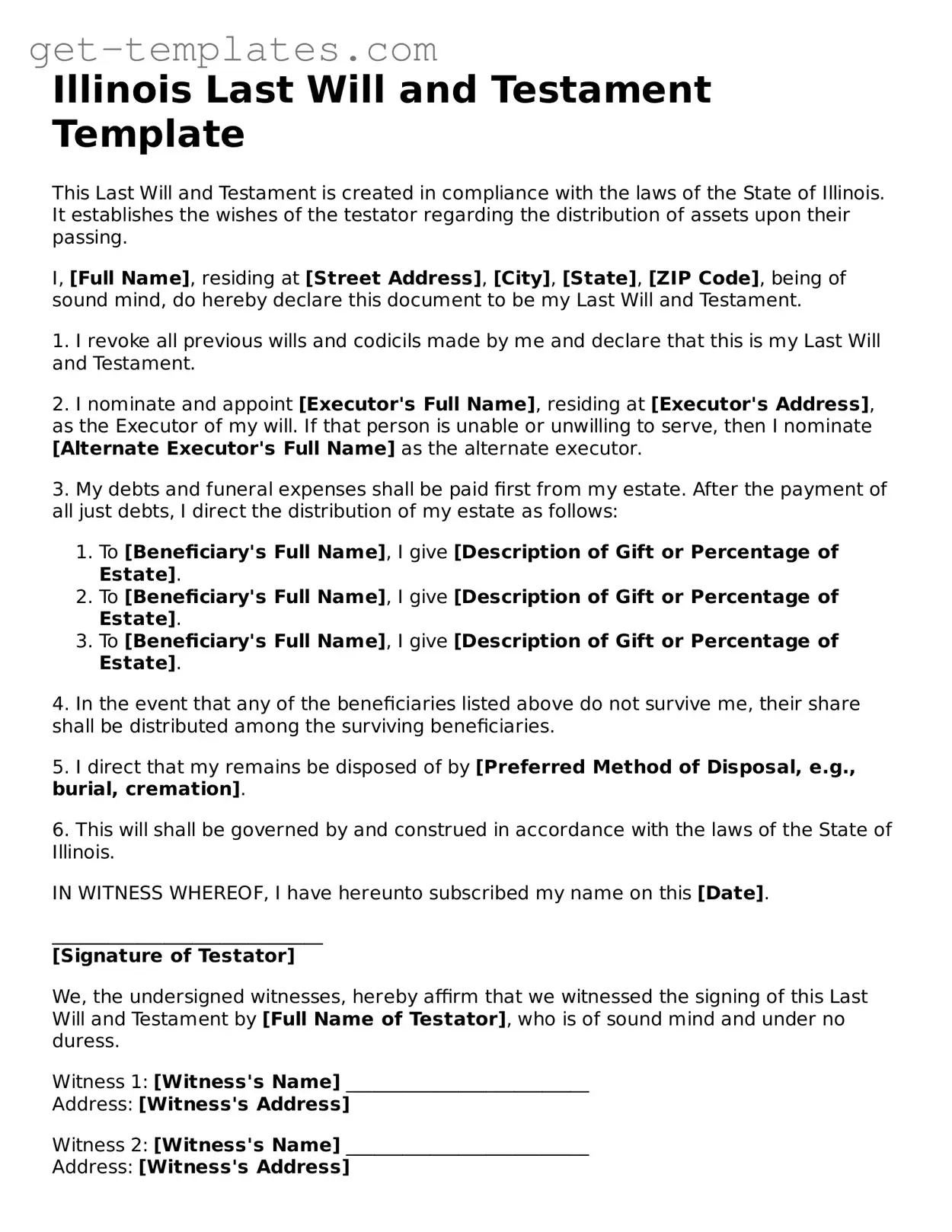

Attorney-Approved Last Will and Testament Document for Illinois

The Illinois Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after their passing. This essential tool helps ensure that your intentions are honored and can provide peace of mind for you and your loved ones. Understanding how to properly complete this form is crucial for effective estate planning.

Get Document Online

Attorney-Approved Last Will and Testament Document for Illinois

Get Document Online

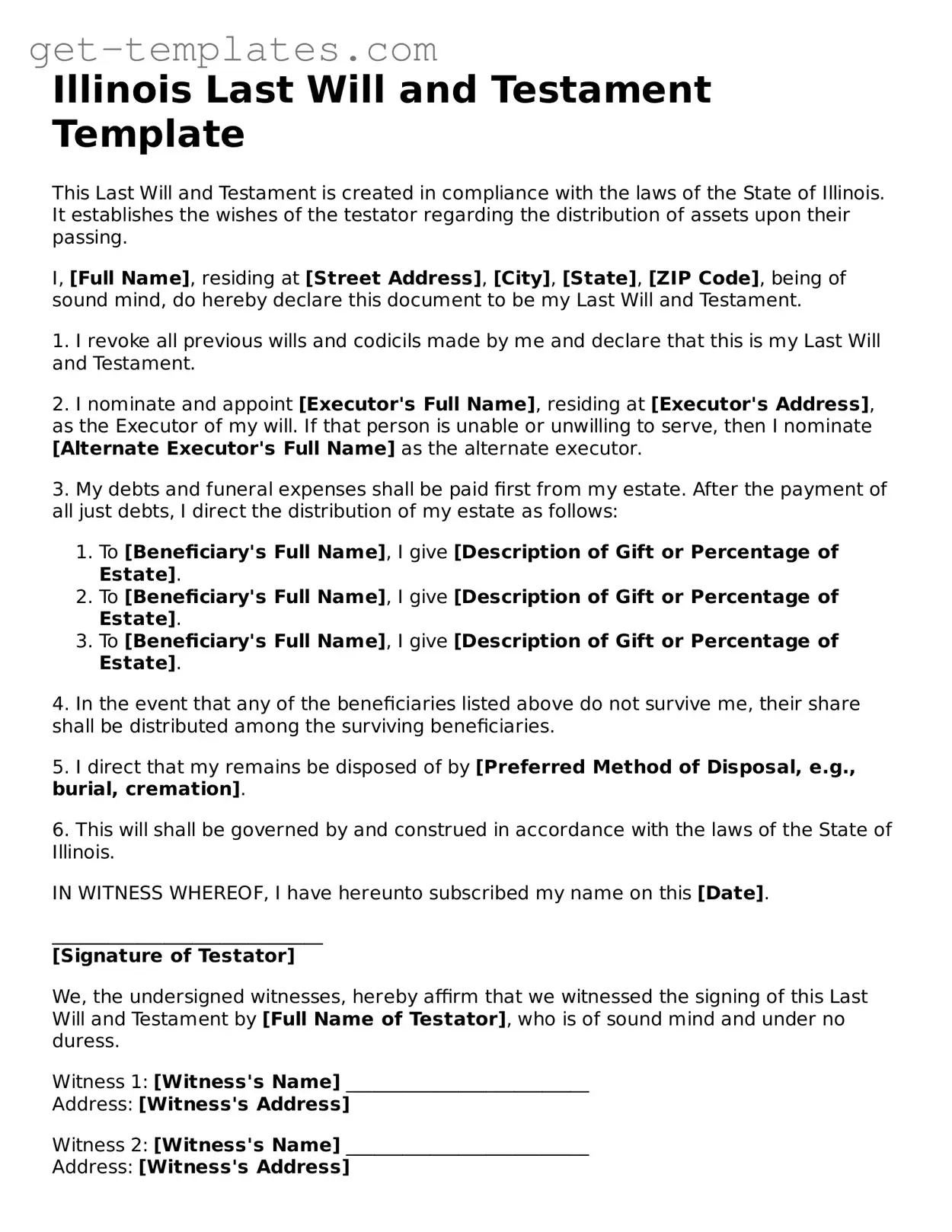

You’re halfway through — finish the form

Finish Last Will and Testament online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form