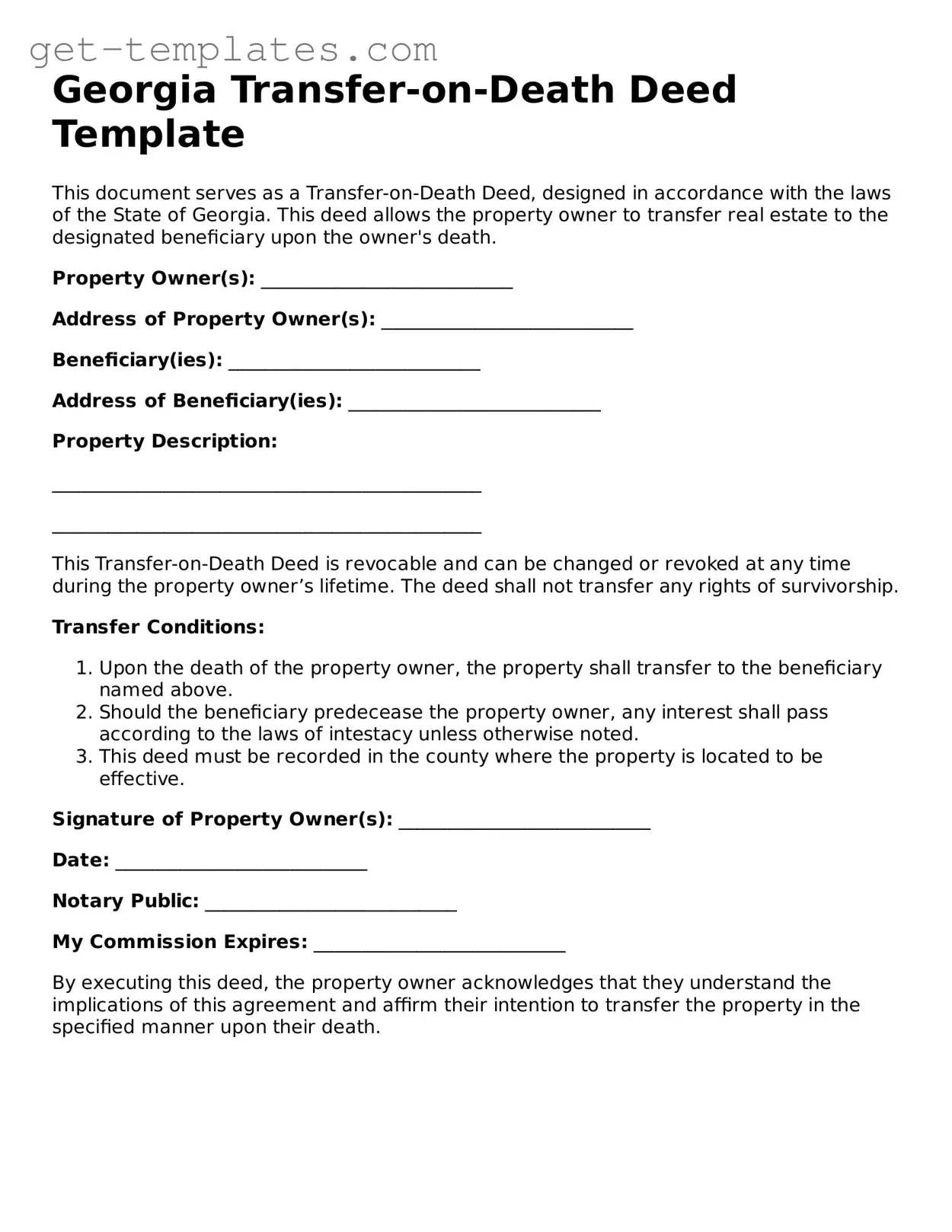

Attorney-Approved Transfer-on-Death Deed Document for Georgia

A Transfer-on-Death Deed in Georgia allows property owners to transfer their real estate to beneficiaries upon their death, bypassing the probate process. This legal tool provides a straightforward way to ensure that your property goes directly to your chosen heirs. Understanding how to properly execute this deed can help secure your estate and simplify matters for your loved ones.

Get Document Online

Attorney-Approved Transfer-on-Death Deed Document for Georgia

Get Document Online

You’re halfway through — finish the form

Finish Transfer-on-Death Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form