What is a North Carolina Real Estate Purchase Agreement?

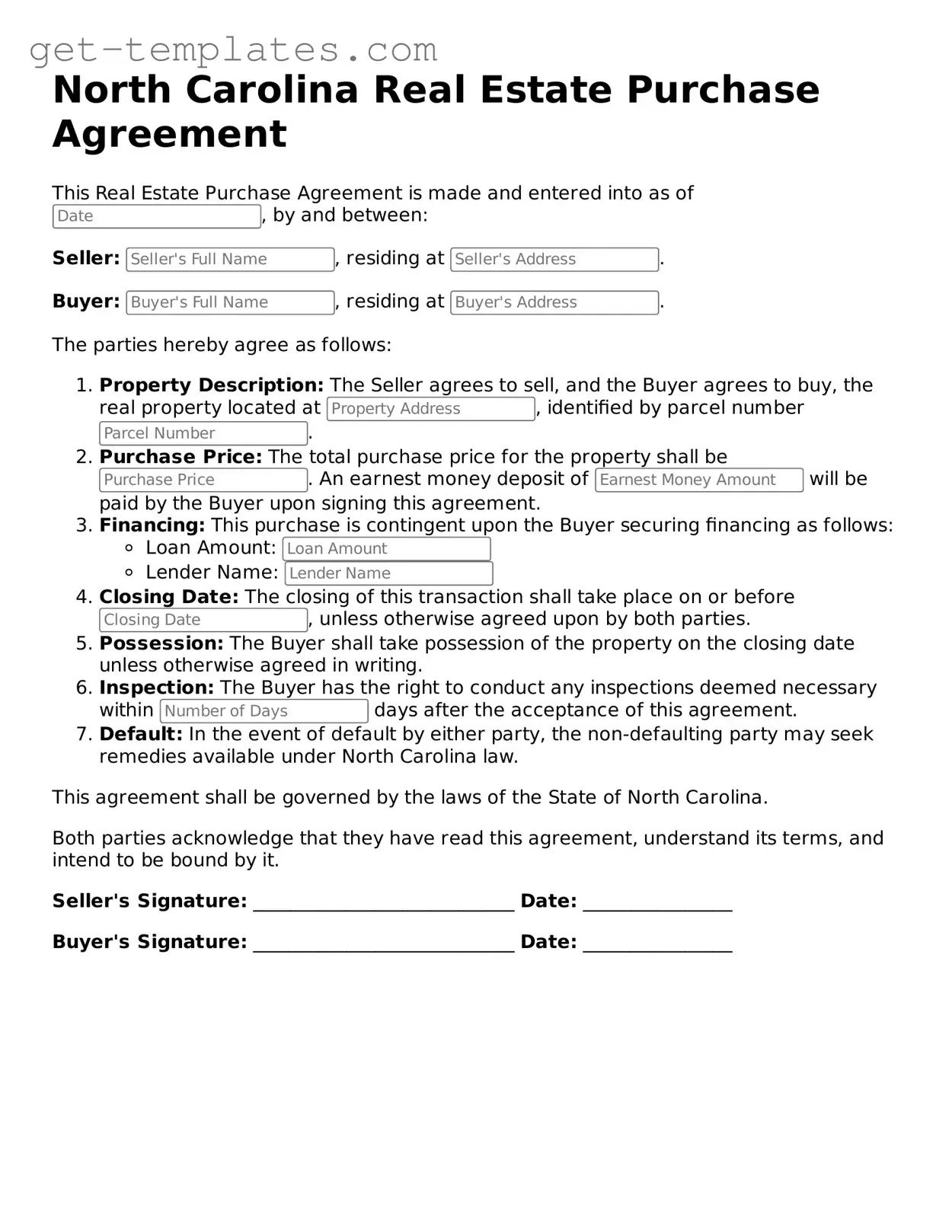

A North Carolina Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement is essential in real estate transactions as it protects the interests of both parties involved.

What key elements should be included in the agreement?

The agreement should contain several important elements, including:

-

The names of the buyer and seller

-

The property address and legal description

-

The purchase price

-

The earnest money deposit amount

-

Contingencies (such as financing or inspection contingencies)

-

The closing date

-

Any additional terms or conditions agreed upon

Is the purchase agreement legally binding?

Yes, once both parties sign the North Carolina Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to fulfill the terms outlined in the agreement, provided that all conditions are met.

What is earnest money, and why is it important?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. This money is typically held in an escrow account and is applied toward the purchase price at closing. It protects the seller by providing assurance that the buyer is committed to the transaction.

What are contingencies, and how do they work?

Contingencies are conditions that must be met for the purchase agreement to remain valid. Common contingencies include:

-

Financing contingency: Allows the buyer to back out if they cannot secure a mortgage.

-

Inspection contingency: Gives the buyer the right to have the property inspected and negotiate repairs or cancel the agreement if significant issues are found.

-

Appraisal contingency: Ensures that the property appraises for at least the purchase price.

If a contingency is not met, the buyer may have the option to terminate the agreement without penalty.

Can the purchase agreement be modified after signing?

Yes, the purchase agreement can be modified after signing, but both parties must agree to any changes. It is advisable to document any modifications in writing to avoid misunderstandings later on.

What happens if one party breaches the agreement?

If one party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party may have several options, including:

-

Seeking damages for any losses incurred

-

Requesting specific performance, which means asking the court to enforce the terms of the agreement

-

Terminating the agreement and recovering any earnest money

Consulting with a real estate attorney can provide guidance on the best course of action in such situations.

How long is the purchase agreement valid?

The validity of a North Carolina Real Estate Purchase Agreement typically lasts until the closing date specified in the contract. However, if contingencies are not met or if either party decides to terminate the agreement, it may become invalid sooner. Always check the specific terms outlined in the agreement.

Do I need a real estate agent to use this agreement?

While it is not legally required to have a real estate agent to use a North Carolina Real Estate Purchase Agreement, having professional representation can be beneficial. A real estate agent can help navigate the complexities of the transaction, ensure that all necessary terms are included, and provide valuable advice throughout the process.