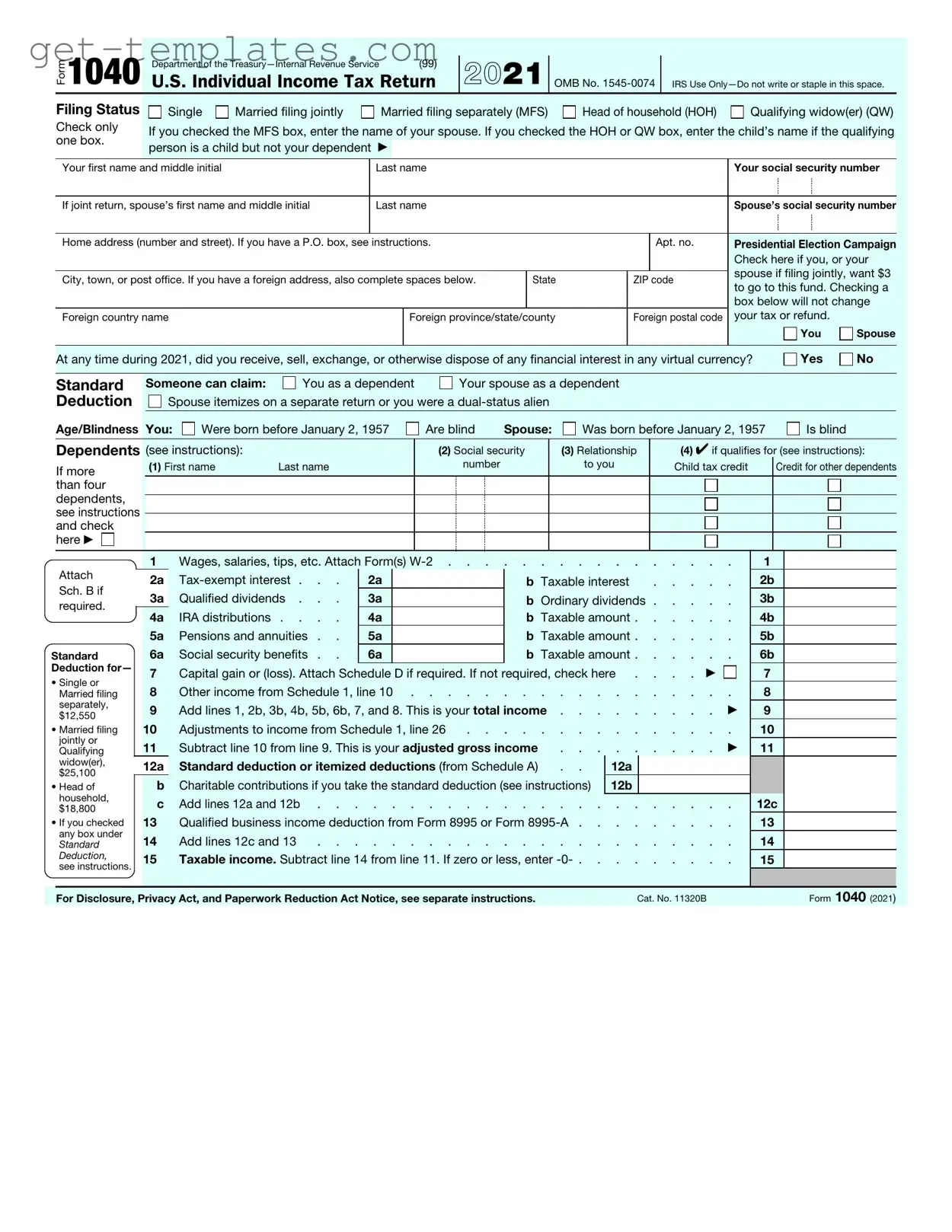

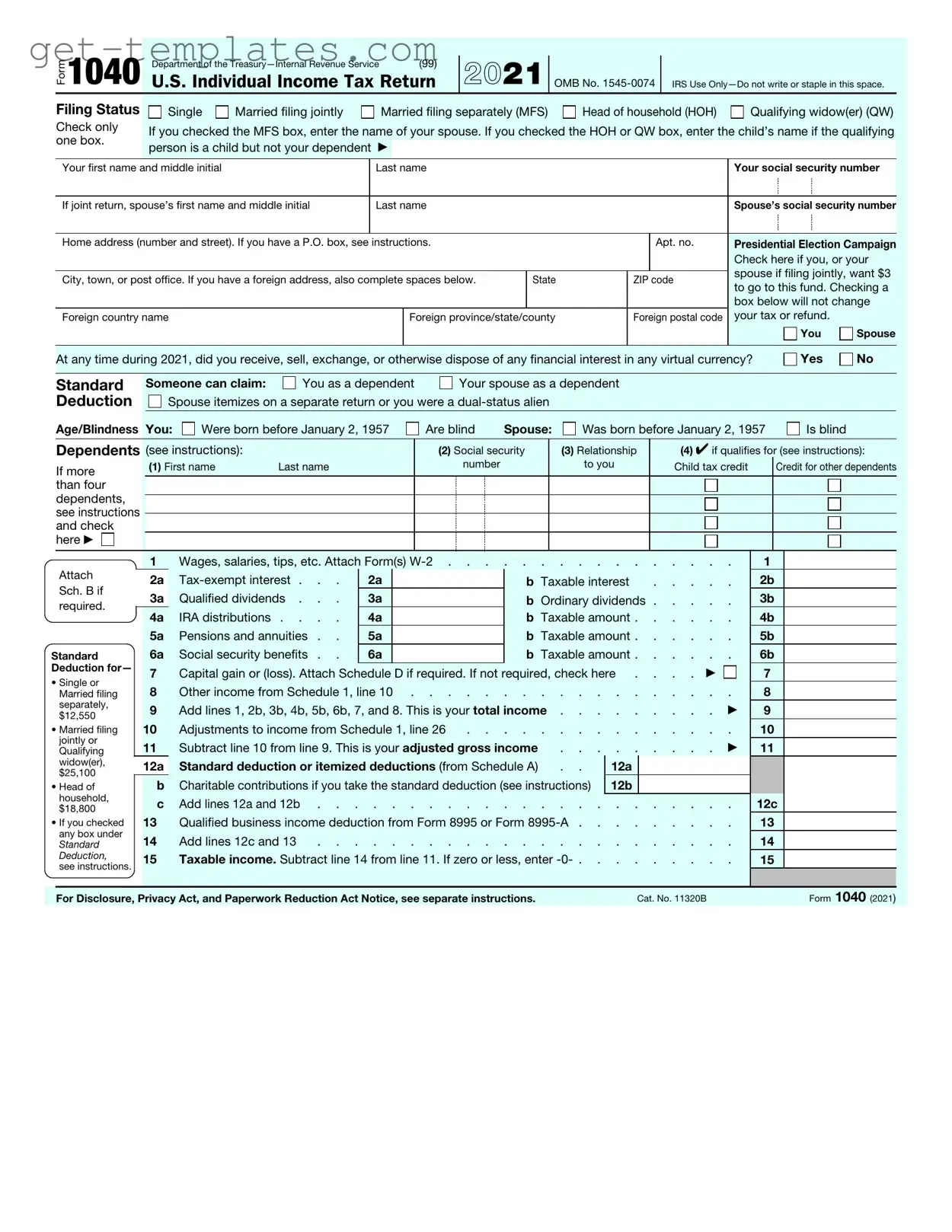

The IRS 1040 form is the standard individual income tax return form used by U.S. taxpayers. It is used to report income, claim tax deductions and credits, and calculate the amount of tax owed or the refund due. This form is essential for filing your federal income tax return each year.

Most U.S. citizens and residents who earn income must file a 1040 form. This includes individuals who:

-

Earn wages or salary.

-

Have self-employment income.

-

Receive unemployment benefits.

-

Have investment income.

Even if you do not meet the income threshold, you may still want to file to claim a refund or certain tax credits.

To complete the 1040 form, gather the following information:

-

Your Social Security number.

-

Your income documents, such as W-2s and 1099s.

-

Information on any tax deductions or credits you plan to claim.

-

Your bank account details if you want a direct deposit for your refund.

The deadline to file your 1040 form is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file on time to avoid penalties and interest on any taxes owed.

Yes, you can file your 1040 form electronically. The IRS encourages electronic filing because it is faster and more secure. Many tax preparation software programs are available to assist you with the process. You can also file for free through the IRS Free File program if you qualify.

What should I do if I cannot pay my taxes owed?

If you cannot pay the full amount of taxes owed, it is important to still file your 1040 form by the deadline. You may qualify for a payment plan or an installment agreement with the IRS. Additionally, you can explore options for requesting an extension or seeking help from a tax professional.

If you discover an error after filing your 1040 form, you can correct it by filing an amended return using Form 1040-X. This form allows you to make changes to your original return, such as correcting income, deductions, or credits. Be sure to file the amended return as soon as you realize the mistake.

How do I check the status of my refund?

You can check the status of your tax refund by visiting the IRS website and using the "Where's My Refund?" tool. You will need to provide your Social Security number, filing status, and the exact amount of your refund. Typically, refunds are issued within 21 days of filing electronically.

Yes, there are different versions of the 1040 form. The main versions include:

-

Form 1040:

The standard form for most taxpayers.

-

Form 1040-SR:

Designed for seniors aged 65 and older, featuring larger print and a simplified format.

-

Form 1040-NR:

For non-resident aliens who need to file a U.S. tax return.

Choose the version that best fits your situation when filing your taxes.