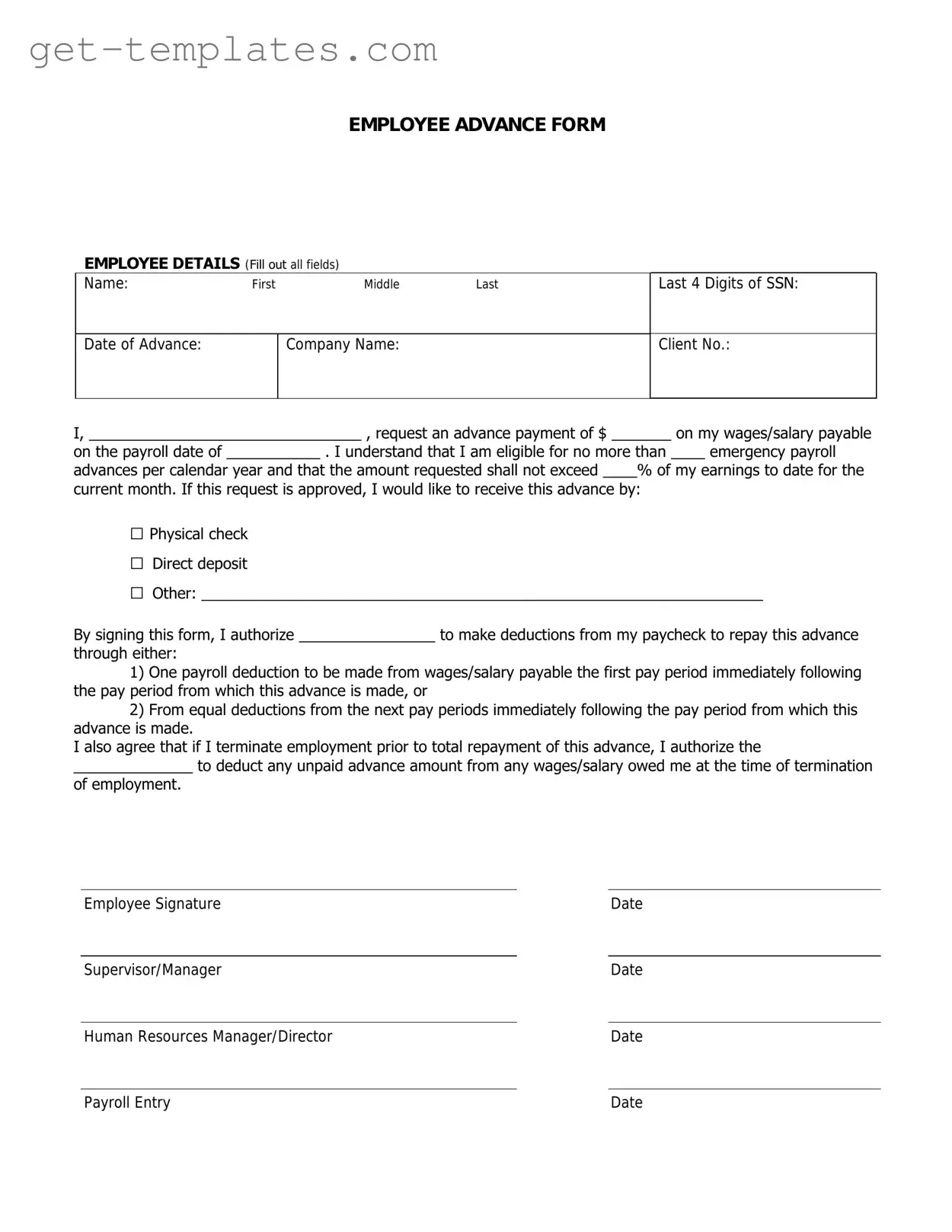

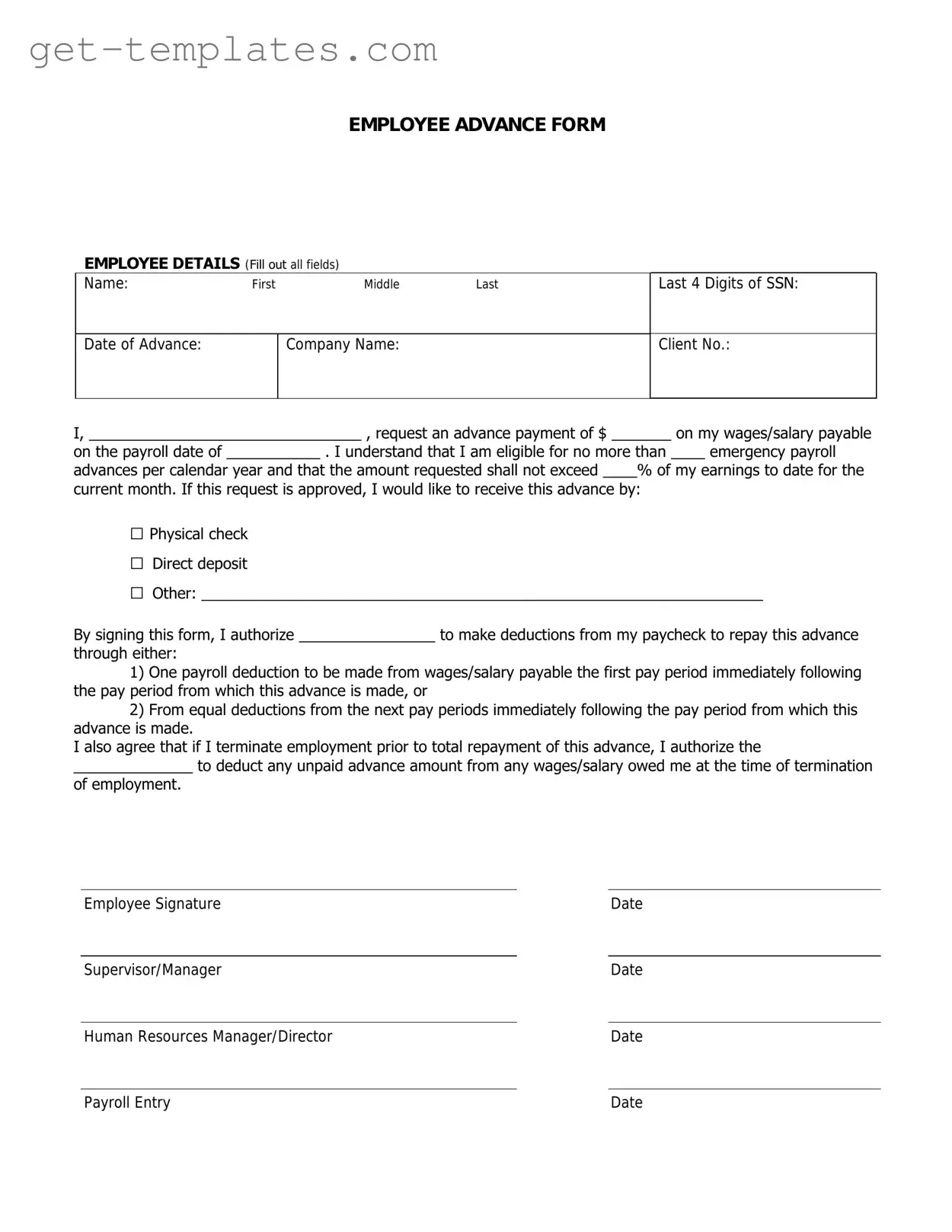

Fill in a Valid Employee Advance Template

The Employee Advance form is a document that allows employees to request an advance on their salary or wages for various purposes. This form serves as a crucial tool for managing financial needs before the regular pay schedule. Understanding how to properly complete and submit this form can ensure a smooth process for both employees and employers.

Get Document Online

Fill in a Valid Employee Advance Template

Get Document Online

You’re halfway through — finish the form

Finish Employee Advance online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form