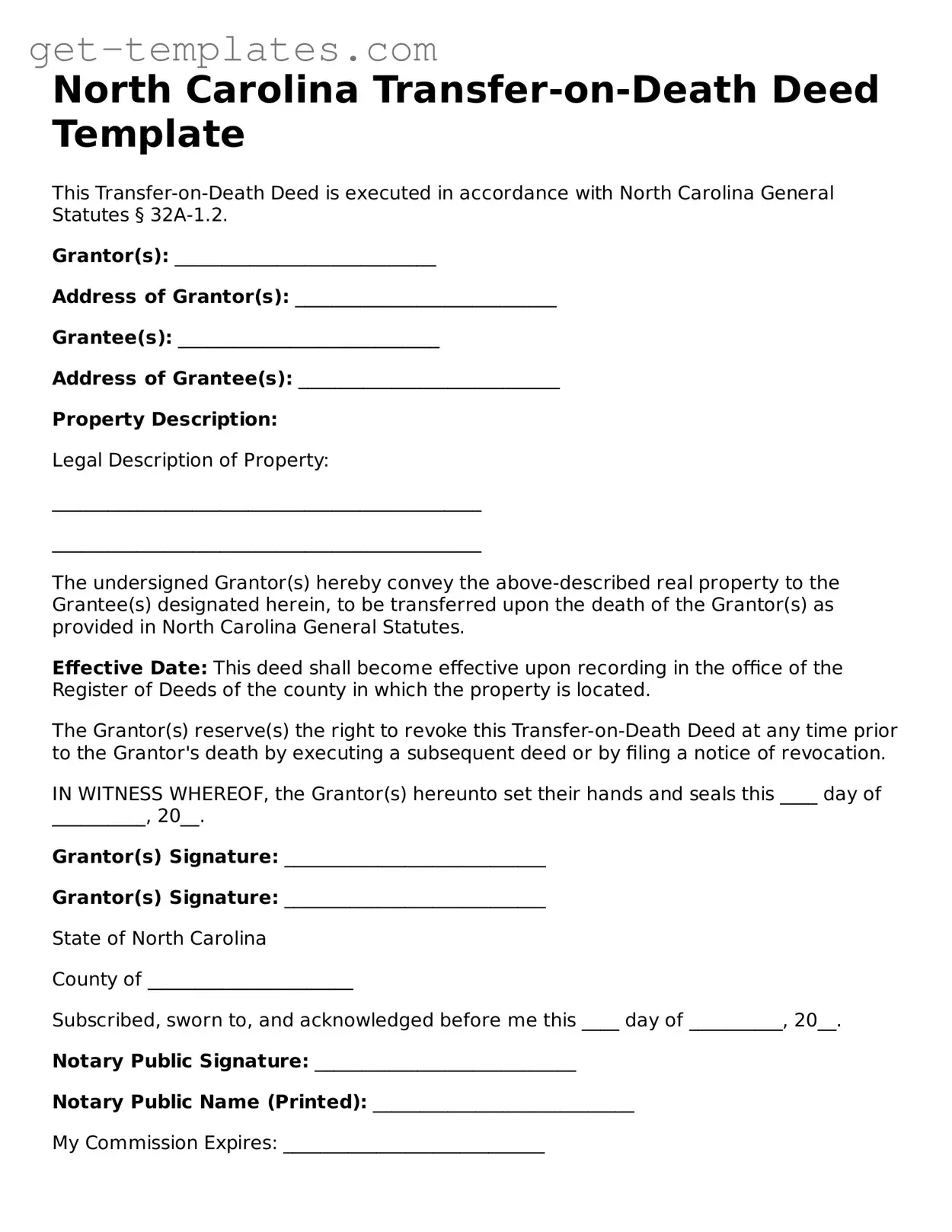

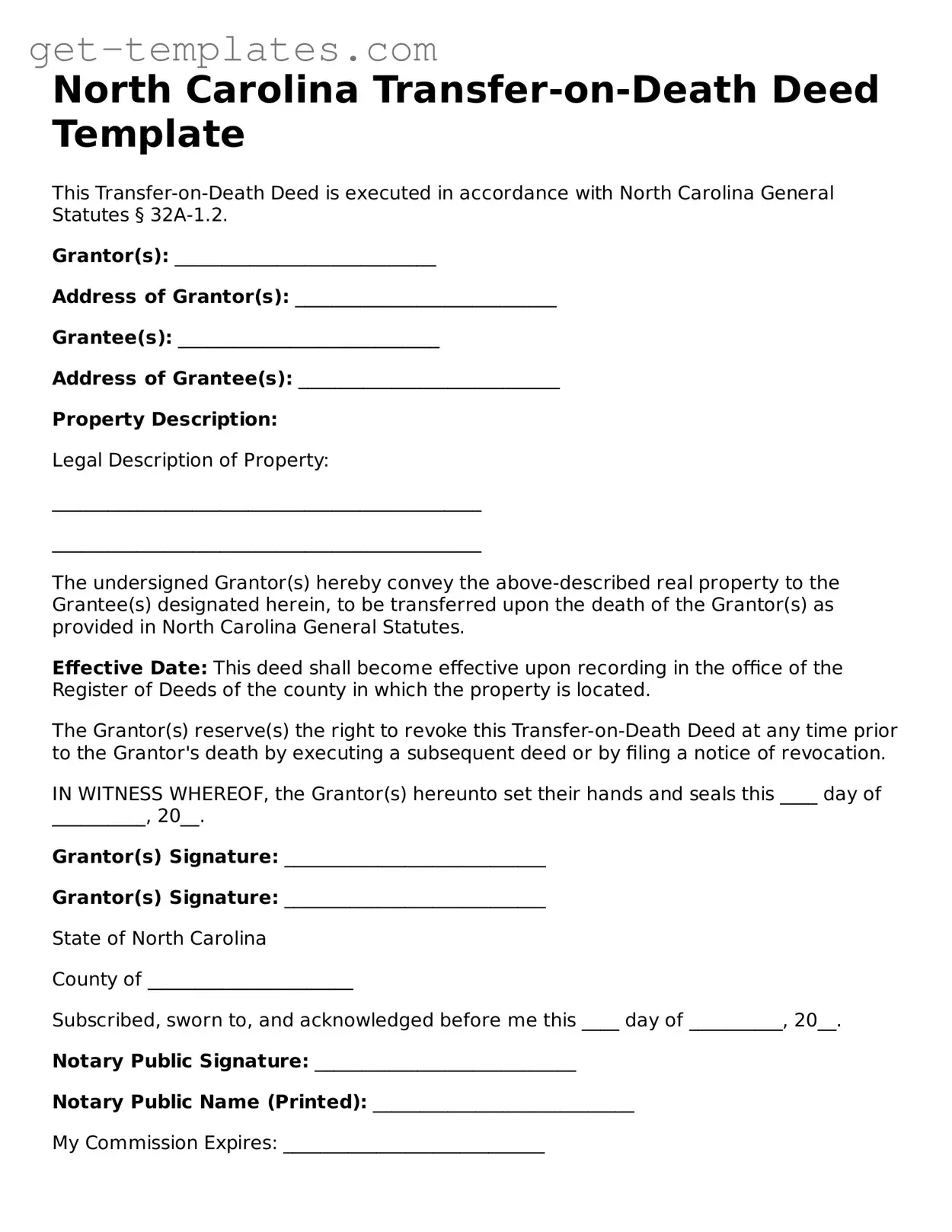

Attorney-Approved Transfer-on-Death Deed Document for North Carolina

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in North Carolina to designate a beneficiary who will receive their real estate upon their passing, without the need for probate. This form provides a straightforward way to transfer ownership, ensuring that your property goes directly to your chosen heir. By using a TODD, you can maintain control of your property during your lifetime while simplifying the transfer process for your loved ones after you’re gone.

Get Document Online

Attorney-Approved Transfer-on-Death Deed Document for North Carolina

Get Document Online

You’re halfway through — finish the form

Finish Transfer-on-Death Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form