What is a North Carolina Promissory Note?

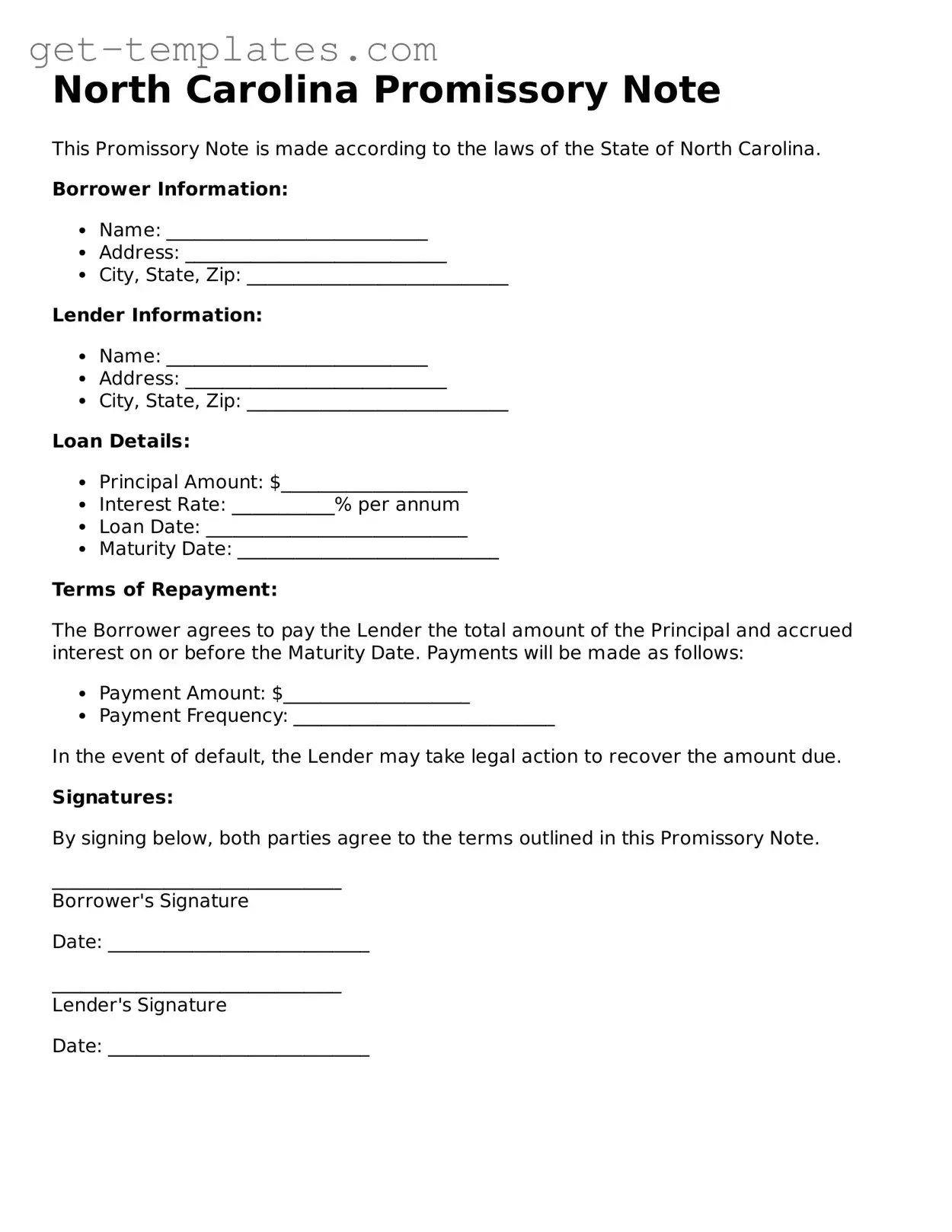

A North Carolina Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

Who can use a Promissory Note in North Carolina?

Any individual or business in North Carolina can use a Promissory Note. It is commonly used in personal loans, business loans, and real estate transactions. Both parties involved—the lender and the borrower—should understand the terms before signing.

What are the key components of a North Carolina Promissory Note?

A typical North Carolina Promissory Note includes the following components:

-

Borrower and Lender Information:

Names and addresses of both parties.

-

Loan Amount:

The total amount being borrowed.

-

Interest Rate:

The rate at which interest will accrue on the unpaid balance.

-

Repayment Terms:

The schedule for repayment, including due dates.

-

Default Terms:

Conditions under which the borrower would be considered in default.

-

Governing Law:

A statement that the note is governed by North Carolina law.

Is a Promissory Note legally binding in North Carolina?

Yes, a Promissory Note is legally binding in North Carolina, provided it meets the necessary requirements. Both parties must agree to the terms, and the document should be signed and dated. It is advisable to keep a copy for personal records.

Do I need a witness or notarization for a Promissory Note?

While North Carolina does not require a witness or notarization for a Promissory Note to be valid, having it notarized can provide additional legal protection. It serves as proof that the parties signed the document voluntarily and can help prevent disputes later on.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may involve filing a lawsuit or seeking a judgment. The terms of the Promissory Note should outline the specific consequences of default, including any fees or penalties.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended document to avoid confusion or disputes in the future.

Promissory Note forms can be obtained from various sources, including online legal document providers, local office supply stores, or through legal professionals. It is important to ensure that the form complies with North Carolina laws and meets the specific needs of the transaction.

What should I do if I have more questions about Promissory Notes?

If you have additional questions about Promissory Notes or specific situations, consider consulting with a legal professional or a financial advisor. They can provide personalized guidance based on your circumstances and ensure that you fully understand the implications of the document.