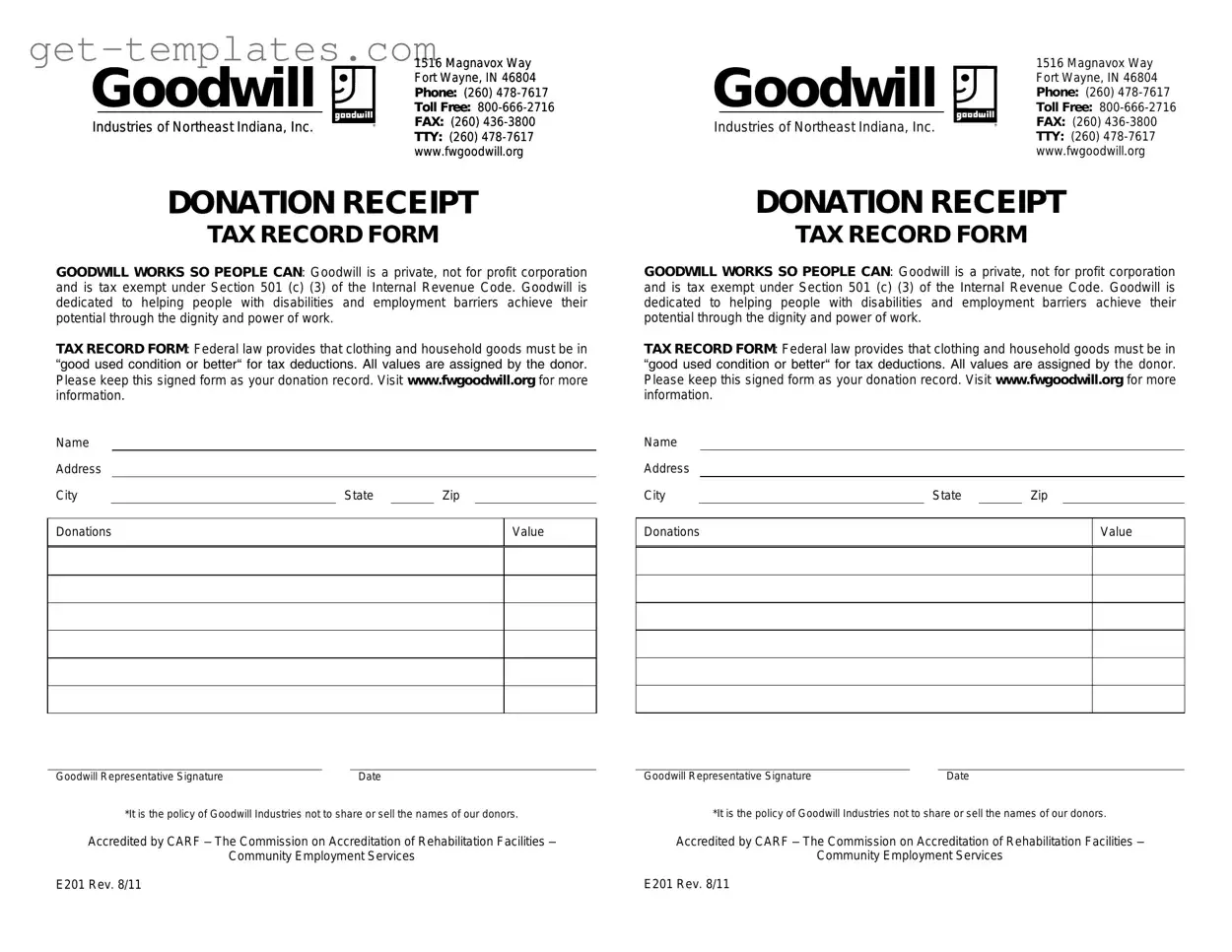

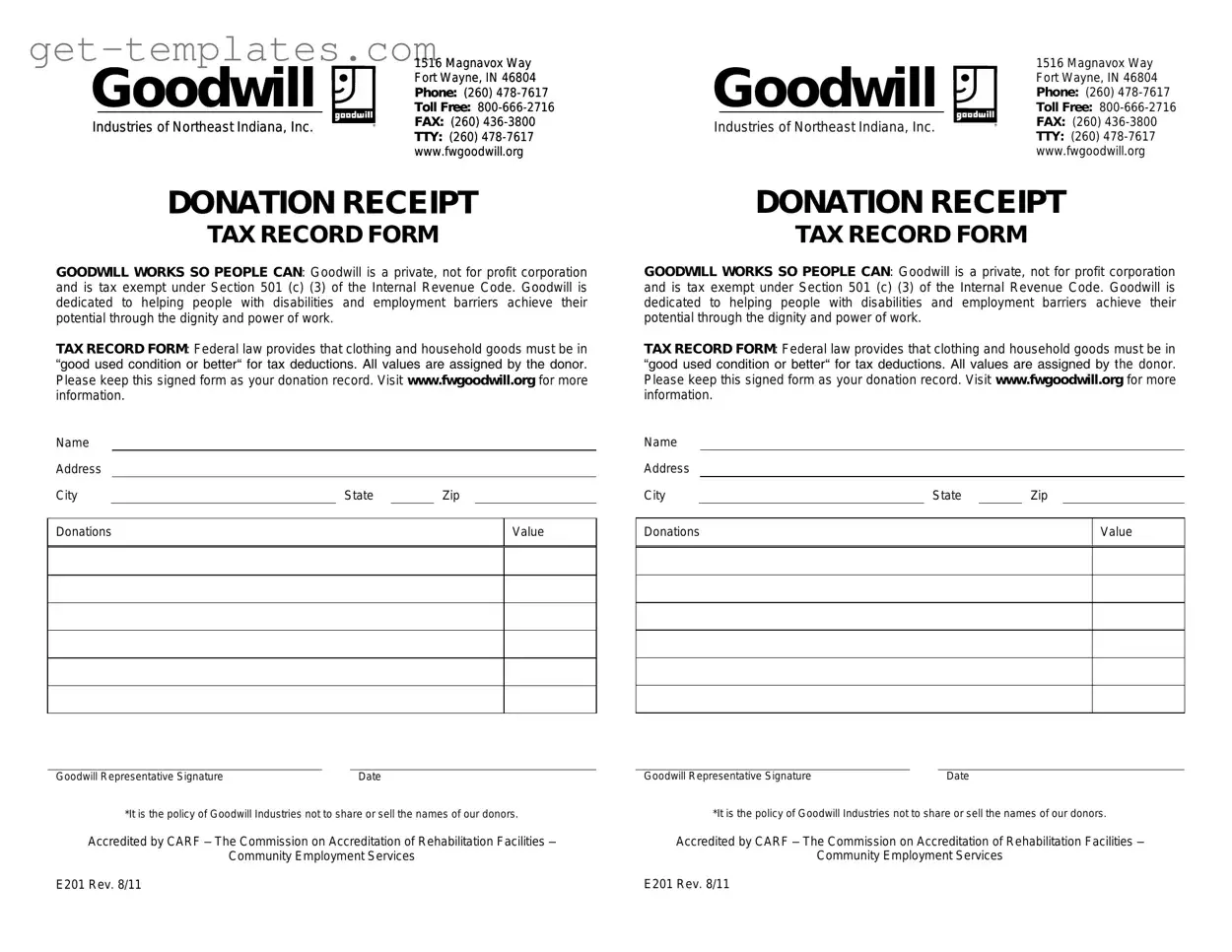

A Goodwill donation receipt form is a document that acknowledges the donation of goods or items to Goodwill Industries. It serves as proof of the donation for tax purposes and provides a record for both the donor and the organization.

Why do I need a Goodwill donation receipt?

The receipt is essential for several reasons:

-

It provides proof of your charitable contribution, which can be claimed as a tax deduction.

-

It helps you keep track of the items you donated and their estimated value.

-

It supports Goodwill's mission by documenting the donations they receive.

How do I obtain a Goodwill donation receipt?

You can obtain a Goodwill donation receipt by following these steps:

-

Make your donation at a Goodwill location.

-

Ask the staff for a donation receipt when you drop off your items.

-

Fill out any required information on the receipt, such as your name and address.

What items can I donate to Goodwill?

Goodwill accepts a wide range of items, including:

-

Clothing and shoes

-

Household goods

-

Electronics

-

Furniture

-

Toys and games

However, some items may be restricted due to safety or legal reasons, such as hazardous materials or perishable goods. Always check with your local Goodwill for specific guidelines.

How do I determine the value of my donated items?

Estimating the value of your donated items can be done by considering the following:

-

Research similar items online or in thrift stores to gauge market value.

-

Use the Goodwill valuation guide, which provides average prices for various items.

-

Consider the condition of the items; gently used items will have a higher value than those in poor condition.

Can I deduct the full value of my donation on my taxes?

You can deduct the fair market value of your donated items, but not necessarily the full retail value. It's important to keep accurate records and receipts to substantiate your claims. The IRS provides guidelines on how to value donated items, which can help you determine the appropriate deduction.

What if I lose my Goodwill donation receipt?

If you lose your receipt, you may not be able to claim the deduction on your taxes. However, you can try the following:

-

Contact your local Goodwill location. They may be able to provide a duplicate receipt if you can provide details about your donation.

-

Keep a detailed list of the items you donated, along with their estimated values, as a backup.

Is there a limit to how much I can donate to Goodwill?

There is no set limit on how much you can donate to Goodwill. However, if you are donating a large quantity of items or high-value items, it is advisable to consult with a tax professional to understand any implications for your tax return.

How does Goodwill use my donations?

Goodwill uses donations to fund its programs and services, which include job training, employment placement, and community support. By donating, you help individuals gain skills and find jobs, contributing to the overall well-being of the community.