What is a Georgia Real Estate Purchase Agreement?

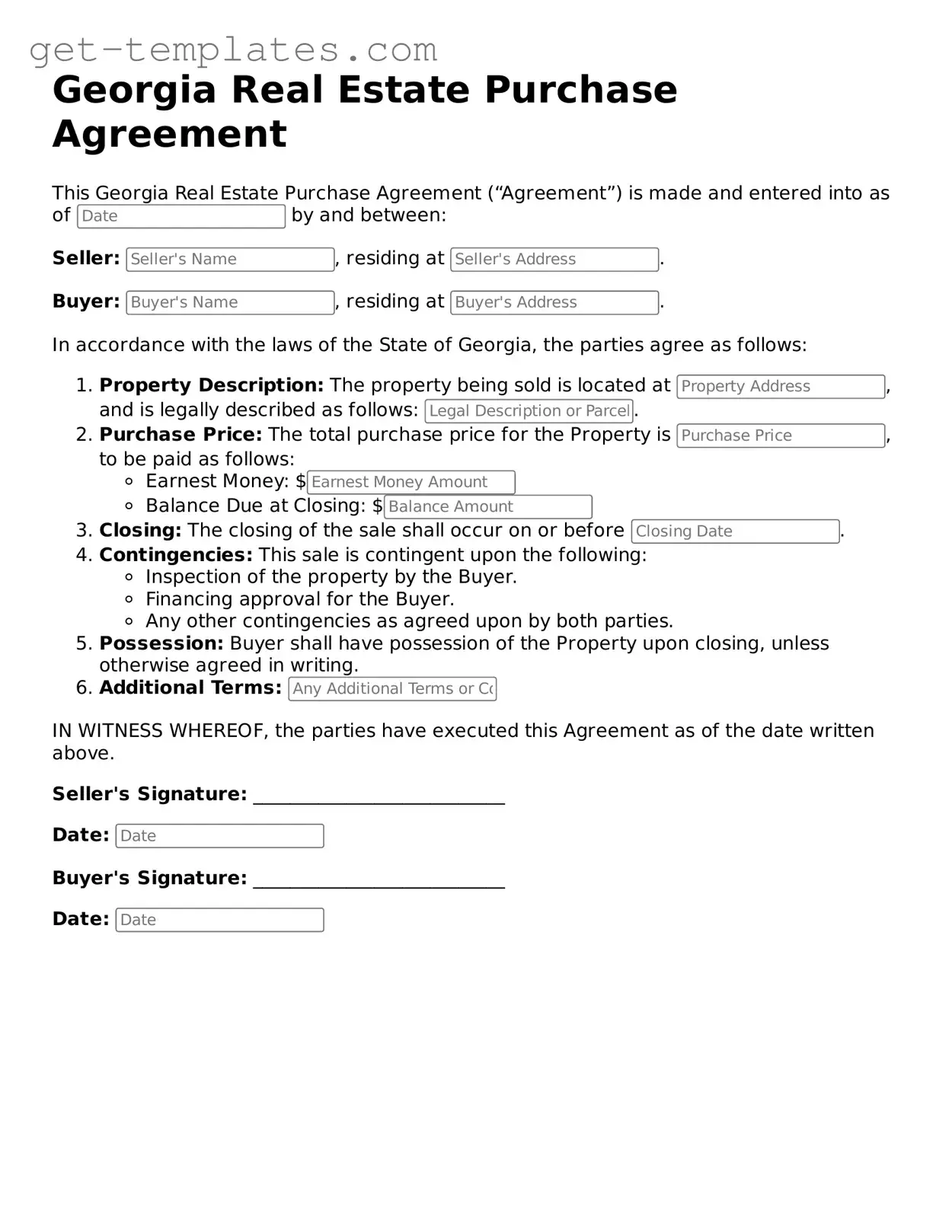

A Georgia Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller for the sale of real estate in Georgia. This document outlines the terms and conditions of the sale, including the purchase price, financing details, and the responsibilities of both parties. It serves as a roadmap for the transaction, ensuring that all aspects of the sale are clearly defined and agreed upon.

What key elements should be included in the agreement?

Several essential components should be included in a Georgia Real Estate Purchase Agreement to ensure clarity and enforceability. These elements typically include:

-

Identification of the Parties:

The full names and contact information of both the buyer and the seller.

-

Property Description:

A detailed description of the property being sold, including the address and legal description.

-

Purchase Price:

The agreed-upon amount that the buyer will pay for the property.

-

Contingencies:

Any conditions that must be met before the sale can proceed, such as financing or home inspections.

-

Closing Date:

The date on which the sale will be finalized and ownership will transfer.

How does the negotiation process work?

The negotiation process for a Real Estate Purchase Agreement typically begins when a buyer submits an offer to the seller. The seller can accept the offer, reject it, or make a counteroffer. This back-and-forth can involve adjustments to the purchase price, closing date, or contingencies. Both parties should communicate openly and be willing to compromise to reach a mutually beneficial agreement.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the agreement, the consequences depend on the timing and the specific terms outlined in the contract. If a buyer withdraws before any contingencies are met, they may forfeit their earnest money deposit. However, if the seller decides to back out without a valid reason, they may face legal repercussions or be required to pay damages to the buyer. It is crucial for both parties to understand their rights and obligations before signing the agreement.

Is it necessary to have a lawyer review the agreement?

While it is not legally required to have a lawyer review a Georgia Real Estate Purchase Agreement, it is highly advisable. A lawyer can help ensure that the contract is fair, legally sound, and that all necessary terms are included. Their expertise can also provide peace of mind, especially for first-time homebuyers or sellers who may not be familiar with the process.

Can the agreement be modified after it is signed?

Yes, a Georgia Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability. Verbal agreements are not sufficient in this context, as they can lead to misunderstandings or disputes.