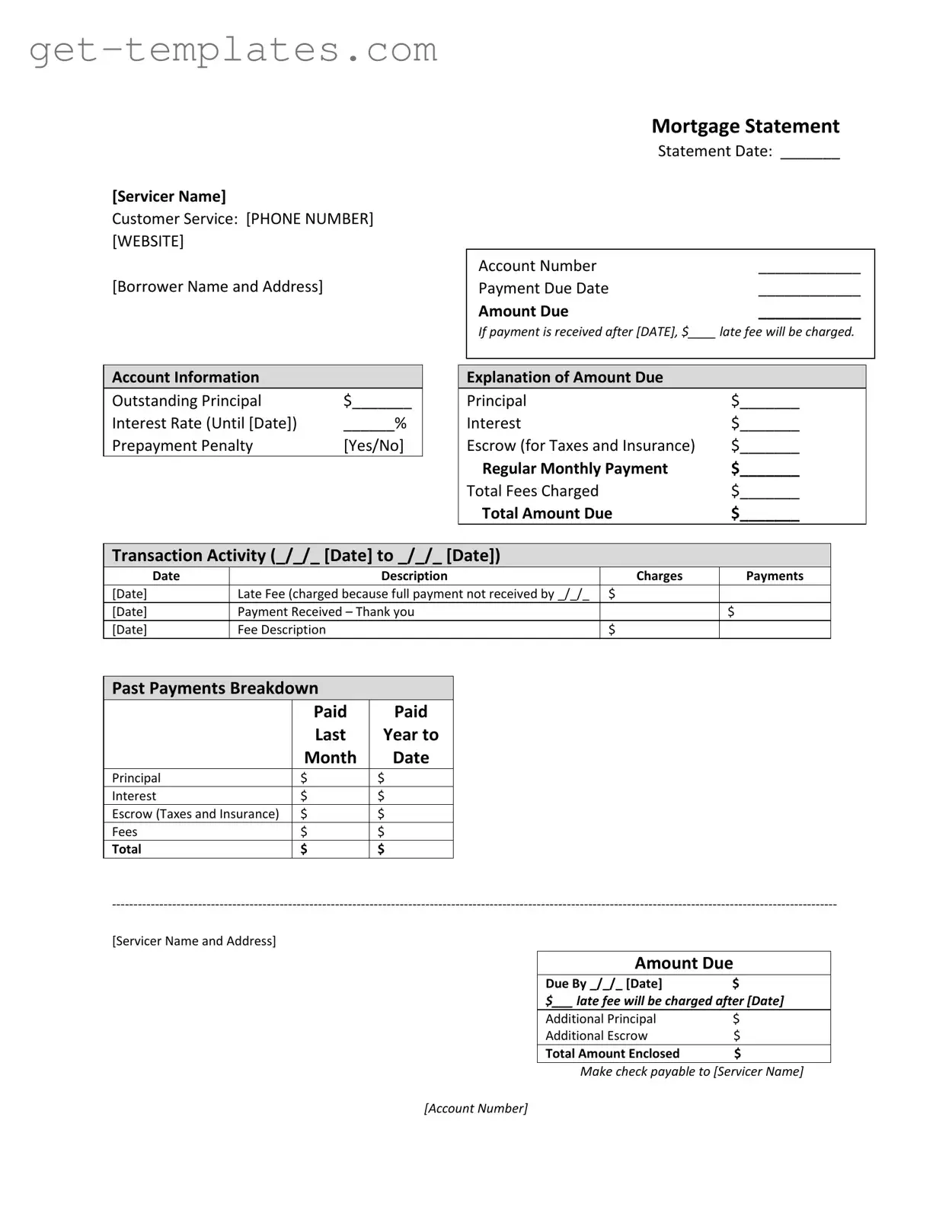

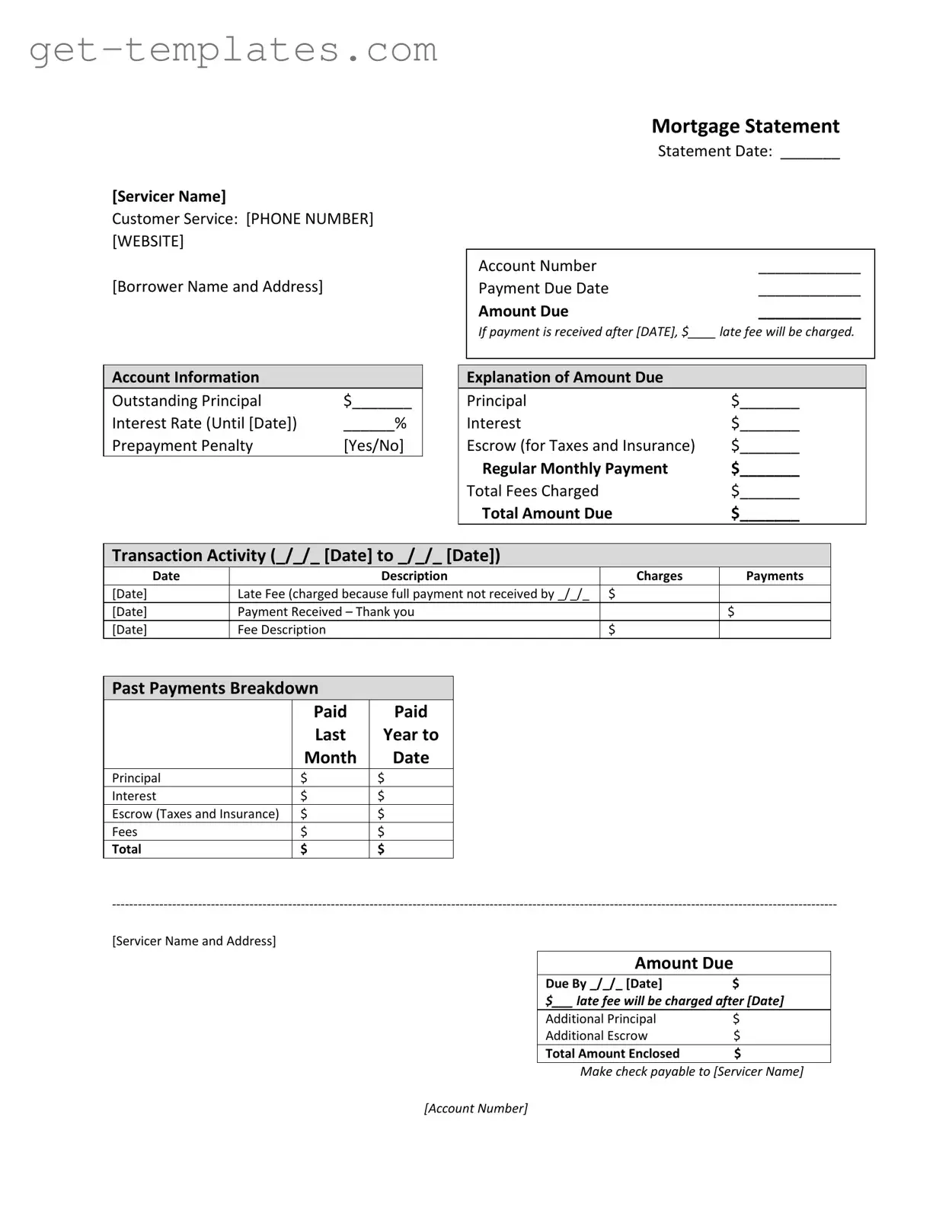

Fill in a Valid Mortgage Statement Template

A Mortgage Statement is a detailed document provided by a mortgage servicer that outlines a borrower's current mortgage account status. It includes essential information such as the amount due, payment history, and any outstanding fees. Understanding this statement is crucial for homeowners to manage their finances and maintain their mortgage obligations effectively.

Get Document Online

Fill in a Valid Mortgage Statement Template

Get Document Online

You’re halfway through — finish the form

Finish Mortgage Statement online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form