Attorney-Approved Quitclaim Deed Document for Georgia

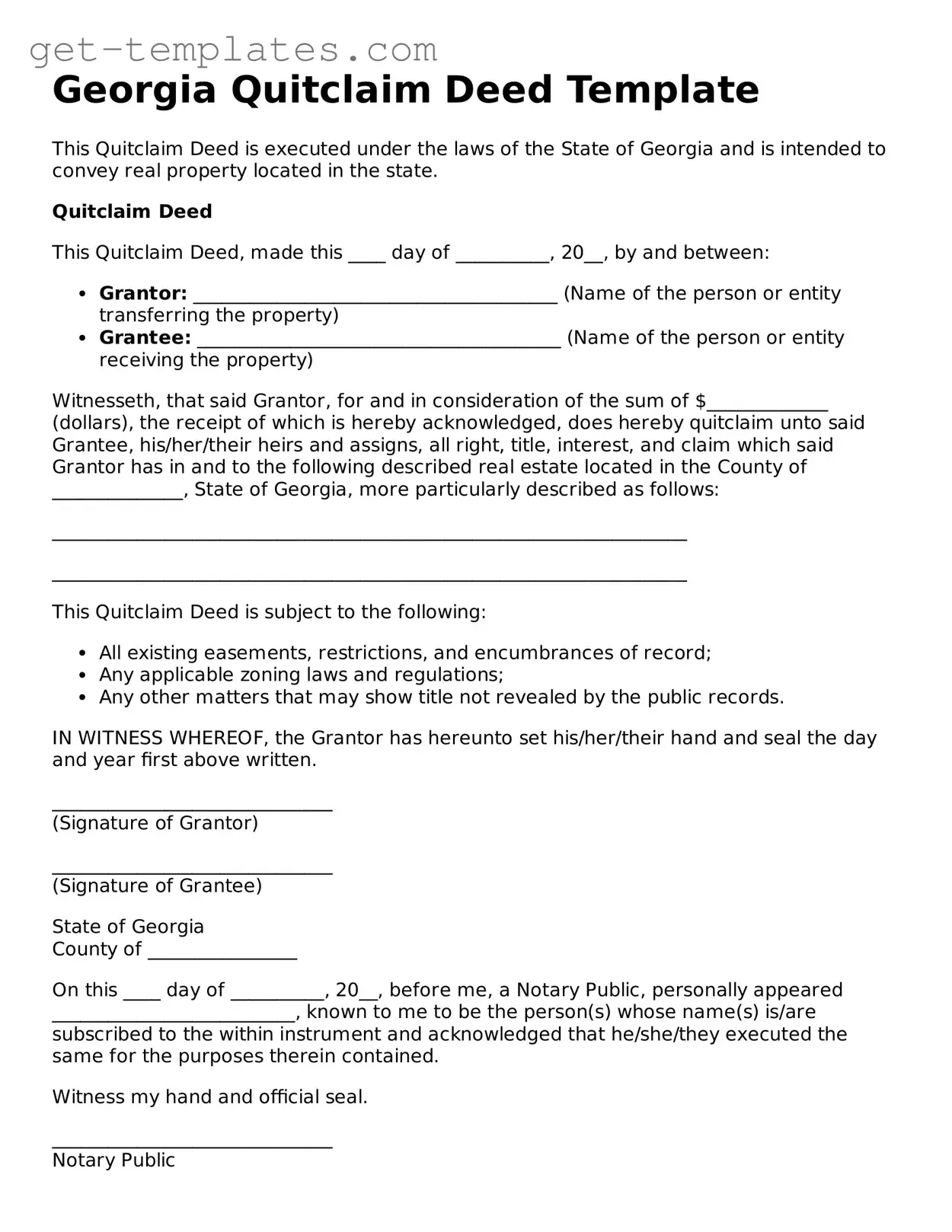

A Georgia Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without guaranteeing the title. This form is commonly utilized in situations where the grantor wishes to relinquish any claim to the property without providing warranties regarding the title's validity. Understanding the implications of using a quitclaim deed is essential for both parties involved in the transaction.

Get Document Online

Attorney-Approved Quitclaim Deed Document for Georgia

Get Document Online

You’re halfway through — finish the form

Finish Quitclaim Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form