What is a Lady Bird Deed in North Carolina?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their real estate to beneficiaries while retaining the right to live on and control the property during their lifetime. This type of deed can help avoid probate and provide flexibility in estate planning.

Who can use a Lady Bird Deed?

Any property owner in North Carolina can use a Lady Bird Deed. It is particularly beneficial for individuals who wish to ensure that their property passes directly to their heirs without going through the probate process. It is often used by seniors who want to protect their assets while still retaining control over their property.

What are the benefits of a Lady Bird Deed?

-

Allows the property owner to retain full control over the property during their lifetime.

-

Avoids probate, allowing for a smoother transfer of property upon death.

-

Provides protection from creditors and potential Medicaid claims, depending on the circumstances.

-

Can be revoked or altered at any time before the property owner's death.

Are there any drawbacks to using a Lady Bird Deed?

While a Lady Bird Deed has many advantages, there are some potential drawbacks to consider. For example, if the property owner needs to qualify for Medicaid, the transfer might impact eligibility. Additionally, the property may not be protected from all creditors. It is important to evaluate individual circumstances before proceeding.

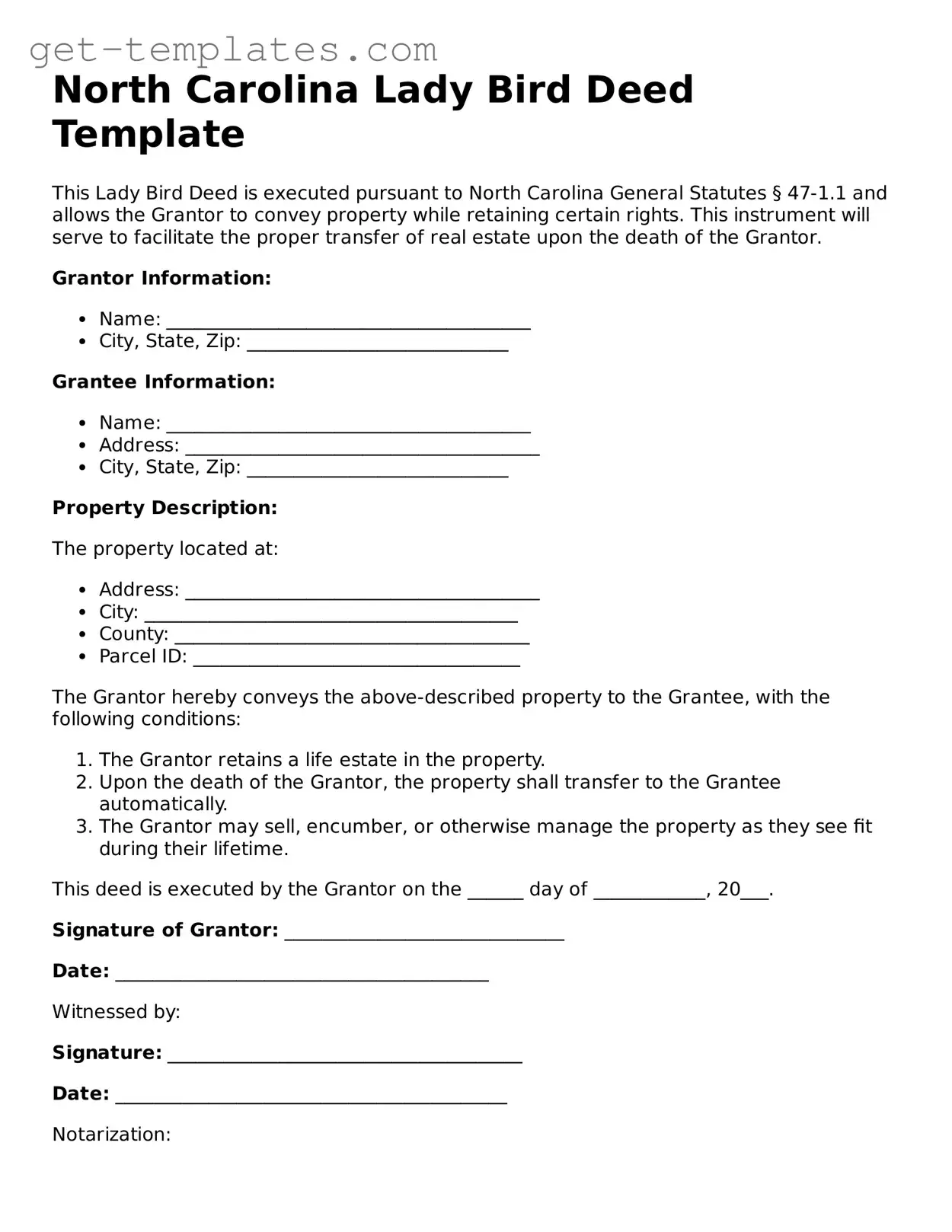

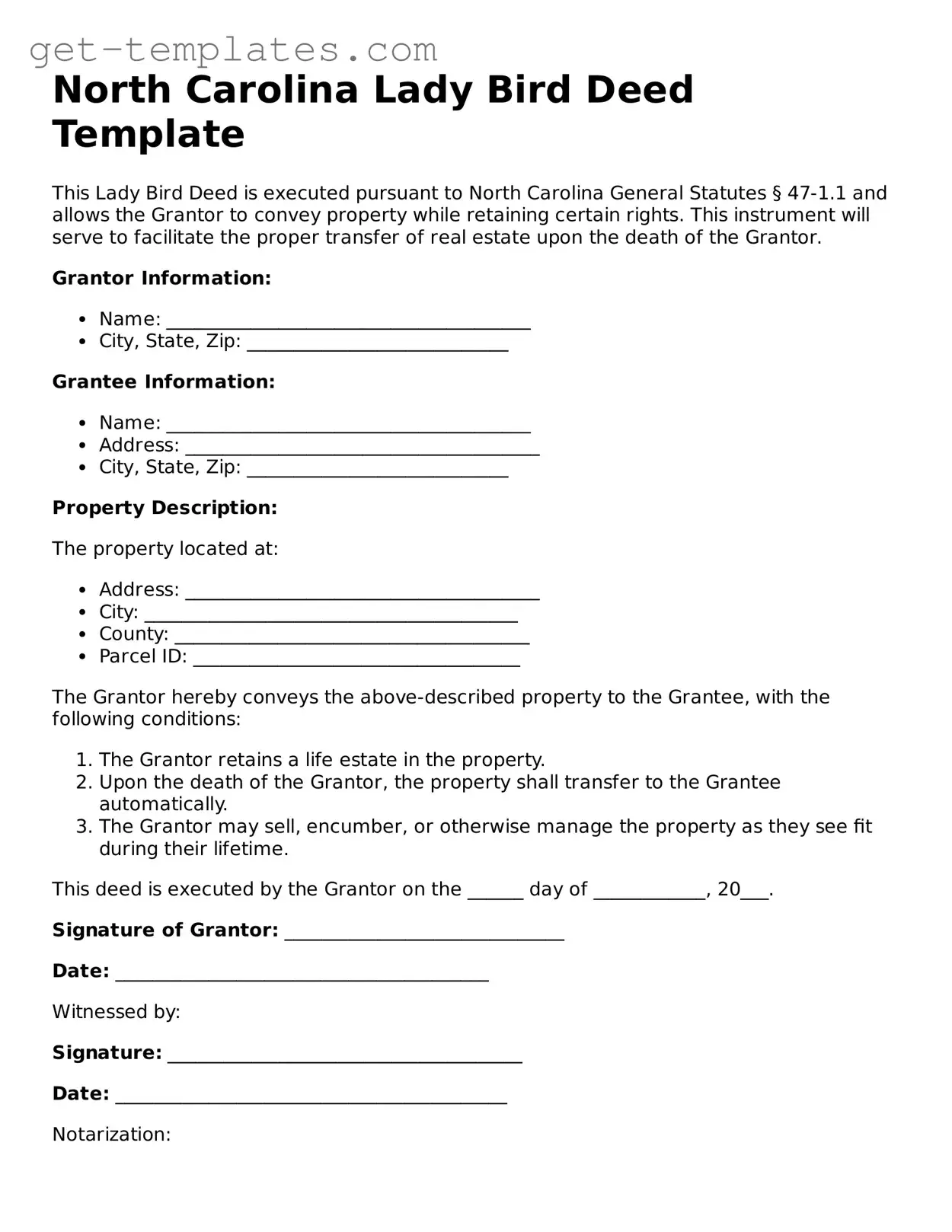

How is a Lady Bird Deed executed in North Carolina?

To execute a Lady Bird Deed in North Carolina, the property owner must complete the deed form, which includes the legal description of the property, the names of the beneficiaries, and the statement of retention of rights. The deed must then be signed in front of a notary public and recorded with the county register of deeds.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked at any time before the property owner's death. The property owner can create a new deed that explicitly revokes the previous one or simply execute a new Lady Bird Deed with different terms. It is advisable to consult with a legal professional when making changes to ensure proper execution.

Will a Lady Bird Deed affect property taxes?

Generally, a Lady Bird Deed does not directly affect property taxes. The property owner retains ownership and control during their lifetime, so they remain responsible for property taxes. However, upon the owner's death, the property may be reassessed based on its current market value, which could affect future tax obligations for the beneficiaries.

Is legal assistance necessary to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, it is highly recommended to consult with an attorney. An attorney can provide guidance on the implications of the deed, ensure that it is executed correctly, and help avoid potential legal issues in the future.

Can a Lady Bird Deed be used for all types of property?

A Lady Bird Deed can be used for most types of real estate, including residential homes, land, and commercial properties. However, it is important to consider the specific circumstances surrounding the property and consult with a legal professional to determine if this option is appropriate.