What is a Promissory Note in Indiana?

A Promissory Note is a written promise to pay a specific amount of money at a designated time or on demand. In Indiana, it serves as a legal document that outlines the terms of a loan between a borrower and a lender. This note includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

Any individual or business in Indiana can use the Promissory Note form. It is commonly used by lenders and borrowers in personal loans, business loans, or any situation where money is borrowed with the intention of repayment. Both parties should understand the terms before signing.

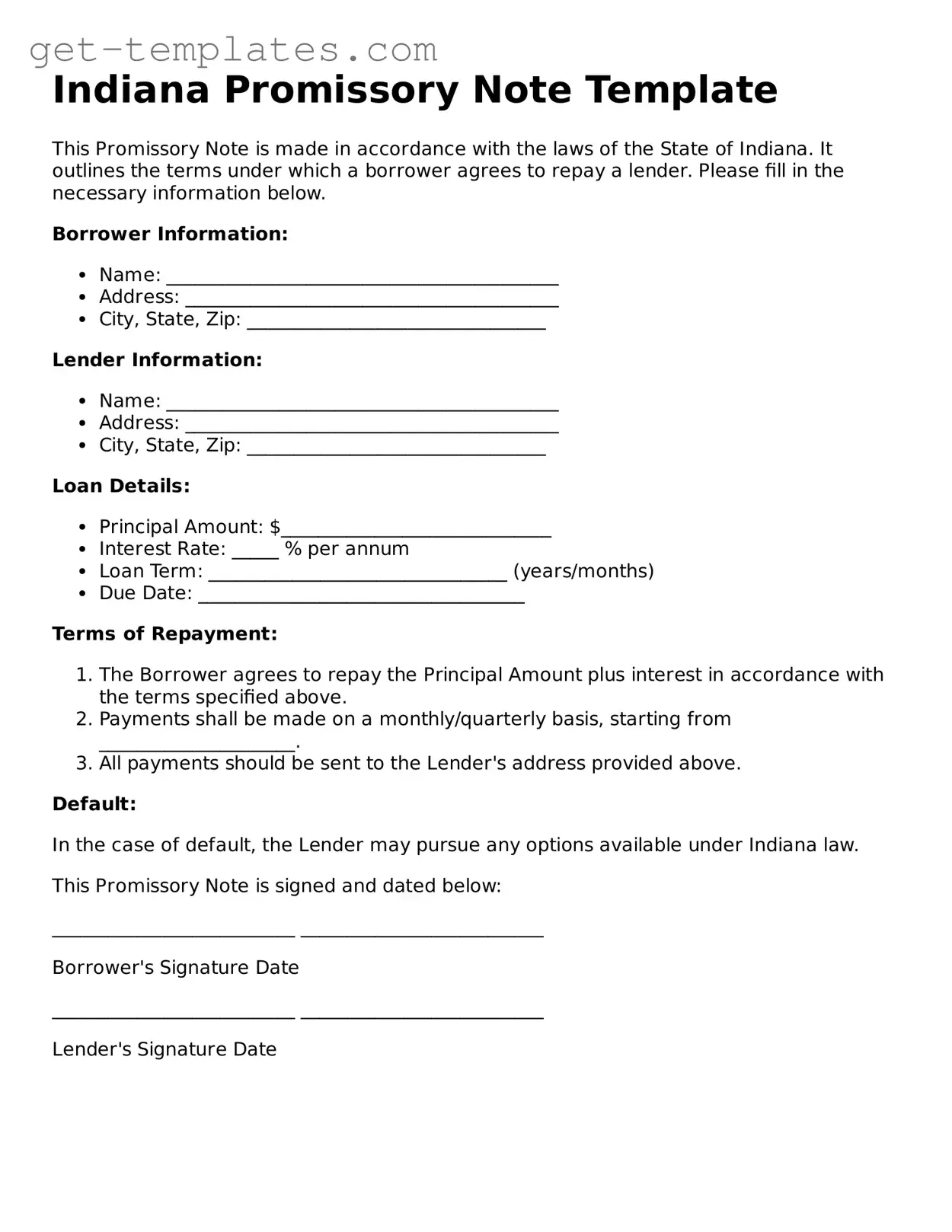

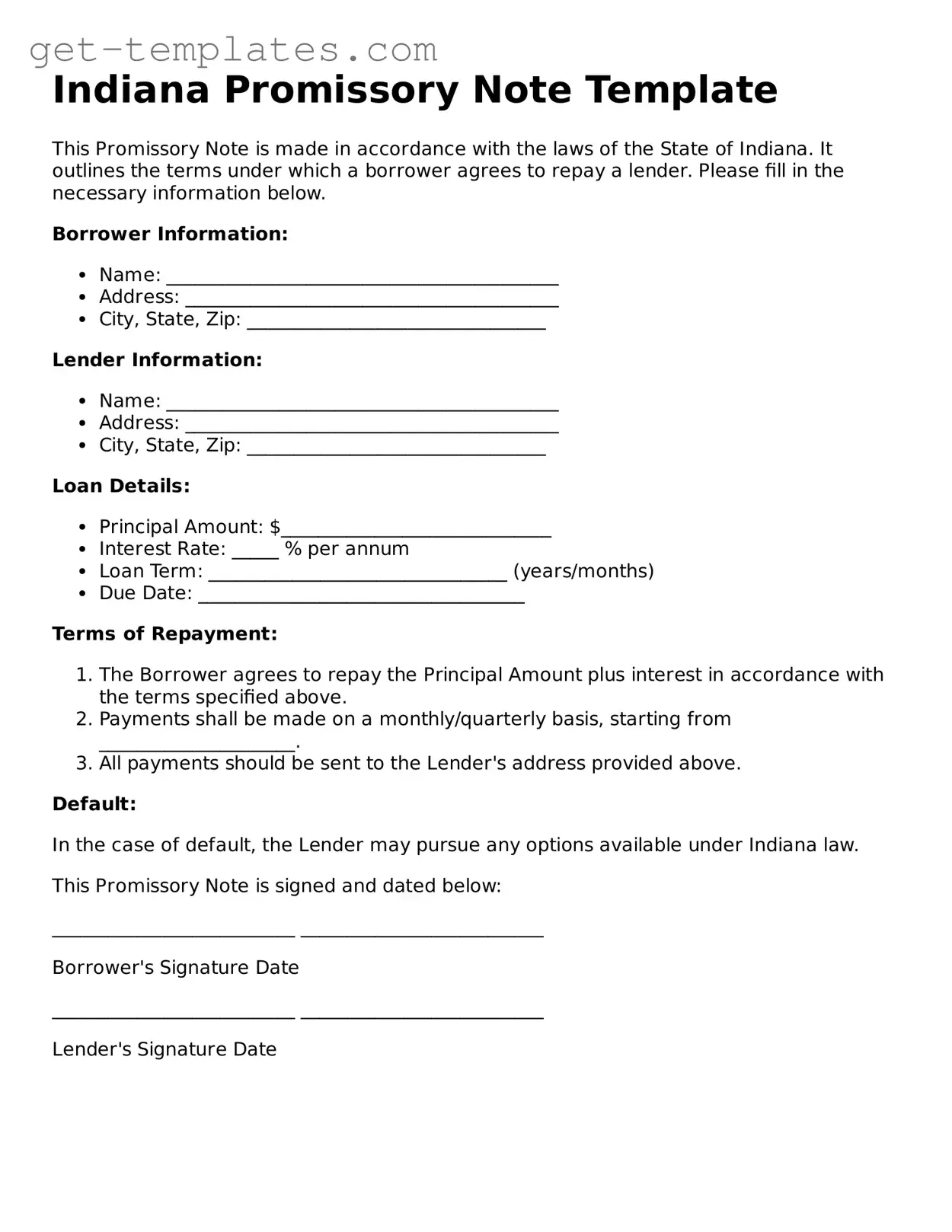

To complete the Indiana Promissory Note form, you will need the following information:

-

The names and addresses of both the borrower and the lender.

-

The principal amount being borrowed.

-

The interest rate, if applicable.

-

The repayment schedule, including due dates.

-

Any late fees or penalties for missed payments.

-

Signatures of both parties.

Is notarization required for an Indiana Promissory Note?

No, notarization is not required for a Promissory Note in Indiana. However, having the document notarized can provide an extra layer of authenticity and may be beneficial in case of disputes. It is always a good practice to have clear documentation.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender can take legal action to recover the owed amount. The terms outlined in the Promissory Note will guide the lender on what steps to take, including any penalties or interest that may accrue. It is essential for both parties to understand their rights and obligations.

Can the terms of the Promissory Note be changed after it is signed?

Yes, the terms of a Promissory Note can be changed, but both parties must agree to the modifications. It is advisable to document any changes in writing and have both parties sign the amended agreement. This helps prevent misunderstandings later on.

How long is a Promissory Note valid in Indiana?

A Promissory Note does not have a set expiration date in Indiana. However, the statute of limitations for enforcing a Promissory Note is typically six years. After this period, the lender may lose the legal right to collect the debt. It’s important to keep track of payment schedules and any outstanding balances.

Where can I find an Indiana Promissory Note template?

You can find Indiana Promissory Note templates online through various legal form websites. Many of these resources offer customizable templates that you can fill out based on your specific needs. Always ensure that the template complies with Indiana laws.