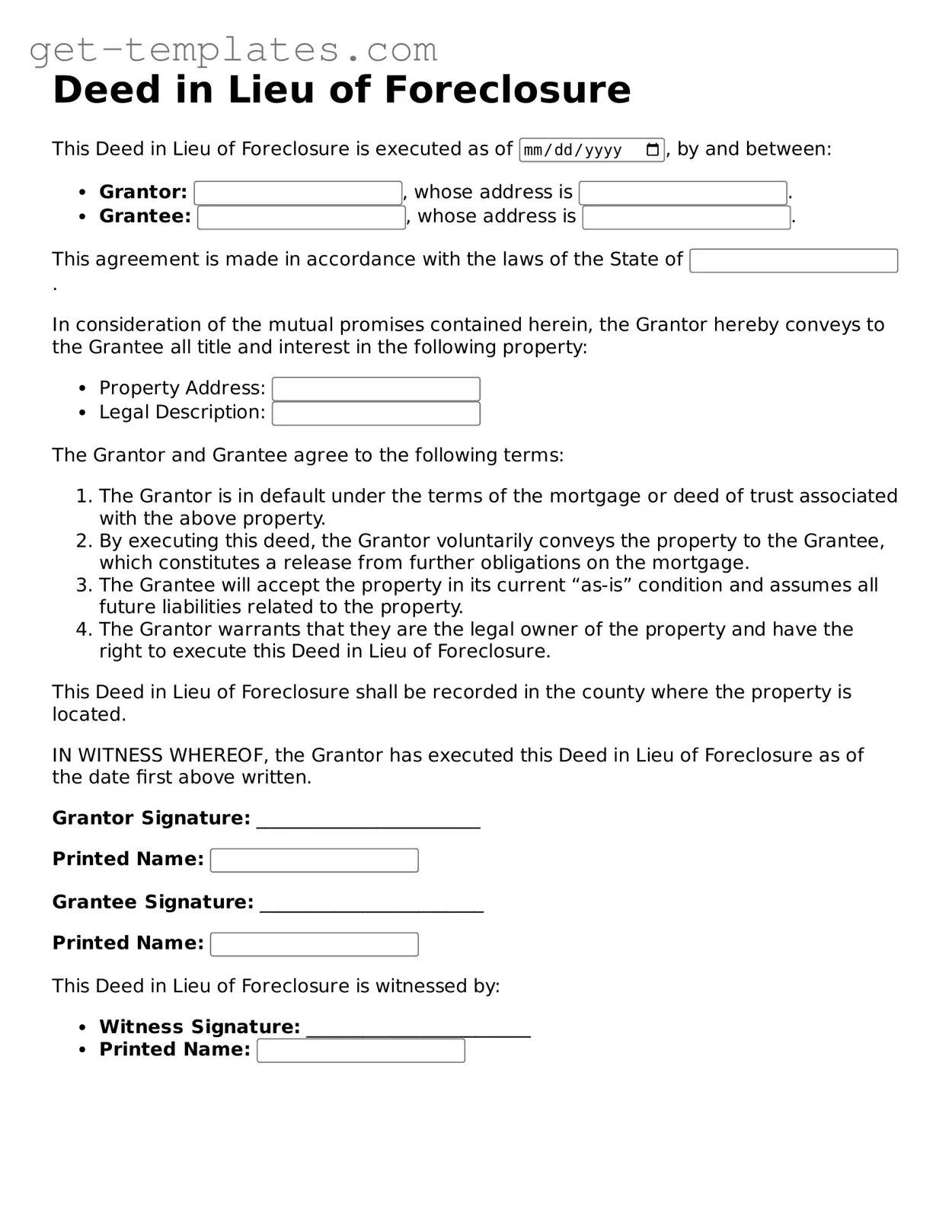

What steps should I take to initiate a Deed in Lieu of Foreclosure?

-

Contact your lender to discuss your financial situation.

-

Gather necessary documents, including your mortgage statement and any financial hardship documentation.

-

Submit a formal request for a Deed in Lieu of Foreclosure.

-

Negotiate terms with the lender, including debt forgiveness and any potential relocation assistance.

-

Sign the deed and any other required documents.

Will I still owe money after a Deed in Lieu of Foreclosure?

In many cases, if the lender agrees to the deed, they will forgive the remaining mortgage debt. However, it’s crucial to confirm this with the lender before proceeding, as some lenders may pursue a deficiency judgment for any remaining balance.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure will impact your credit score, it generally has a less severe effect than a foreclosure. The specific impact varies based on your overall credit history and the scoring model used, but it typically results in a lower score than a conventional mortgage payment but higher than a foreclosure.

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, you can still buy a home after a Deed in Lieu of Foreclosure, but it may take some time. Most lenders will require a waiting period, often around two to four years, before you can qualify for a new mortgage. During this time, focusing on rebuilding your credit can improve your chances of securing a loan in the future.

Is legal assistance necessary for a Deed in Lieu of Foreclosure?

While it is not strictly necessary, seeking legal assistance can be beneficial. An attorney can help you understand the implications, negotiate with the lender, and ensure that all documents are properly executed. This support can provide peace of mind during a challenging time.