What is a Tractor Bill of Sale?

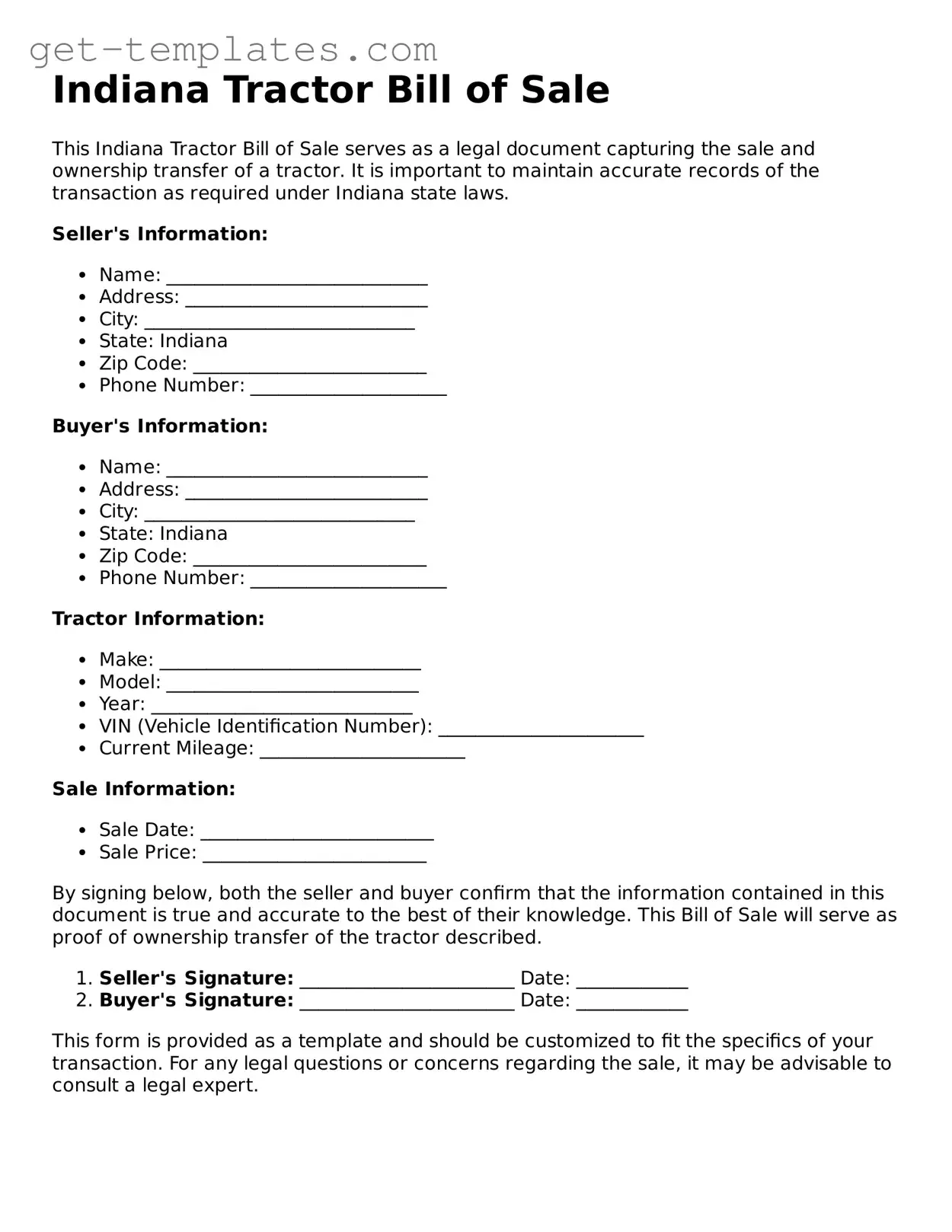

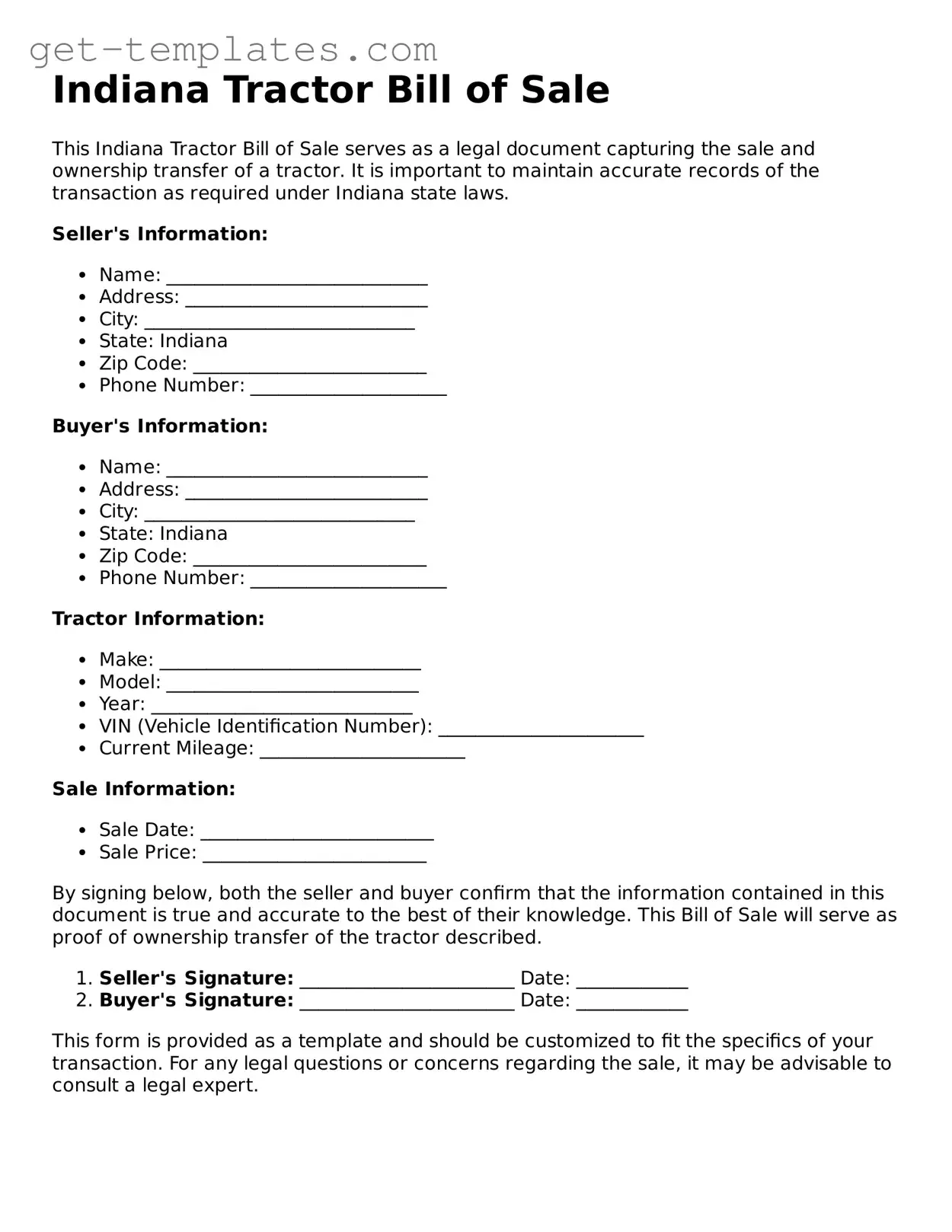

A Tractor Bill of Sale is a legal document that records the sale of a tractor from one party to another. It serves as proof of the transaction and outlines important details about the sale, including the buyer, seller, and the tractor's specifications.

Why do I need a Tractor Bill of Sale in Indiana?

In Indiana, a Tractor Bill of Sale is important for several reasons:

-

It provides legal protection for both the buyer and seller.

-

It helps establish ownership of the tractor.

-

The document can be useful for tax purposes or when registering the tractor.

A comprehensive Tractor Bill of Sale usually includes the following information:

-

The names and addresses of the buyer and seller.

-

The date of the sale.

-

A description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

-

The sale price of the tractor.

-

Any warranties or guarantees provided by the seller.

Do I need to have the Tractor Bill of Sale notarized?

While notarization is not a legal requirement in Indiana, having the document notarized can add an extra layer of security and credibility. It helps verify the identities of the parties involved and confirms that both have agreed to the terms of the sale.

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale. It is important to ensure that all necessary information is included and that the document is clear and concise. Alternatively, templates are available online that can guide you in drafting a proper bill of sale.

What should I do after completing the Tractor Bill of Sale?

After completing the Tractor Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may also need to present this document when registering the tractor with the Indiana Bureau of Motor Vehicles (BMV).

Is there a fee associated with registering the tractor after the sale?

Yes, there may be fees associated with registering the tractor in Indiana. These fees can vary based on the type of vehicle and its weight. It is advisable to check with the BMV for the most current fee schedule.

What if the tractor has a lien on it?

If the tractor has a lien, the seller must disclose this information to the buyer. The lien must be resolved before the sale can be finalized. The buyer should ensure that the lien is released or that they understand the implications of purchasing a liened vehicle.

Can a Tractor Bill of Sale be used for other types of equipment?

Yes, a Tractor Bill of Sale can often be adapted for other types of agricultural or heavy equipment. However, it is important to modify the document to accurately reflect the specifics of the equipment being sold.

What should I do if I have further questions about the Tractor Bill of Sale?

If you have further questions, consider consulting with a legal professional or contacting your local BMV office. They can provide additional guidance and ensure that you have all the necessary information for your transaction.