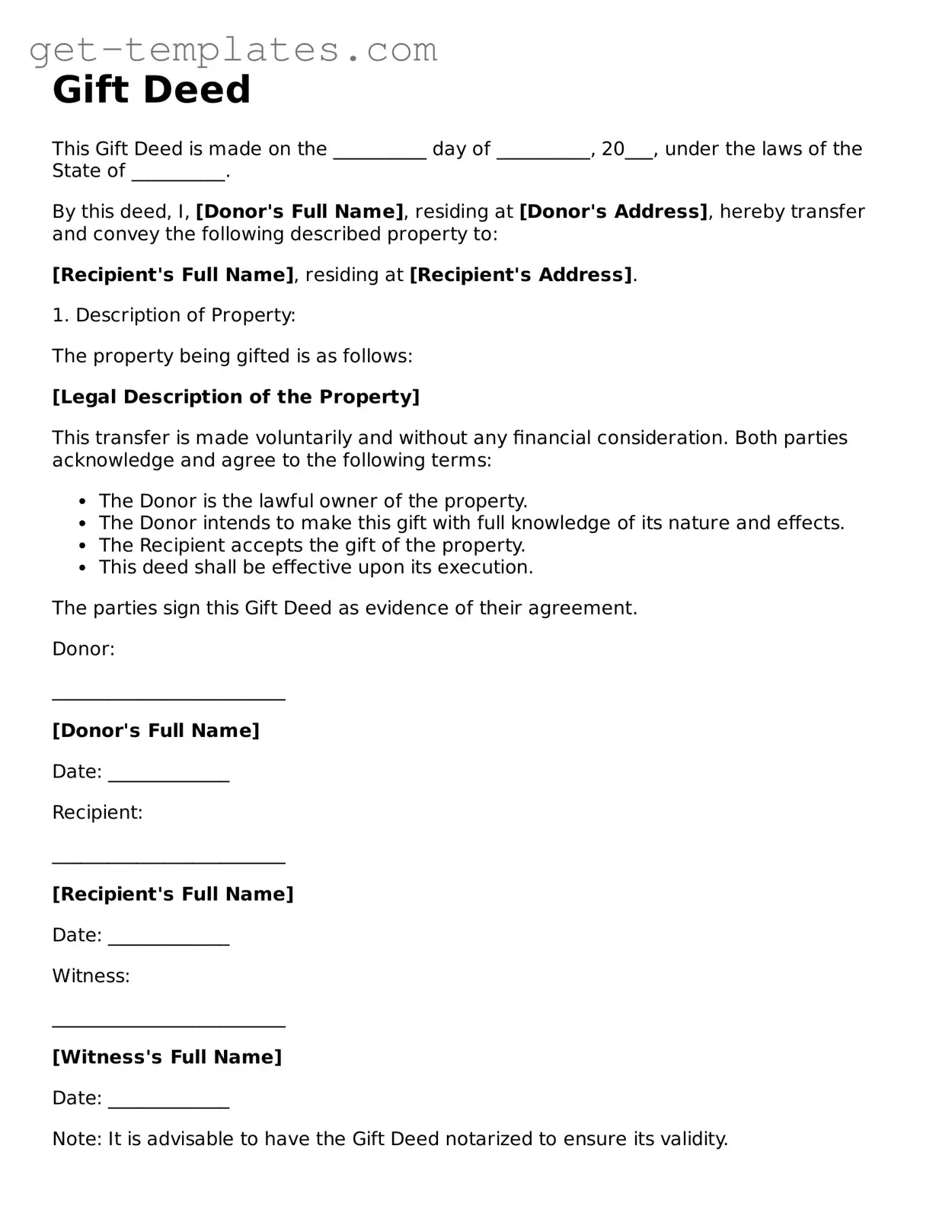

Attorney-Approved Gift Deed Form

A Gift Deed is a legal document that facilitates the transfer of ownership of property or assets from one individual to another without any exchange of money. This form is essential for ensuring that the transfer is recognized by law and protects the interests of both parties involved. Understanding how to properly complete a Gift Deed can simplify the process of giving and receiving gifts of significant value.

Get Document Online

Attorney-Approved Gift Deed Form

Get Document Online

You’re halfway through — finish the form

Finish Gift Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form