Attorney-Approved Deed Document for Michigan

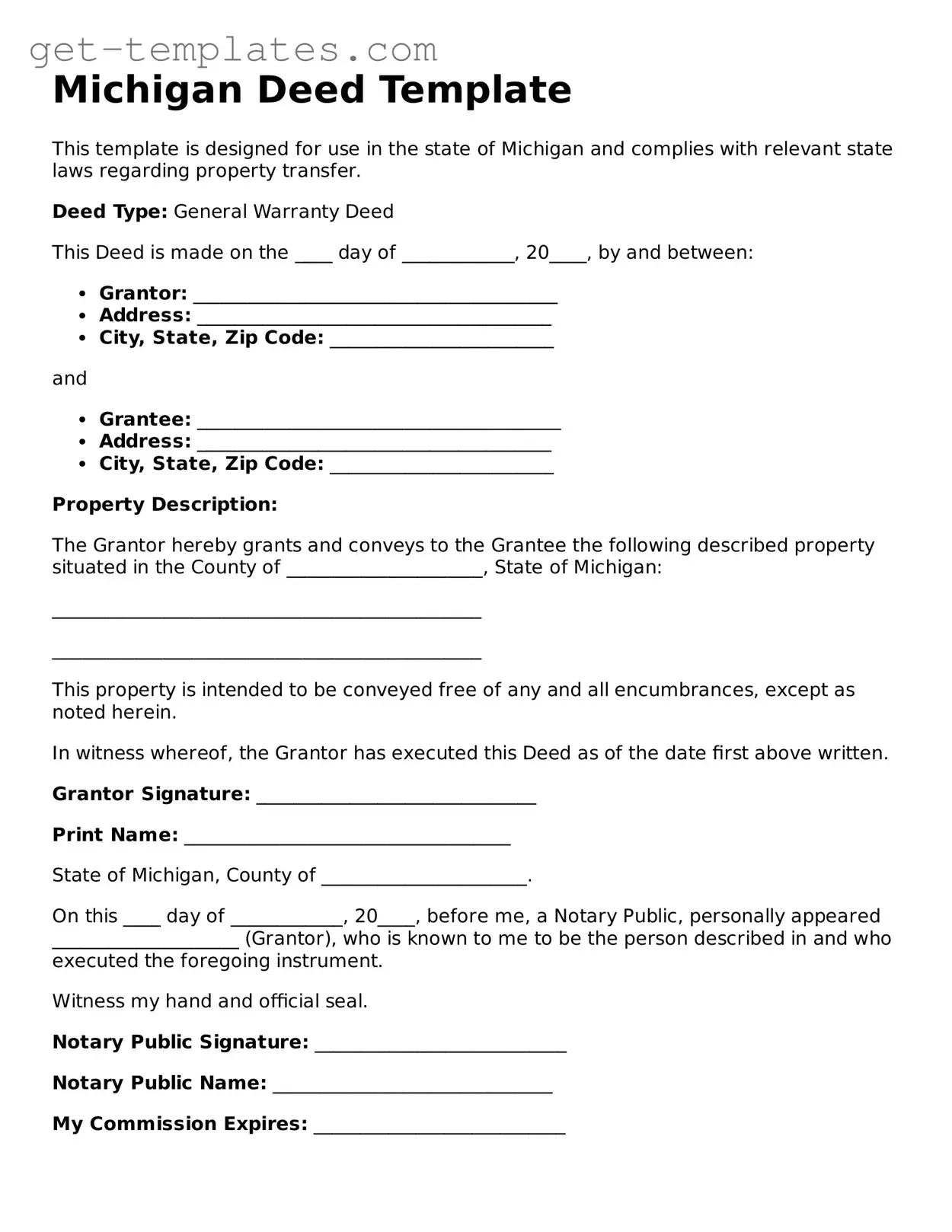

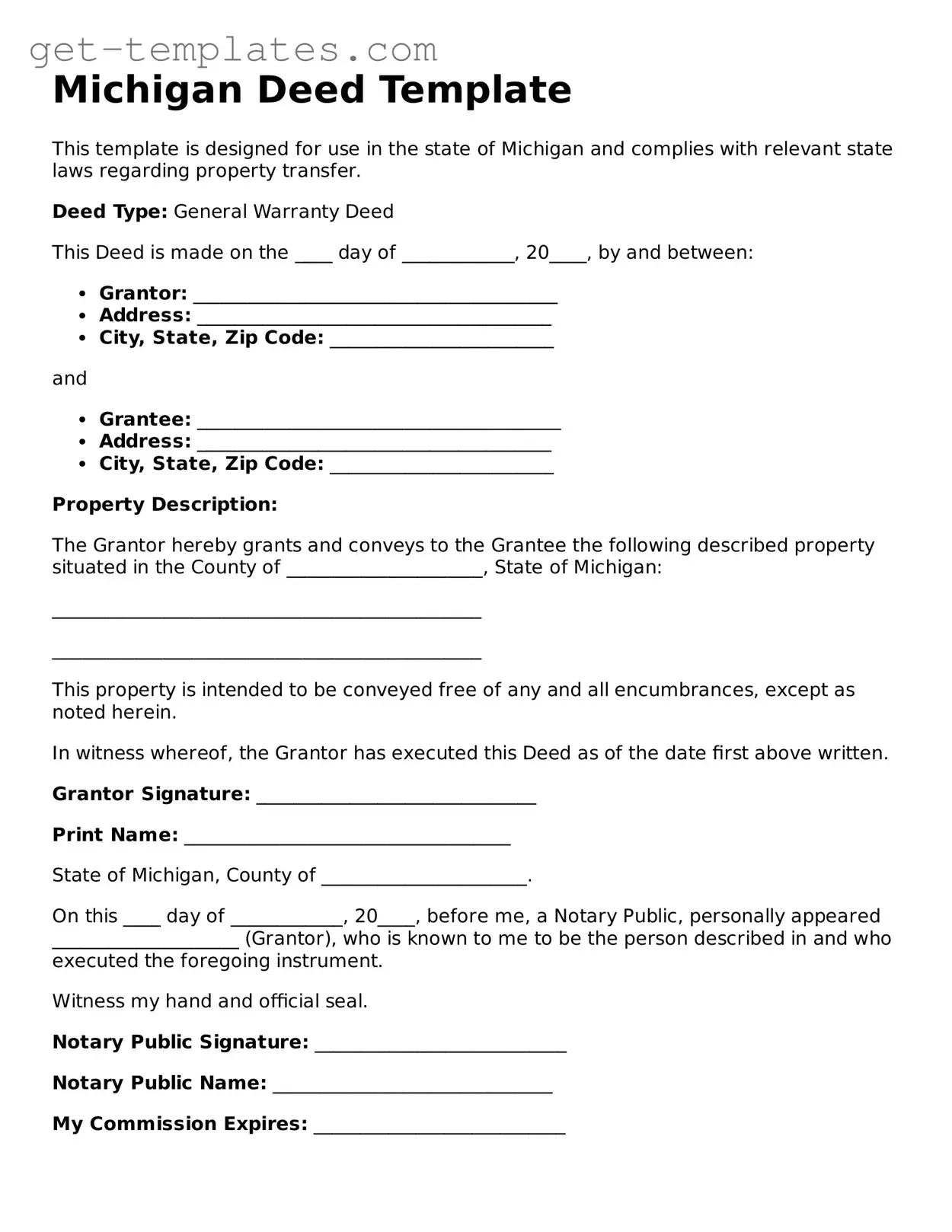

A Michigan Deed form is a legal document used to transfer ownership of real property from one party to another. This form outlines the details of the transaction, including the names of the parties involved and a description of the property. Understanding this form is essential for anyone involved in a property transfer in Michigan.

Get Document Online

Attorney-Approved Deed Document for Michigan

Get Document Online

You’re halfway through — finish the form

Finish Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form