What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for independent contractors. Unlike traditional employees, independent contractors are not on a regular payroll, so this pay stub serves as a record of their payments for services rendered. It provides essential information for both the contractor and the client, ensuring transparency in financial transactions.

Why do I need a Pay Stub as an Independent Contractor?

Having a pay stub is crucial for several reasons:

-

Record Keeping:

It helps maintain accurate records of your income, which is essential for tax purposes.

-

Proof of Income:

A pay stub can serve as proof of income when applying for loans, leases, or other financial obligations.

-

Transparency:

It ensures that both you and your clients are clear about payment terms and amounts.

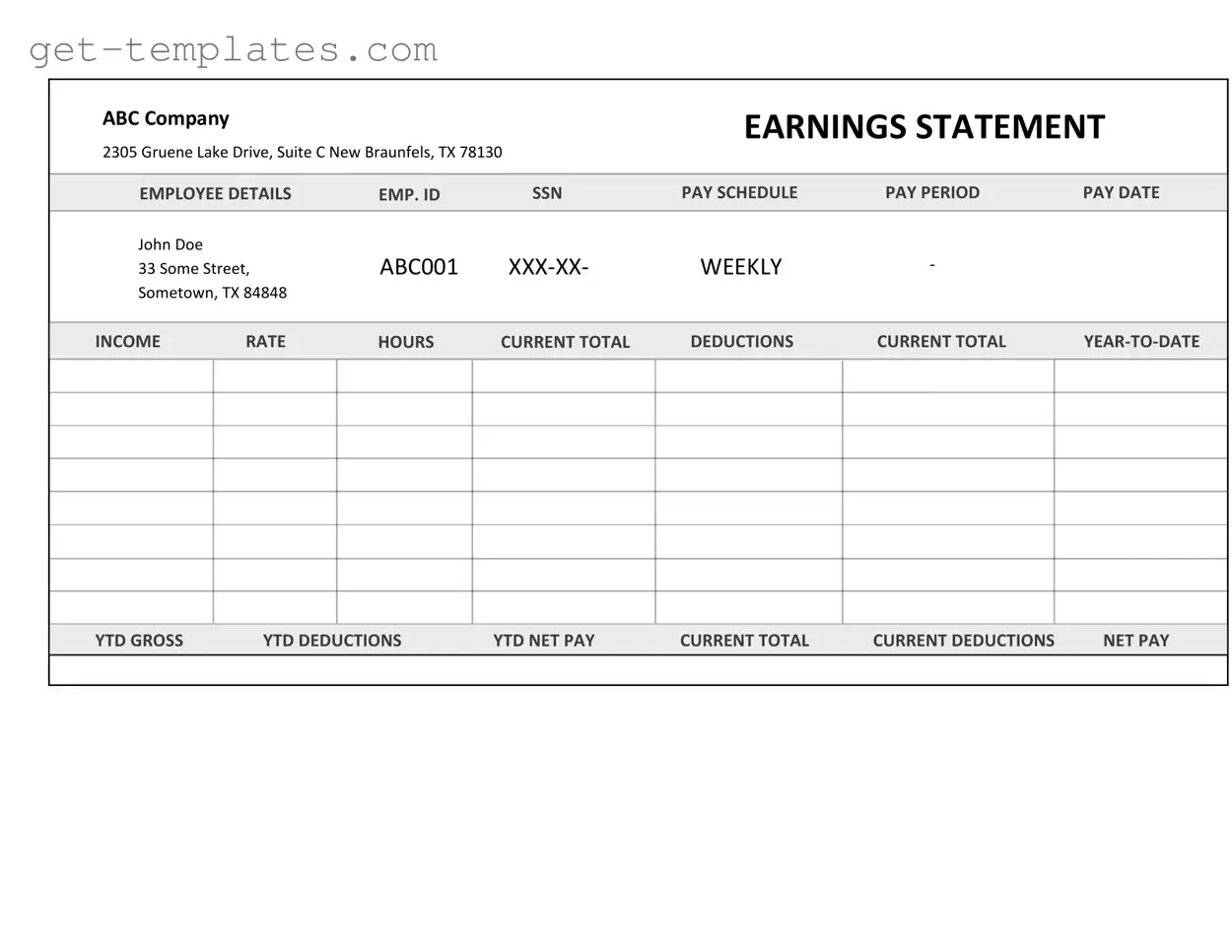

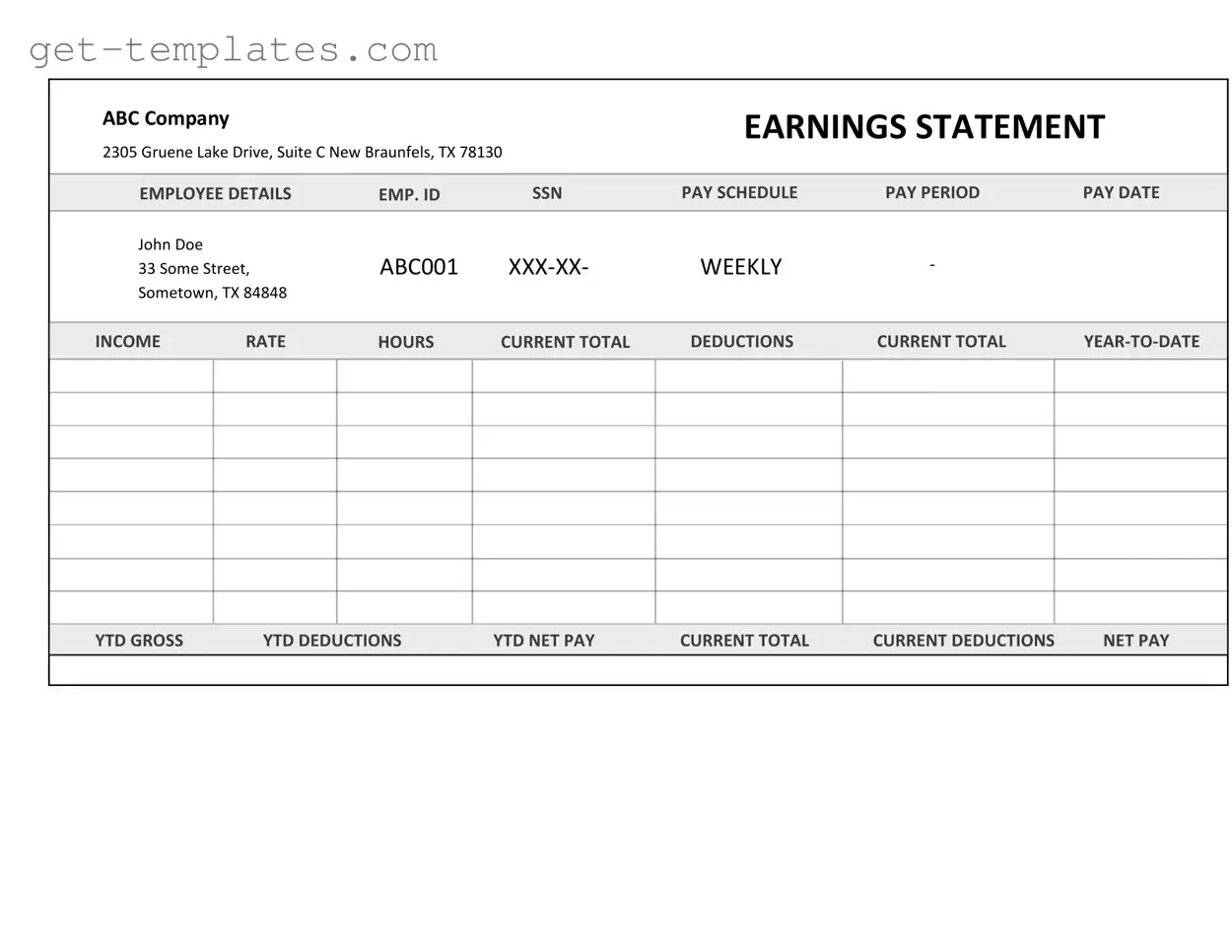

An Independent Contractor Pay Stub should typically include the following details:

-

Contractor's Name:

The full name of the independent contractor.

-

Client's Name:

The name of the business or individual who hired the contractor.

-

Payment Period:

The specific time frame for which the payment is being made.

-

Gross Earnings:

The total amount earned before any deductions.

-

Deductions:

Any applicable deductions, such as taxes or fees.

-

Net Pay:

The final amount the contractor will receive after deductions.

How do I create a Pay Stub?

Creating a pay stub can be done in a few simple steps:

-

Gather all relevant information, including your earnings and any deductions.

-

Choose a template or software that allows you to input this information easily.

-

Fill in the required fields accurately.

-

Review the pay stub for accuracy before sending it to your client.

Can I use a Pay Stub for tax purposes?

Yes, a pay stub can be used for tax purposes. It provides a clear record of your earnings and any deductions that may have been made. When filing taxes, you can use this document to report your income accurately. However, it’s essential to keep all related documents, such as invoices and contracts, for comprehensive tax filing.

What if my client doesn’t provide a Pay Stub?

If your client does not provide a pay stub, you can request one. It's reasonable to ask for documentation that outlines your earnings, especially if you need it for tax or financial purposes. If they refuse, consider creating your own pay stub based on the payments received. Always keep detailed records of your transactions for your own reference.

Are there any legal requirements for providing a Pay Stub?

While independent contractors are not subject to the same labor laws as employees, providing a pay stub is generally considered a best practice. Some states may have specific regulations regarding payment documentation, so it's wise to check local laws. Even if not legally required, having a pay stub can help prevent disputes and foster trust between contractors and clients.

Can I customize my Pay Stub?

Yes, you can customize your pay stub to fit your needs. Many templates allow for modifications to include your branding, specific payment details, or additional information that may be relevant to your clients. Customization can enhance professionalism and ensure that all necessary information is clearly communicated.