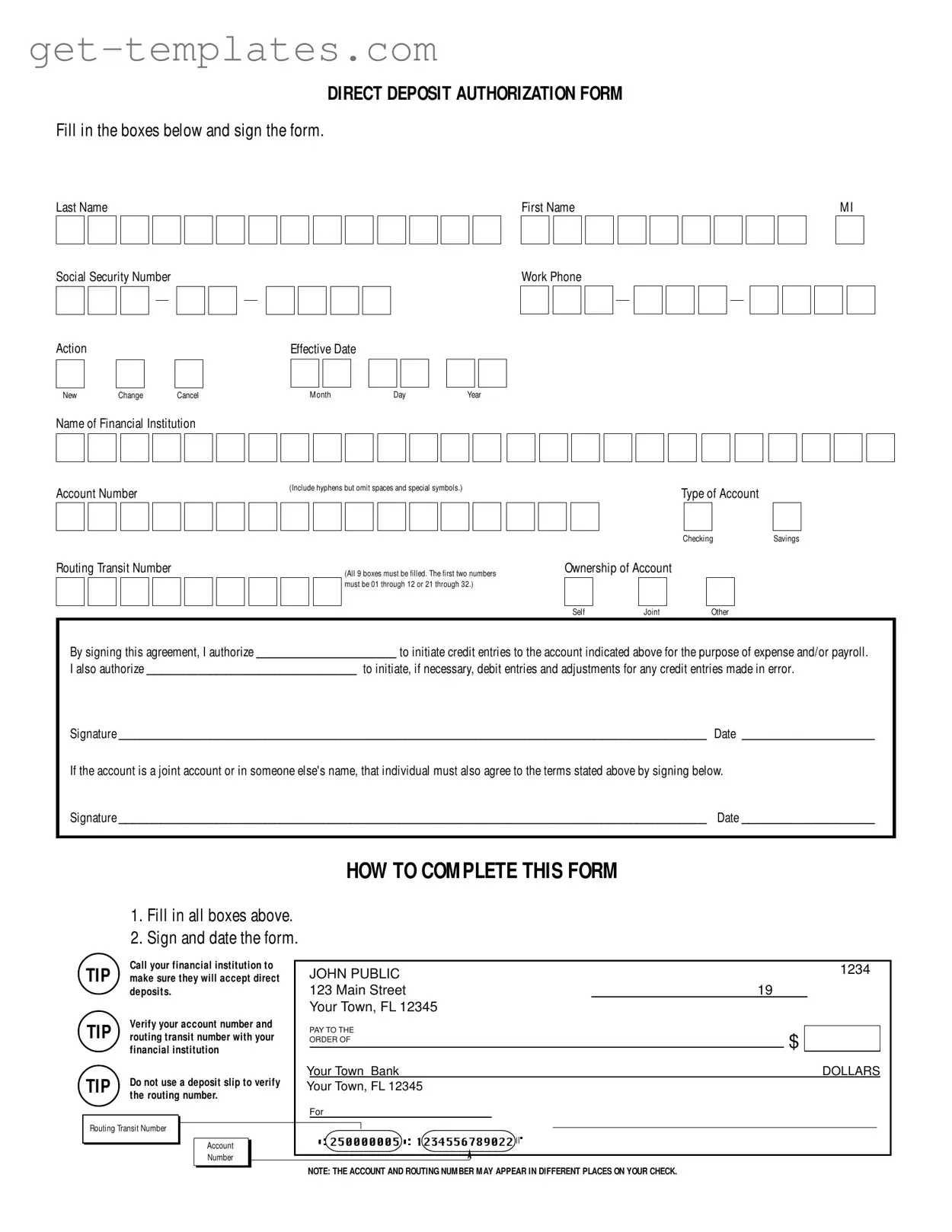

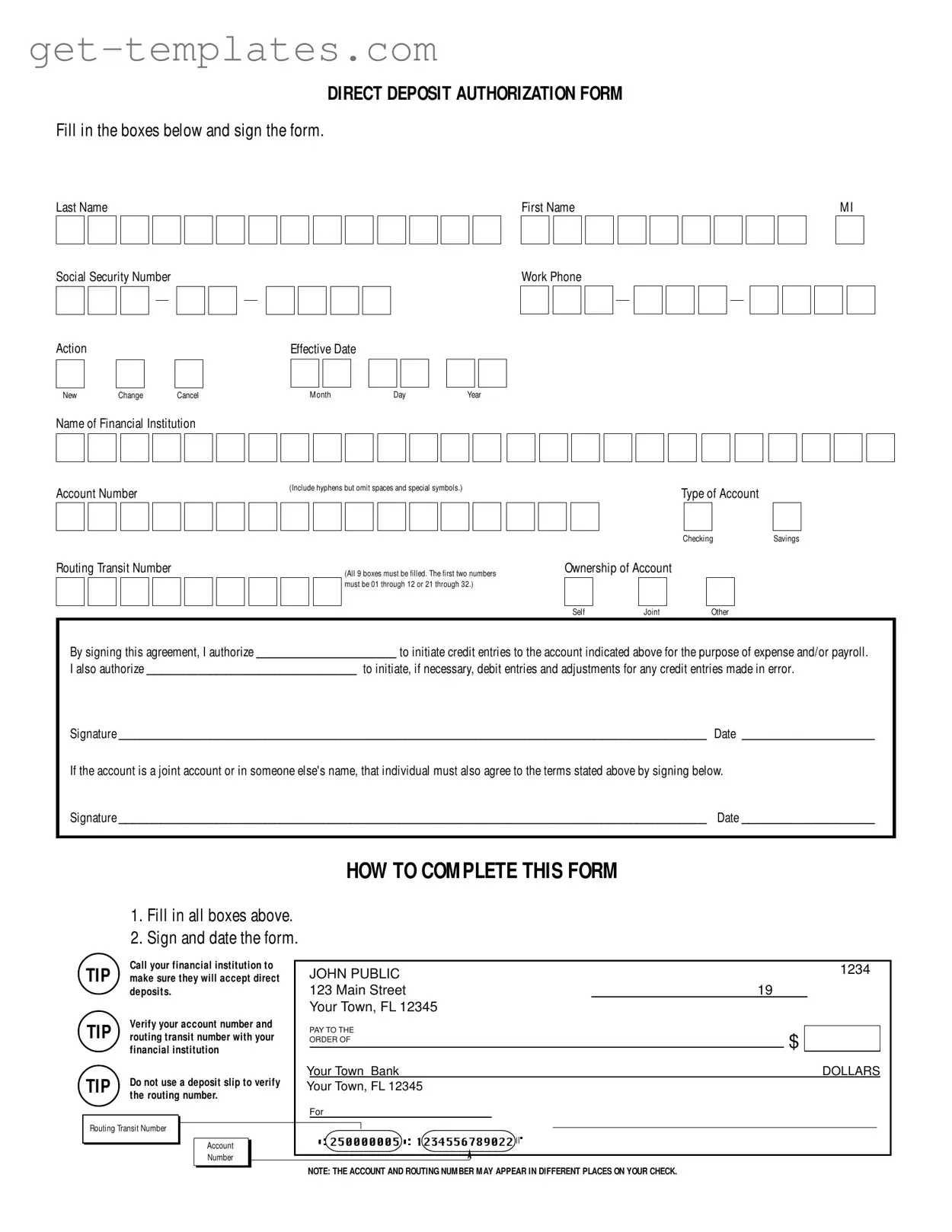

Fill in a Valid Generic Direct Deposit Template

The Generic Direct Deposit Authorization Form is a document that allows individuals to authorize their employer or another entity to deposit funds directly into their bank account. This form requires essential information such as the account holder's name, Social Security number, and bank details. Completing this form correctly ensures that payments, such as salaries or reimbursements, are deposited seamlessly into the designated account.

Get Document Online

Fill in a Valid Generic Direct Deposit Template

Get Document Online

You’re halfway through — finish the form

Finish Generic Direct Deposit online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form

□

□