Attorney-Approved Lady Bird Deed Document for Michigan

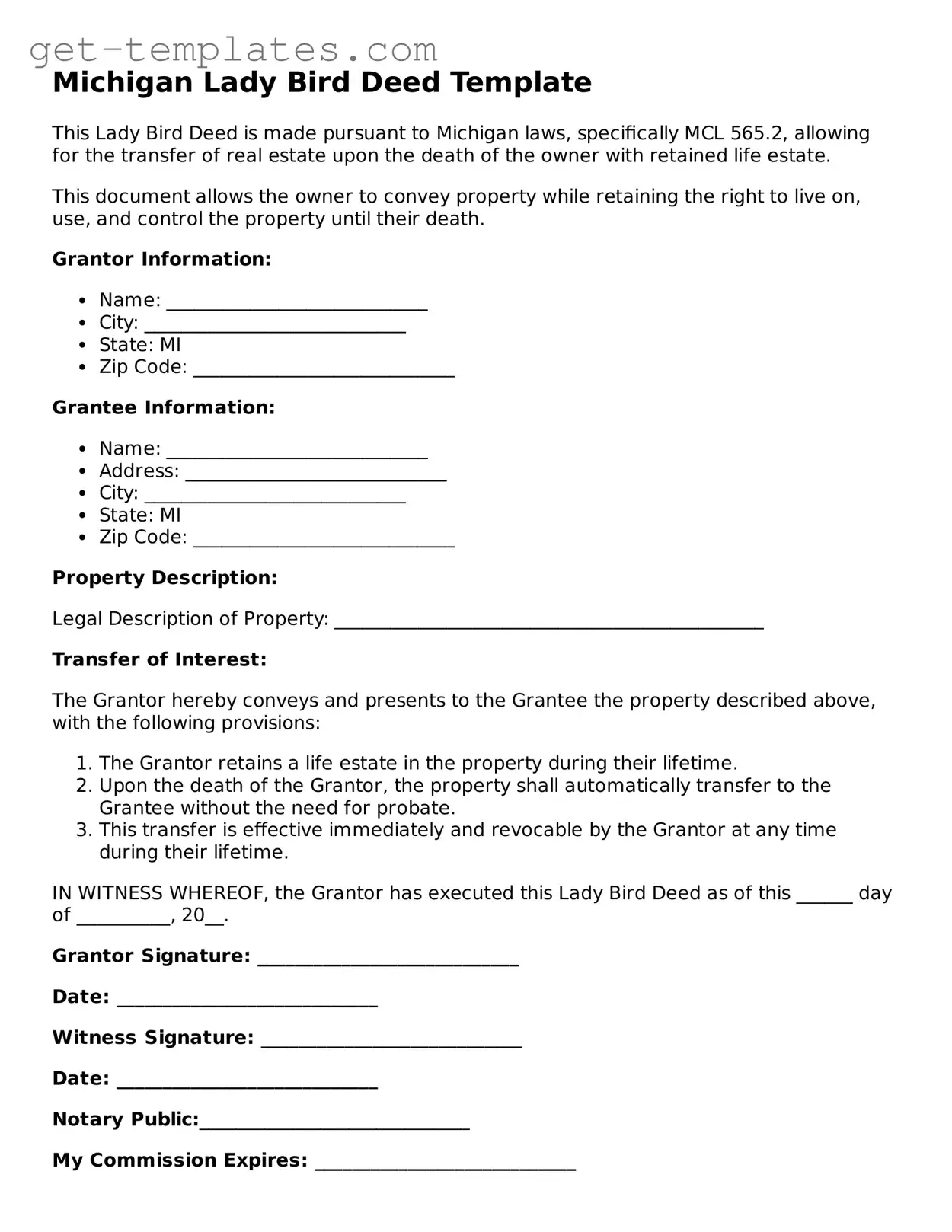

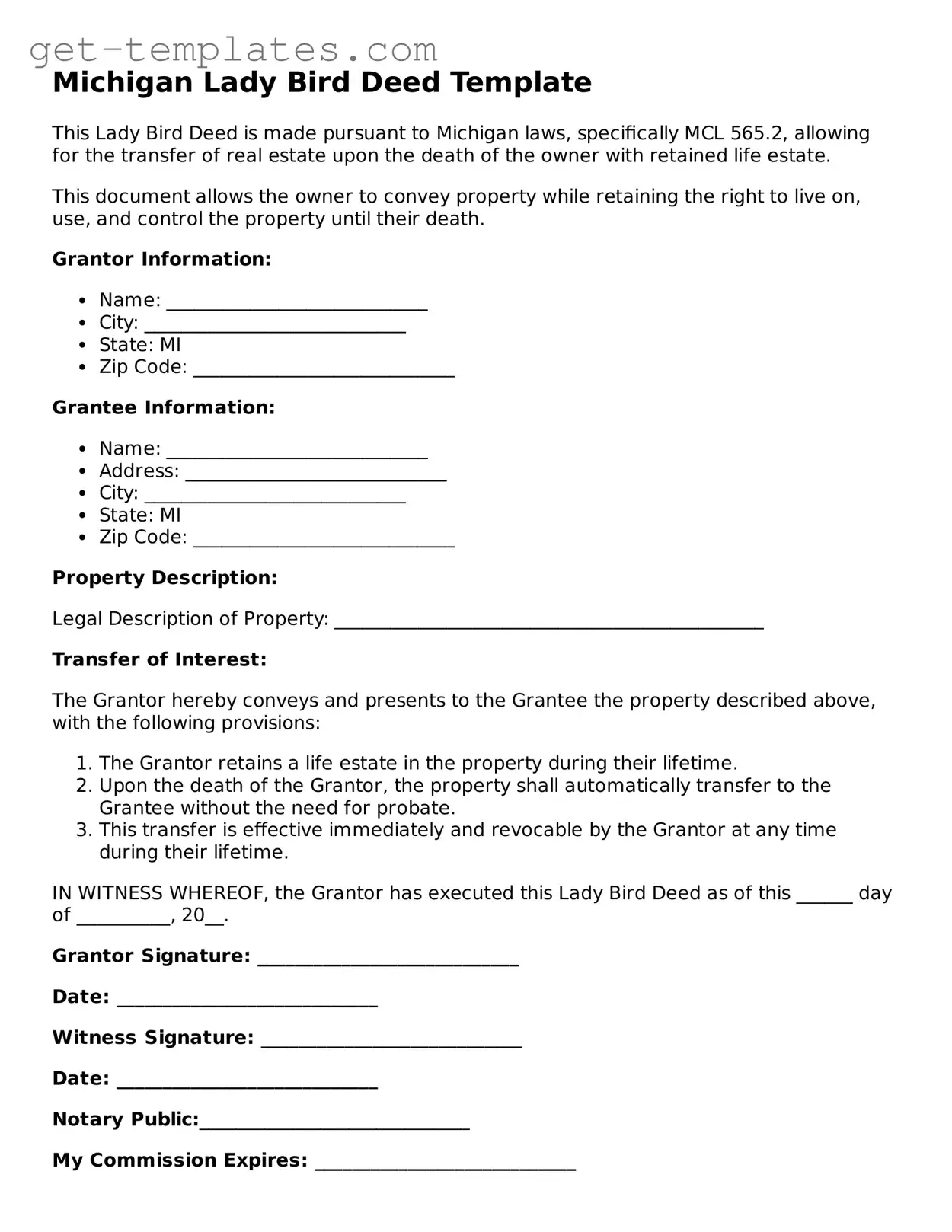

The Michigan Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control of the property during their lifetime. This unique form of deed provides a seamless way to avoid probate and ensure a smooth transition of ownership after death. Understanding its features and benefits can help property owners make informed decisions about their estate planning.

Get Document Online

Attorney-Approved Lady Bird Deed Document for Michigan

Get Document Online

You’re halfway through — finish the form

Finish Lady Bird Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form