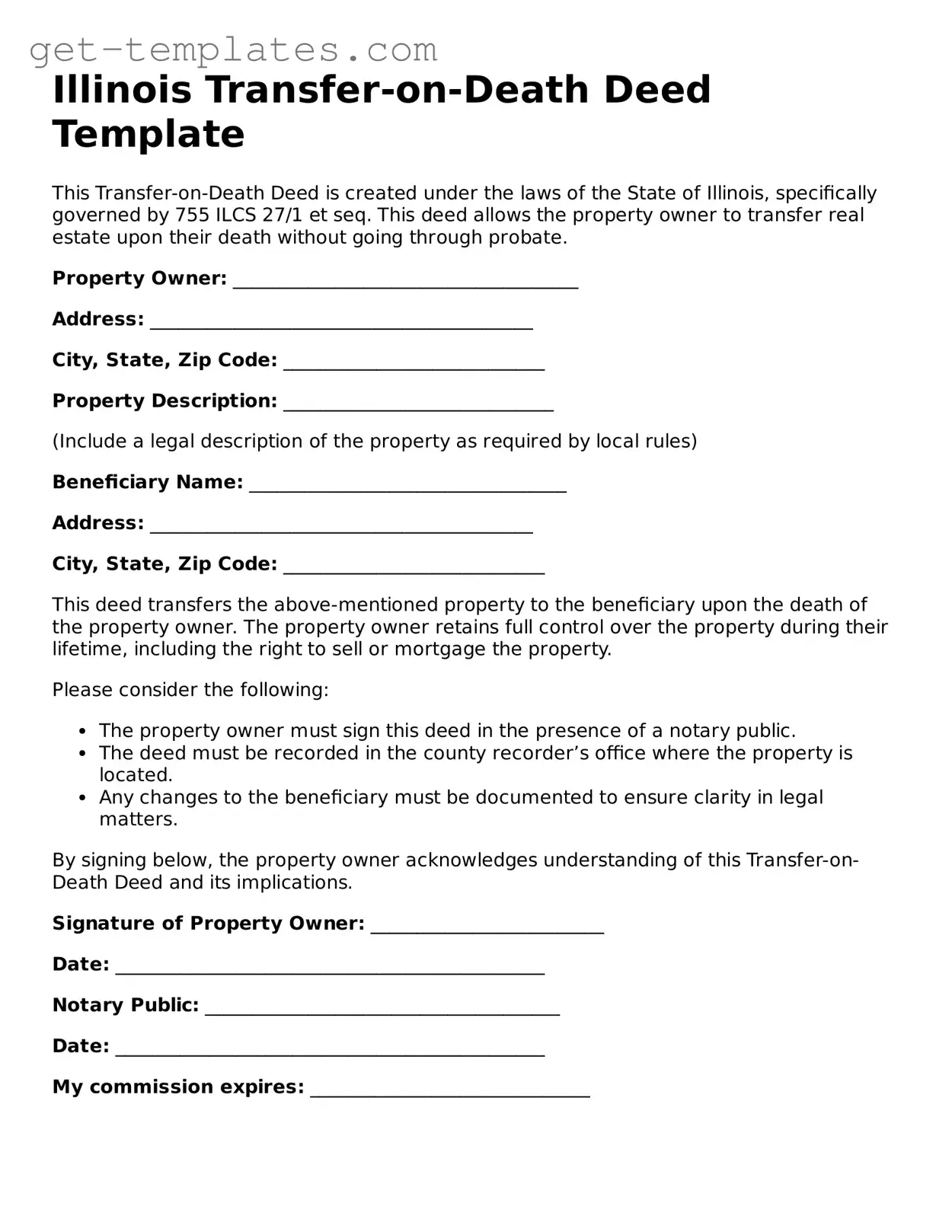

Attorney-Approved Transfer-on-Death Deed Document for Illinois

The Illinois Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without going through probate. This form provides a straightforward way to ensure that property is passed on according to the owner's wishes. It can simplify the process for heirs and reduce potential complications related to property transfer.

Get Document Online

Attorney-Approved Transfer-on-Death Deed Document for Illinois

Get Document Online

You’re halfway through — finish the form

Finish Transfer-on-Death Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form