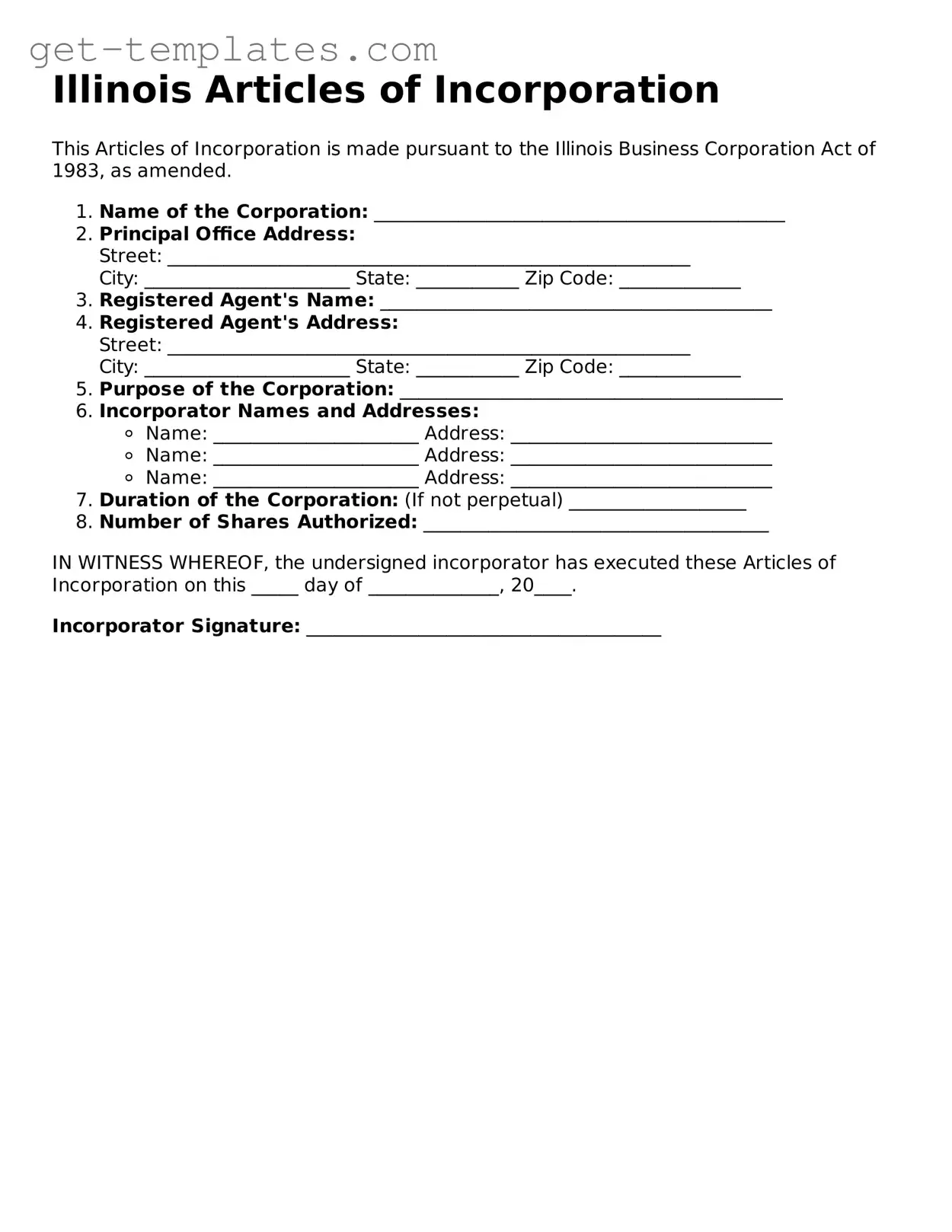

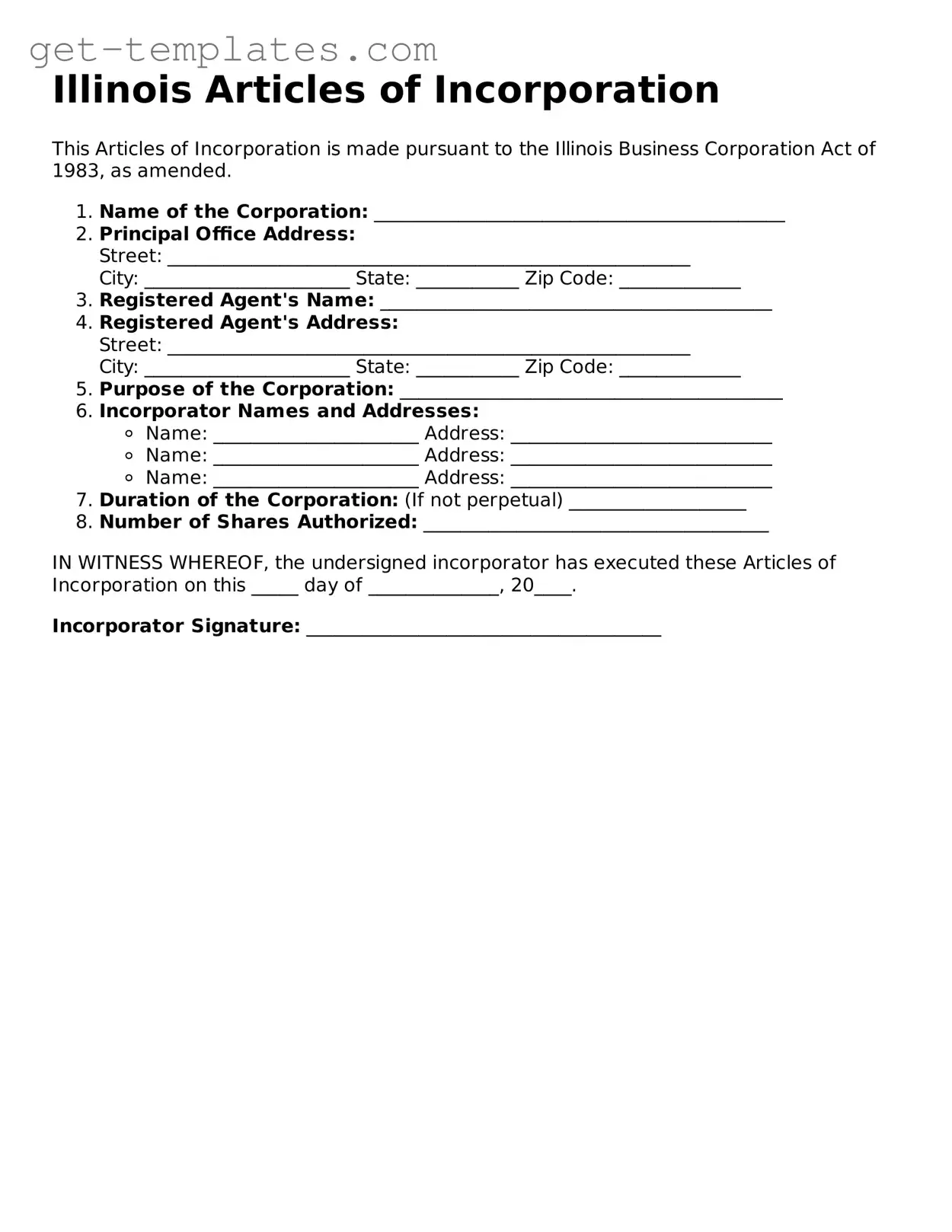

What are the Articles of Incorporation?

The Articles of Incorporation is a legal document that establishes a corporation in Illinois. It includes important information about your business, such as its name, purpose, and the names of its initial directors. Filing this document is a crucial step in forming your corporation.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Illinois must file the Articles of Incorporation. This includes small businesses, nonprofits, and larger enterprises. If you want your business to have limited liability protection and a formal structure, this document is necessary.

What information is required in the Articles of Incorporation?

The form requires several key pieces of information, including:

-

The name of your corporation

-

The purpose of the corporation

-

The address of the corporation's registered office

-

The name and address of the registered agent

-

The number of shares the corporation is authorized to issue

-

The names and addresses of the initial directors

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online or by mail. If filing online, visit the Illinois Secretary of State's website. If you prefer to file by mail, print the form, fill it out, and send it to the appropriate address along with the required fee.

What is the filing fee for the Articles of Incorporation?

The filing fee varies depending on the type of corporation you are forming. Generally, the fee is around $150. It's a good idea to check the latest fee schedule on the Illinois Secretary of State's website to confirm the exact amount.

How long does it take for my Articles of Incorporation to be processed?

Processing times can vary. Typically, online filings are processed faster than paper submissions. You can expect it to take anywhere from a few days to a couple of weeks. If you need it expedited, check for options that may be available for faster processing.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are processed, you will receive a confirmation from the state. Your corporation will officially exist, and you can begin operating under its name. Don't forget to also apply for any necessary business licenses and permits to ensure you comply with local regulations.