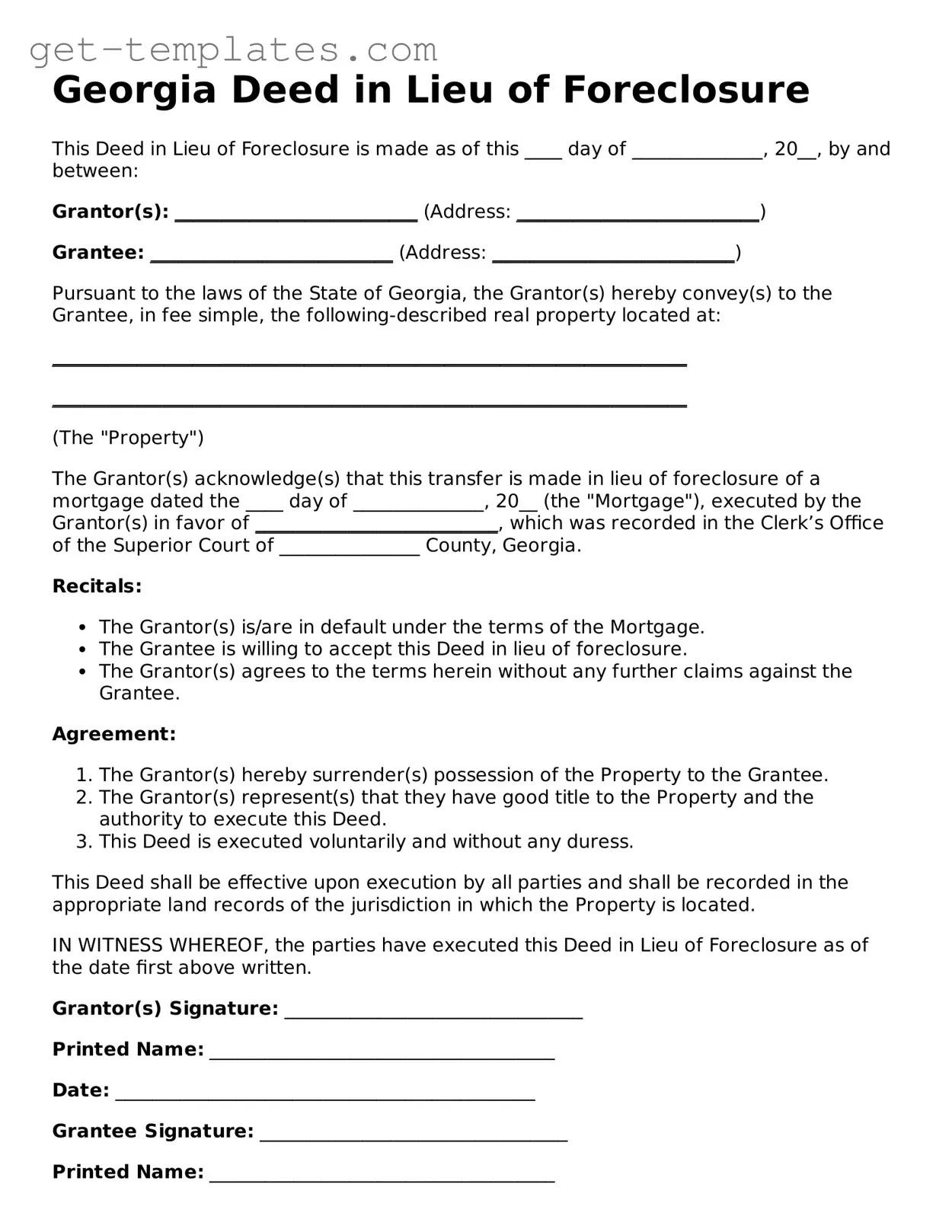

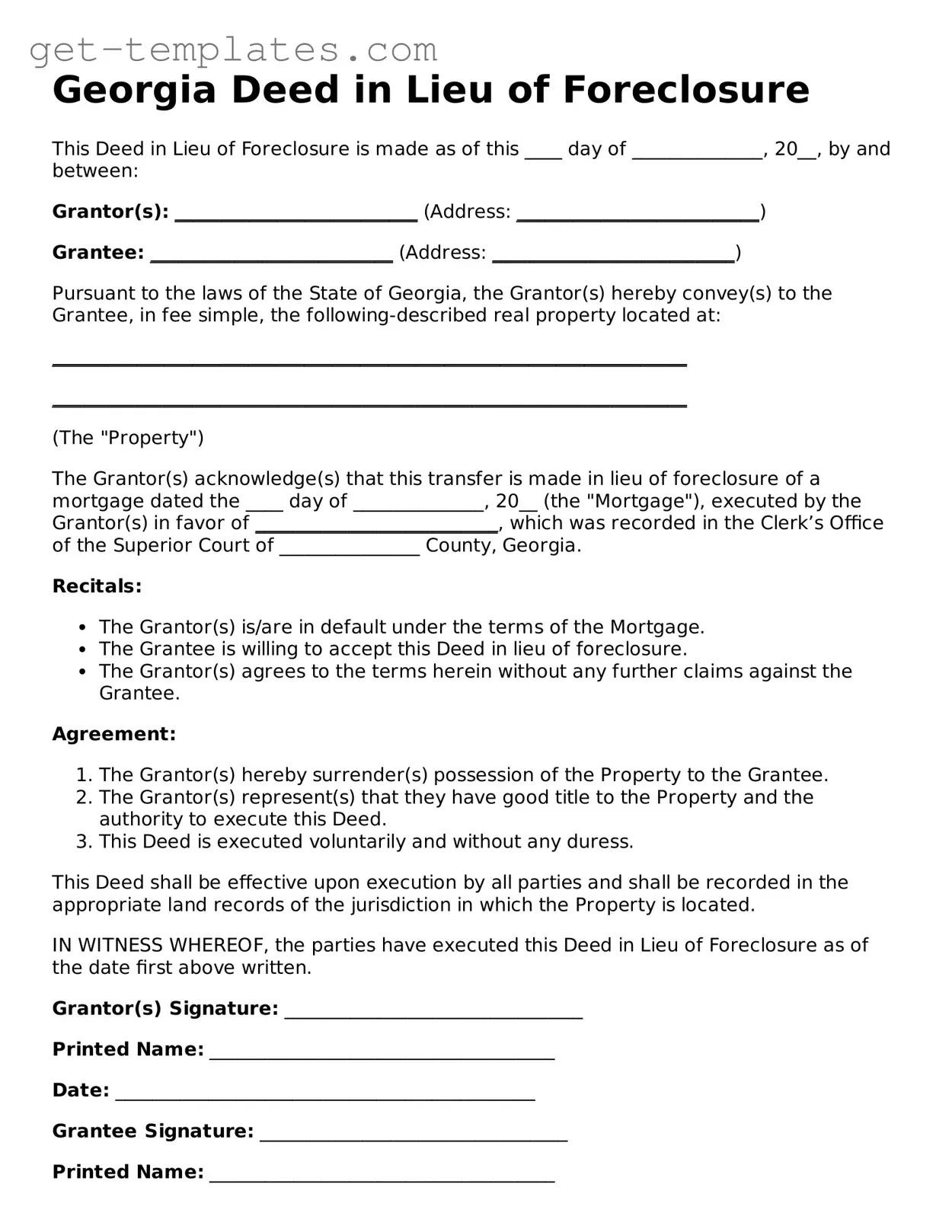

Attorney-Approved Deed in Lieu of Foreclosure Document for Georgia

A Georgia Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid the foreclosure process. This option can provide a more streamlined resolution for individuals facing financial difficulties, potentially minimizing the negative impact on their credit. Understanding the implications and requirements of this form is crucial for homeowners considering this alternative.

Get Document Online

Attorney-Approved Deed in Lieu of Foreclosure Document for Georgia

Get Document Online

You’re halfway through — finish the form

Finish Deed in Lieu of Foreclosure online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form