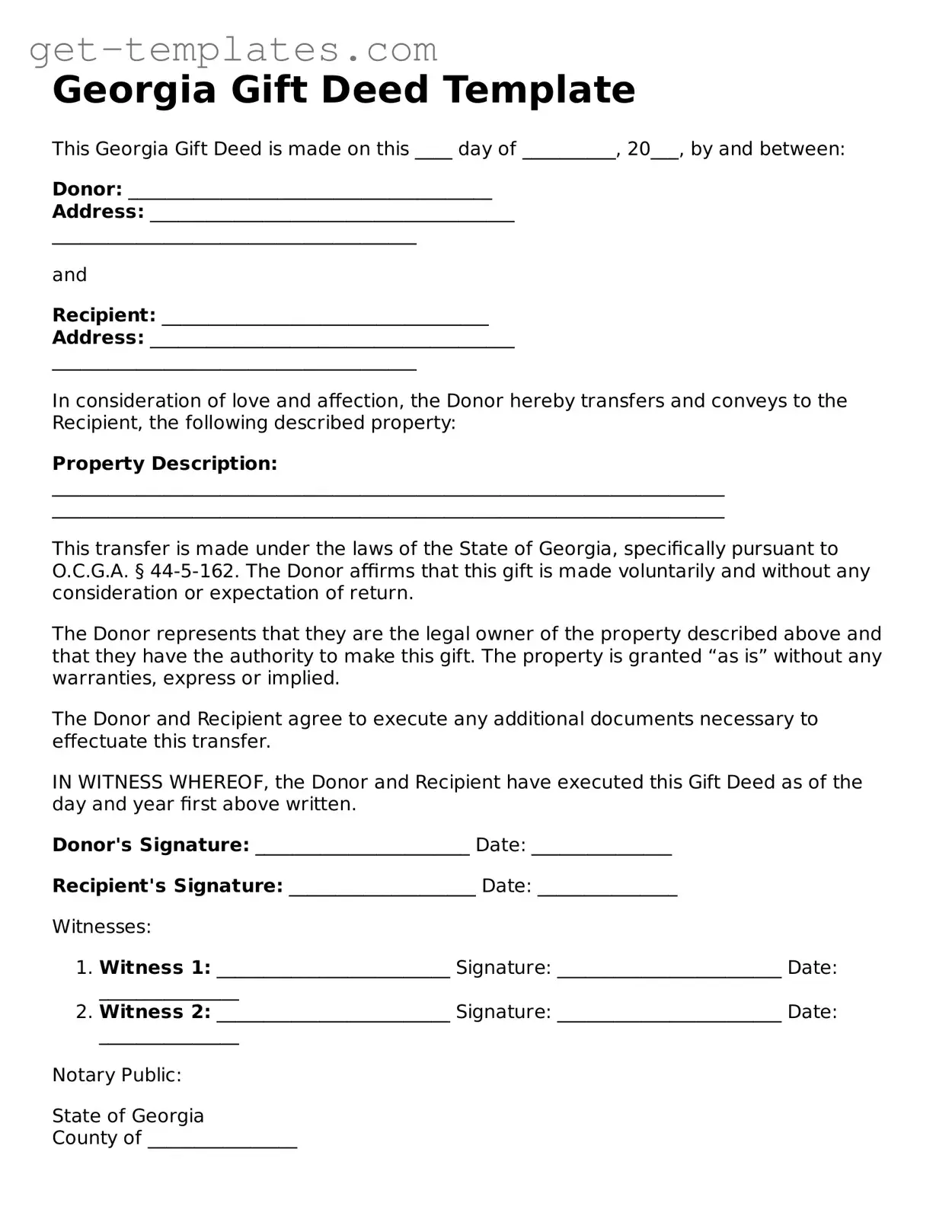

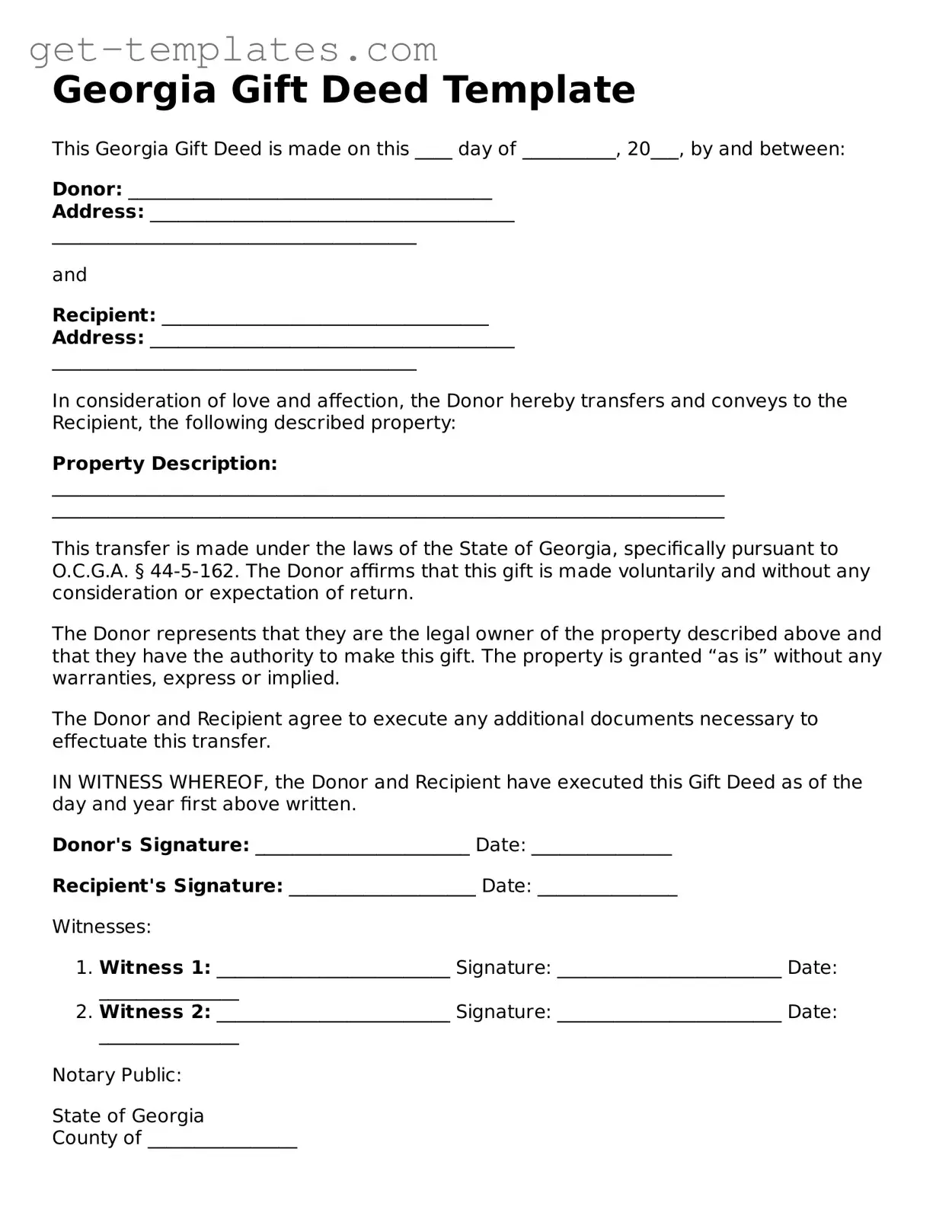

Attorney-Approved Gift Deed Document for Georgia

A Georgia Gift Deed form is a legal document used to transfer property ownership as a gift without any exchange of money. This form allows the donor to convey their property to the recipient, known as the donee, while ensuring that the transaction is properly documented. Understanding the nuances of this form is essential for anyone looking to make a property gift in Georgia.

Get Document Online

Attorney-Approved Gift Deed Document for Georgia

Get Document Online

You’re halfway through — finish the form

Finish Gift Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form