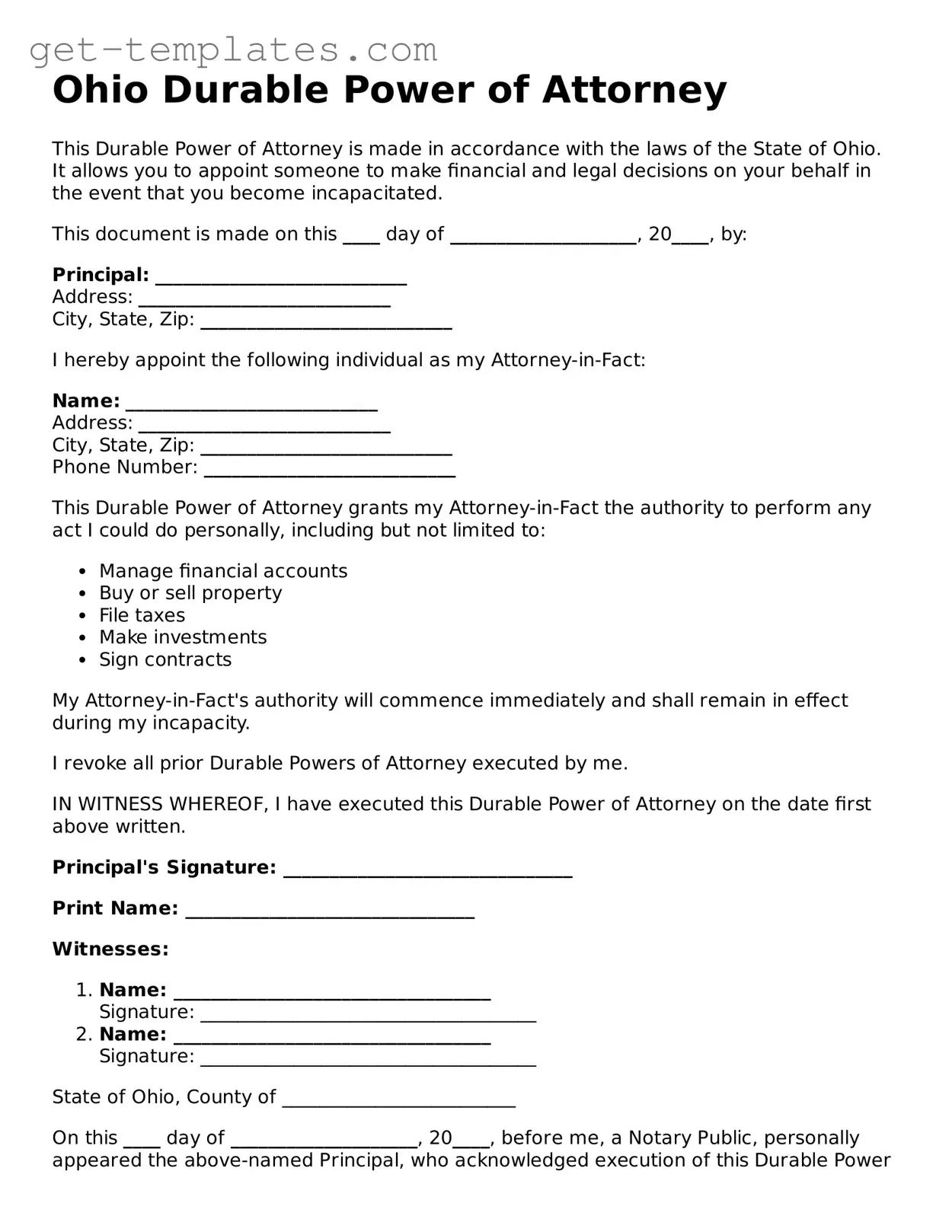

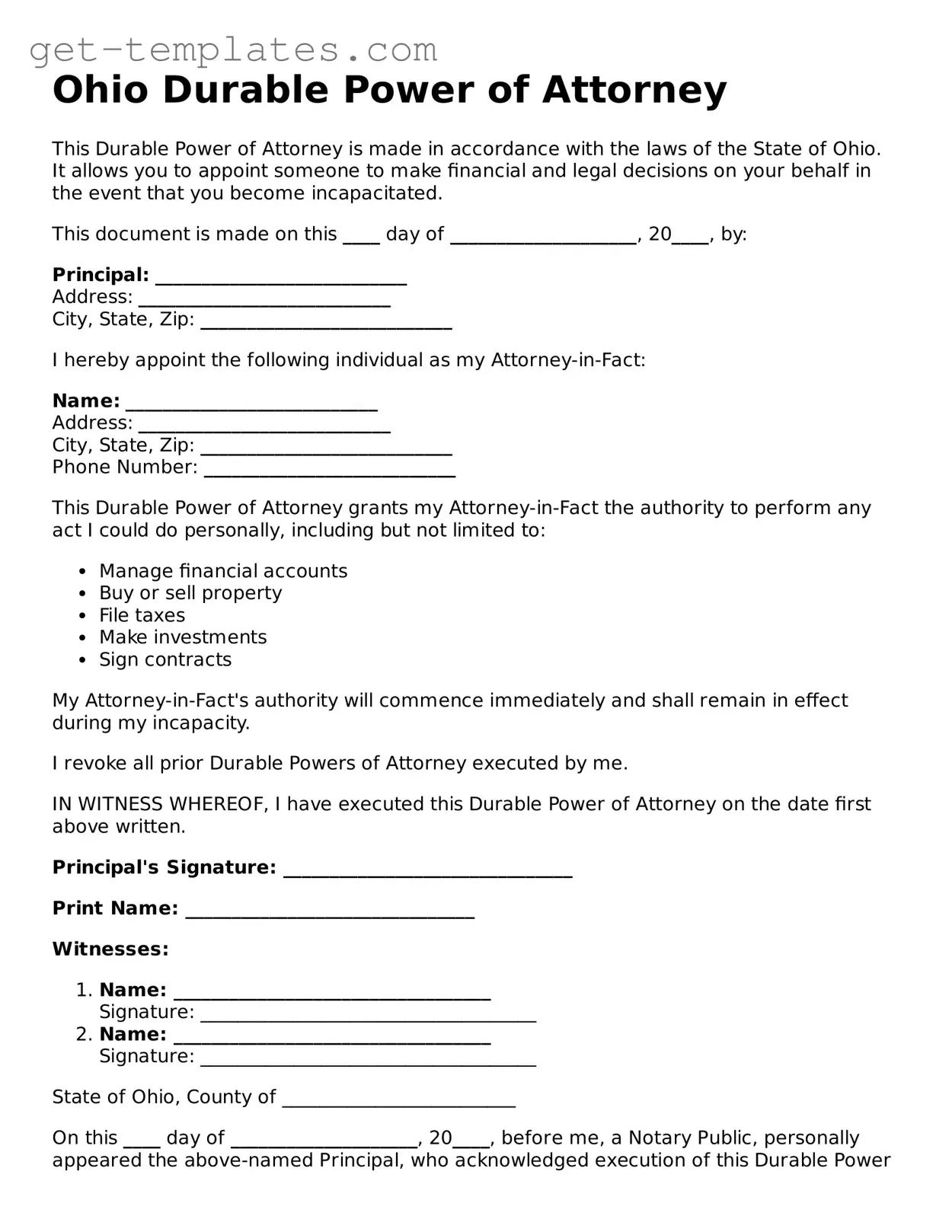

Attorney-Approved Durable Power of Attorney Document for Ohio

A Durable Power of Attorney form in Ohio allows an individual to designate someone else to make decisions on their behalf, particularly in financial or legal matters, should they become incapacitated. This legal document remains effective even if the person who created it can no longer make decisions. Understanding how to properly execute and utilize this form is essential for ensuring that your wishes are respected during challenging times.

Get Document Online

Attorney-Approved Durable Power of Attorney Document for Ohio

Get Document Online

You’re halfway through — finish the form

Finish Durable Power of Attorney online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form