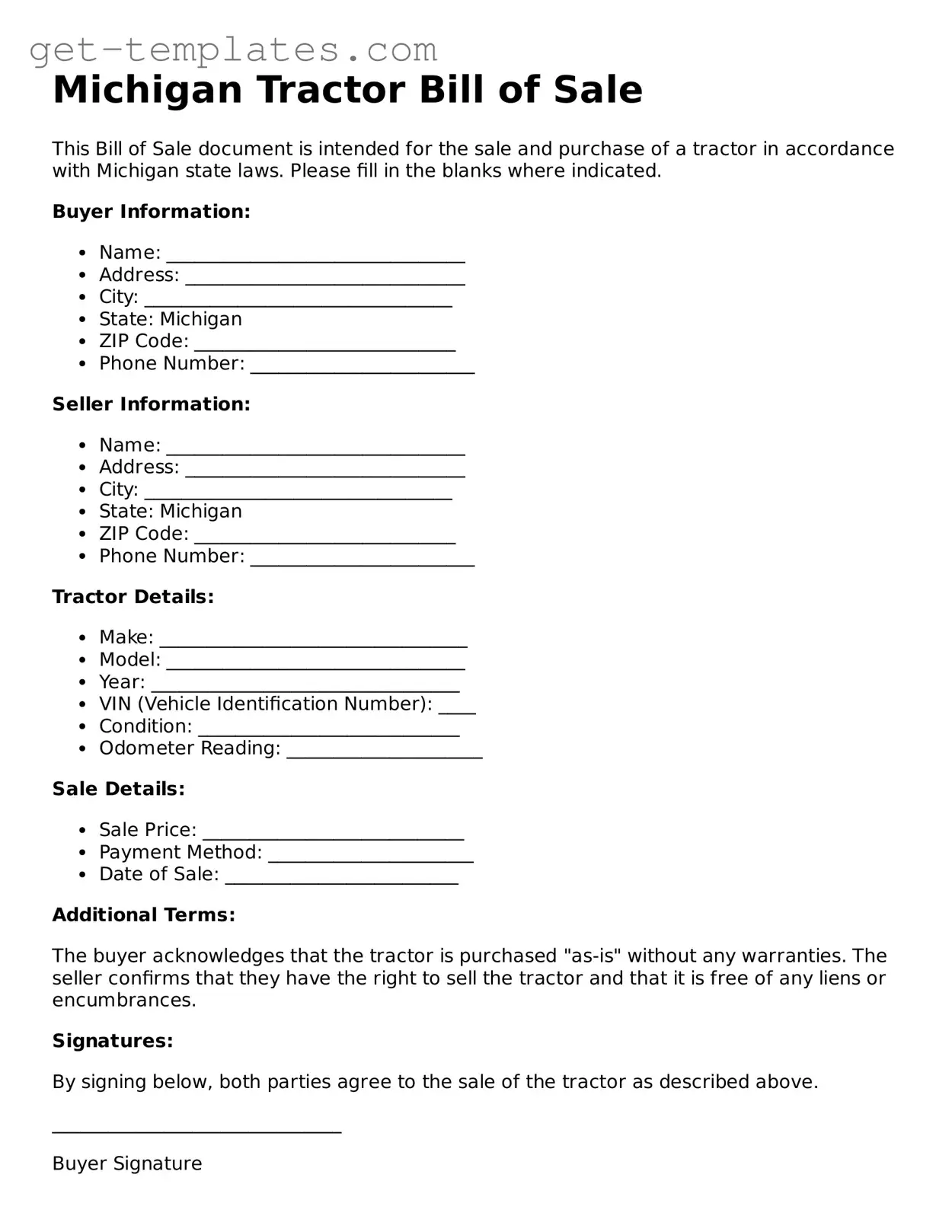

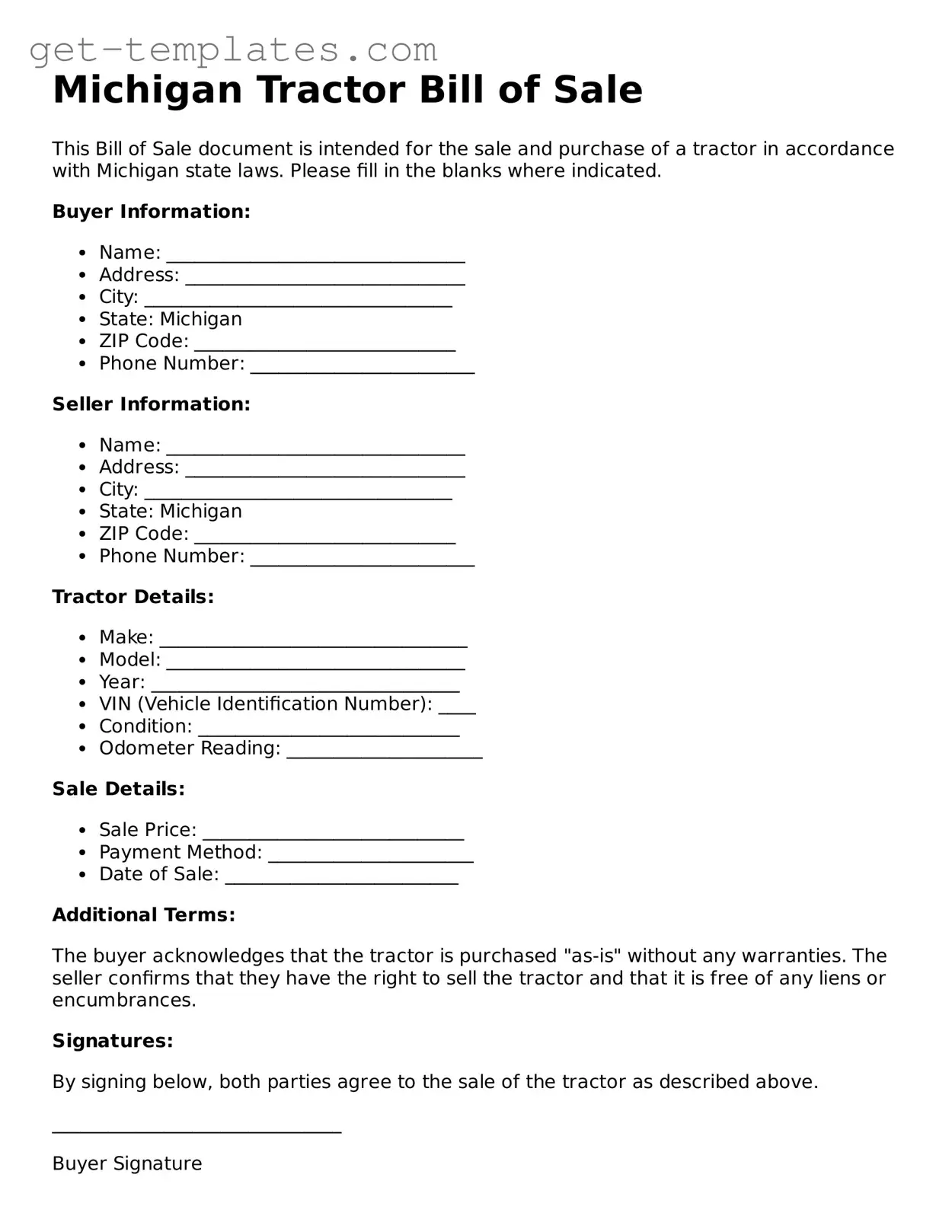

What is a Michigan Tractor Bill of Sale?

A Michigan Tractor Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a tractor from one party to another. This form includes important details about the transaction, such as the names of the buyer and seller, the description of the tractor, the sale price, and the date of the transaction. It is crucial for both parties to retain a copy of this document for their records.

Why is a Bill of Sale necessary?

A Bill of Sale is necessary for several reasons. First, it provides legal protection for both the buyer and the seller by documenting the terms of the sale. This can help resolve any disputes that may arise in the future. Additionally, it can be required when registering the tractor with the state or obtaining insurance. Having a Bill of Sale ensures that there is a clear record of ownership transfer.

The Michigan Tractor Bill of Sale typically includes the following information:

-

The full names and addresses of both the buyer and the seller.

-

A detailed description of the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

-

The sale price of the tractor.

-

The date of the sale.

-

Signatures of both the buyer and the seller, indicating their agreement to the terms of the sale.

Do I need to have the Bill of Sale notarized?

While notarization is not a requirement for a Bill of Sale in Michigan, it is often recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes over the validity of the signatures. If you choose to have it notarized, both parties should be present to sign the document in front of the notary.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale, as long as it includes all the necessary information. However, using a standard template can save time and ensure that you don’t miss any important details. Templates are often available online and can be customized to fit your specific transaction.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should sign the document. Each party should keep a copy for their records. The buyer may need to present the Bill of Sale when registering the tractor with the Michigan Secretary of State or when obtaining insurance. It is also wise to keep any additional documents related to the sale, such as maintenance records or warranties.

There is no specific format mandated by Michigan law for a Bill of Sale. However, it should be clear and easy to read. Including all the necessary information, as mentioned earlier, is essential. The document should be organized logically, and both parties should ensure that they understand all the terms before signing.