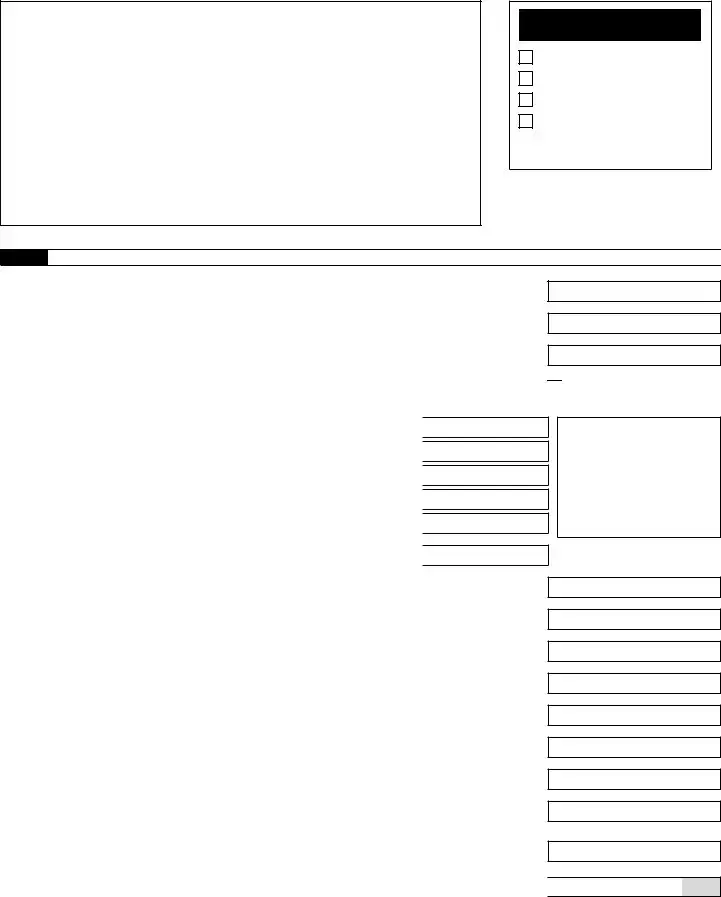

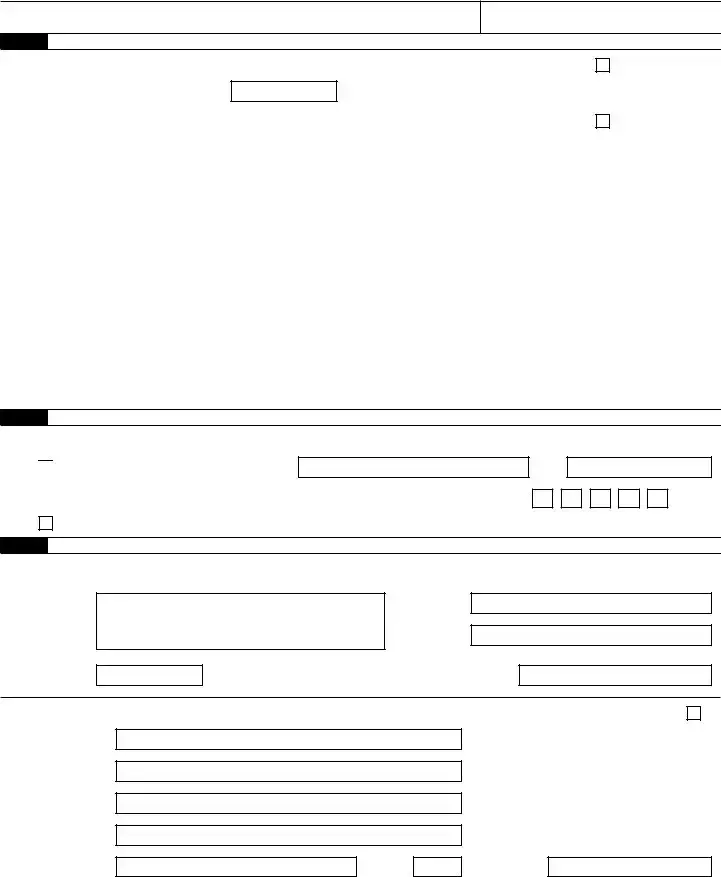

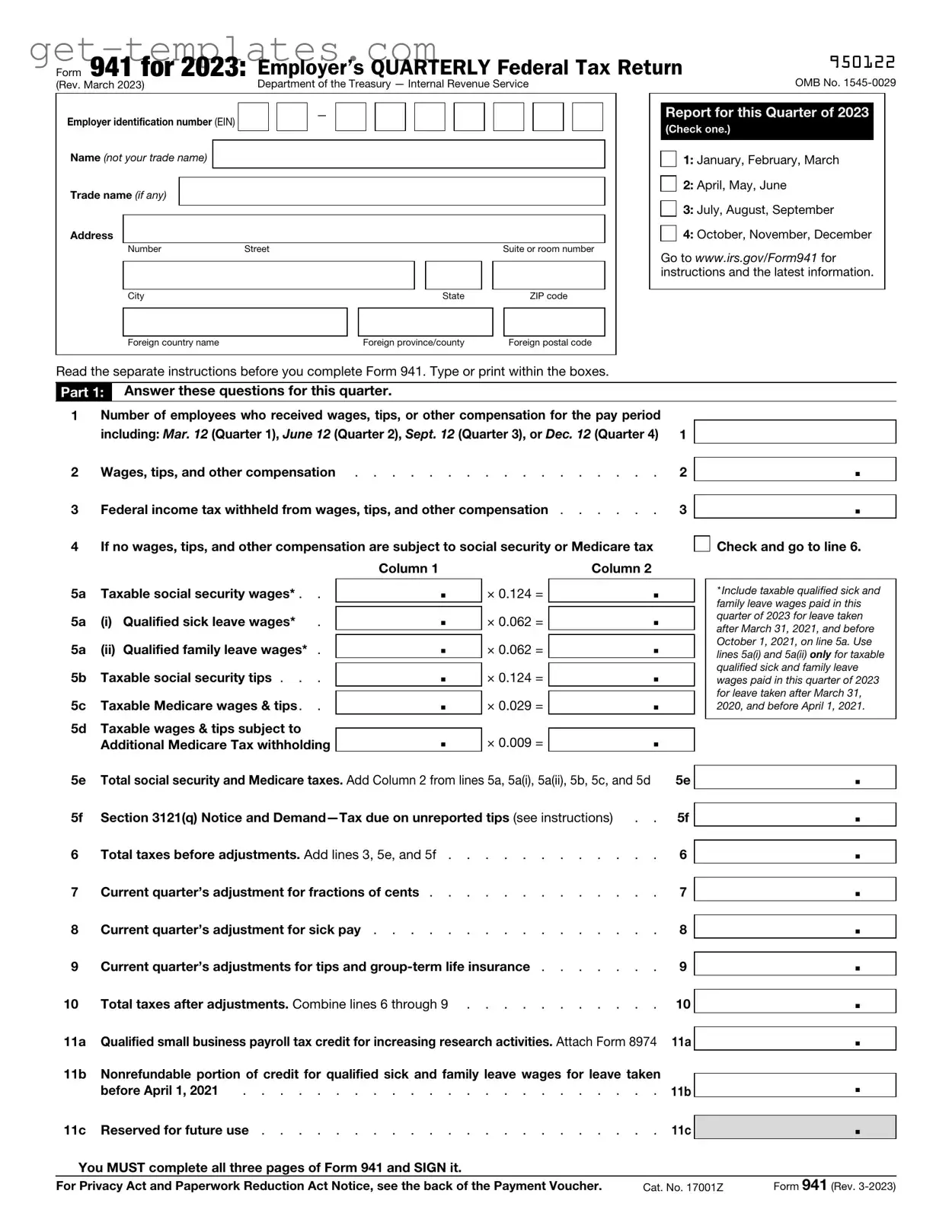

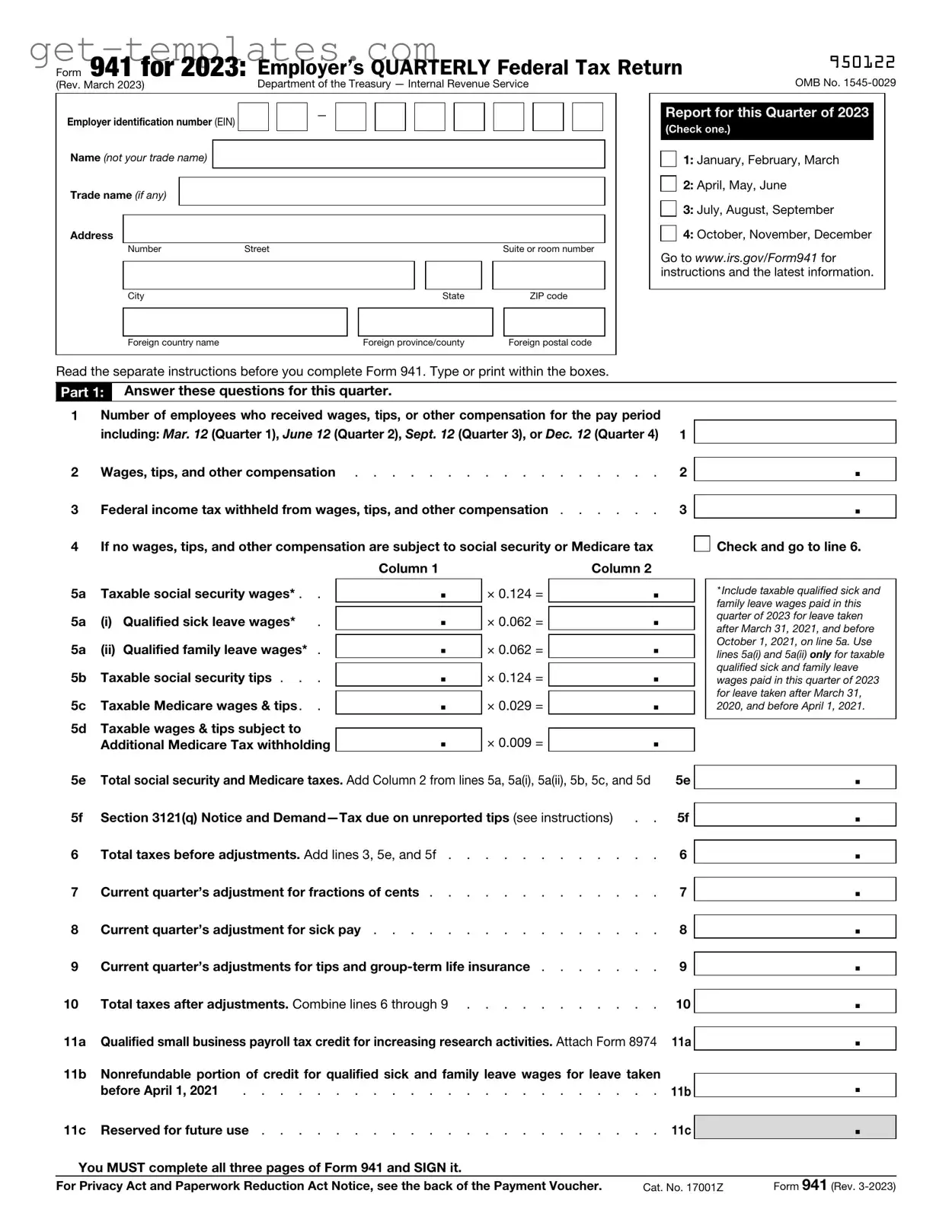

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is filed quarterly and provides the IRS with information about the taxes you owe and the amounts you have already paid.

Any employer who pays wages to employees must file Form 941. This includes businesses, nonprofits, and government entities. If you have employees and withhold federal income tax, Social Security tax, or Medicare tax, you are required to file this form.

Form 941 is due four times a year, specifically on the last day of the month following the end of each quarter. The due dates are:

-

For the first quarter (January - March): April 30

-

For the second quarter (April - June): July 31

-

For the third quarter (July - September): October 31

-

For the fourth quarter (October - December): January 31 of the following year

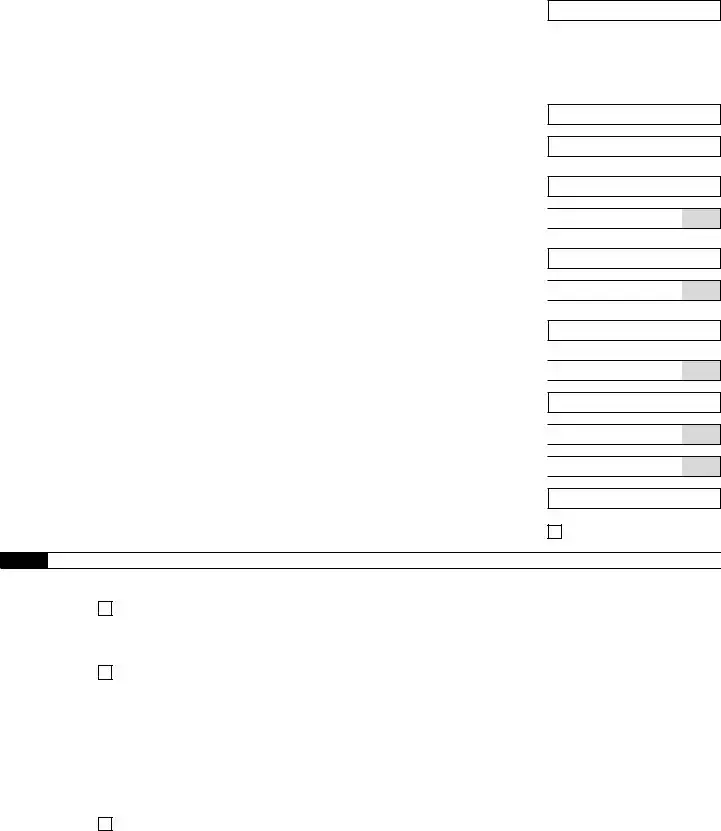

Form 941 requires several key pieces of information, including:

-

Your business name and address

-

Your Employer Identification Number (EIN)

-

The number of employees you paid during the quarter

-

Total wages paid

-

Taxes withheld from employee paychecks

-

Any adjustments for prior quarters

You can file Form 941 electronically or by mail. The IRS encourages electronic filing, as it is faster and more secure. If you choose to file by mail, make sure to send it to the correct address based on your location. You can find the mailing addresses on the IRS website.

If you miss the filing deadline, you may face penalties and interest on any unpaid taxes. The IRS may impose a failure-to-file penalty as well as a failure-to-pay penalty. It’s important to file as soon as possible to minimize any potential penalties.

Yes, if you need to correct errors on a previously filed Form 941, you can do so by filing Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund. This form allows you to make adjustments for overreported or underreported amounts.

For more detailed information about Form 941, including instructions and resources, visit the IRS website. You can also contact the IRS directly or consult with a tax professional for assistance.

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number