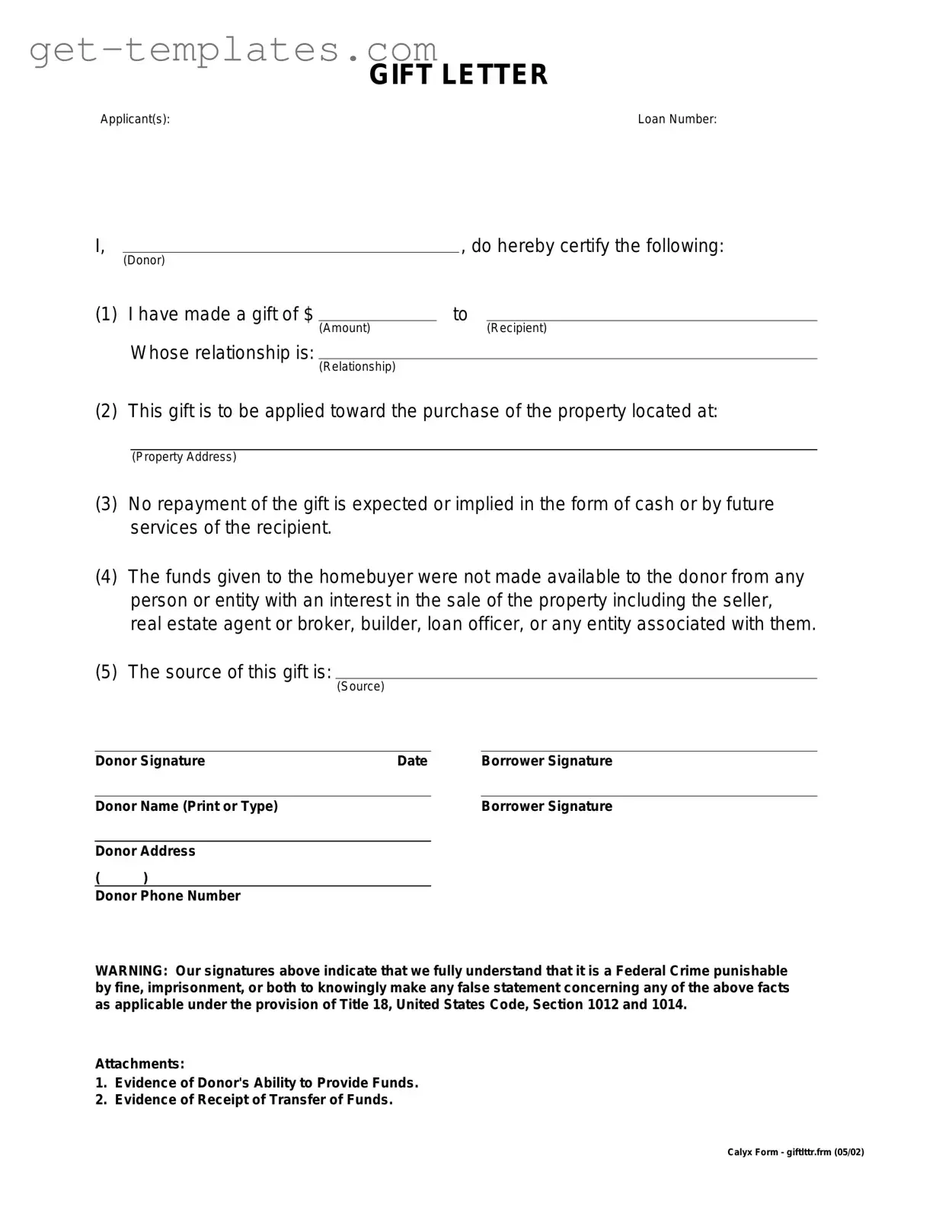

Fill in a Valid Gift Letter Template

The Gift Letter form is a document used to confirm that a monetary gift has been given to a recipient, typically for the purpose of financing a home purchase. This form serves as proof that the funds do not need to be repaid, ensuring that the recipient can meet mortgage requirements. Understanding how to properly complete and utilize this form is essential for both givers and recipients alike.

Get Document Online

Fill in a Valid Gift Letter Template

Get Document Online

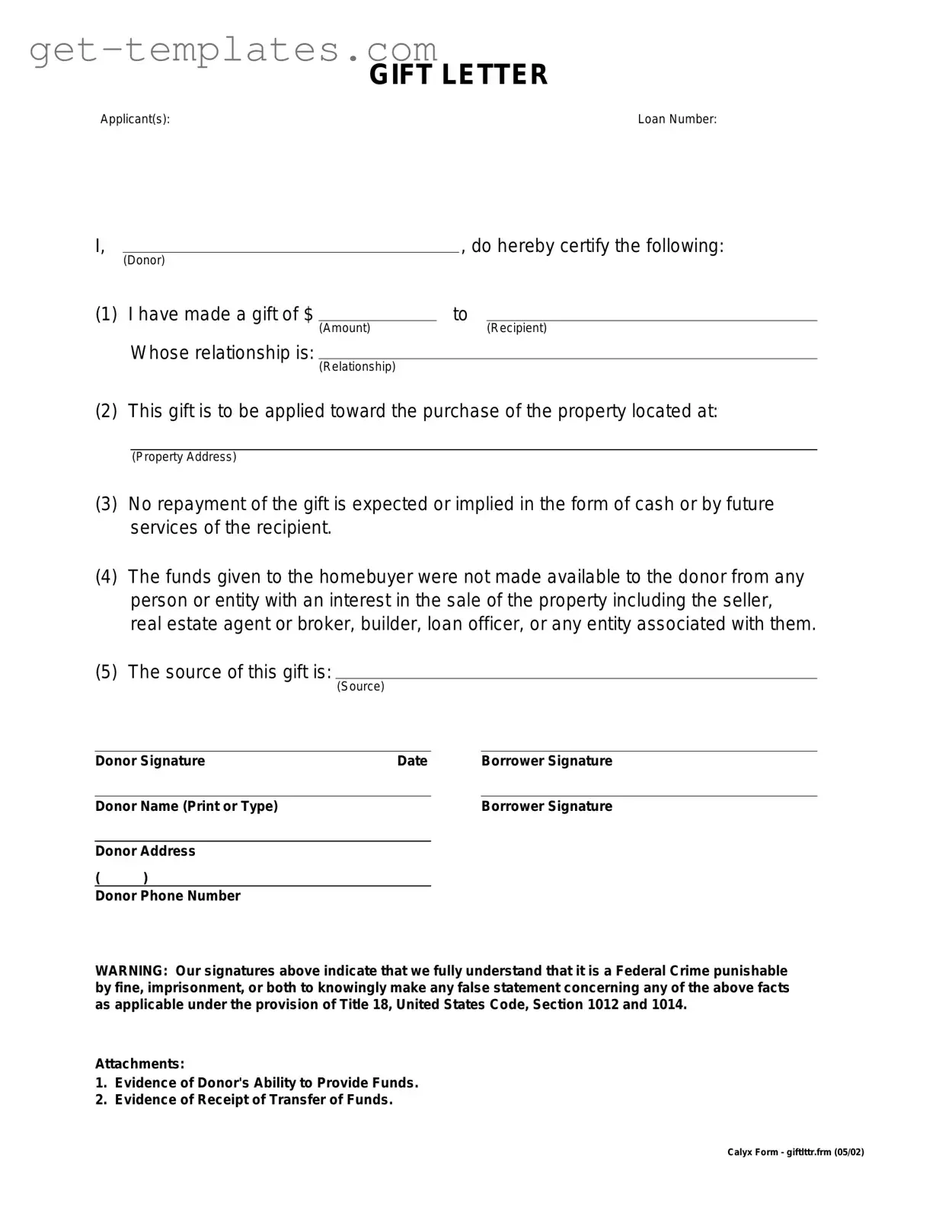

You’re halfway through — finish the form

Finish Gift Letter online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form