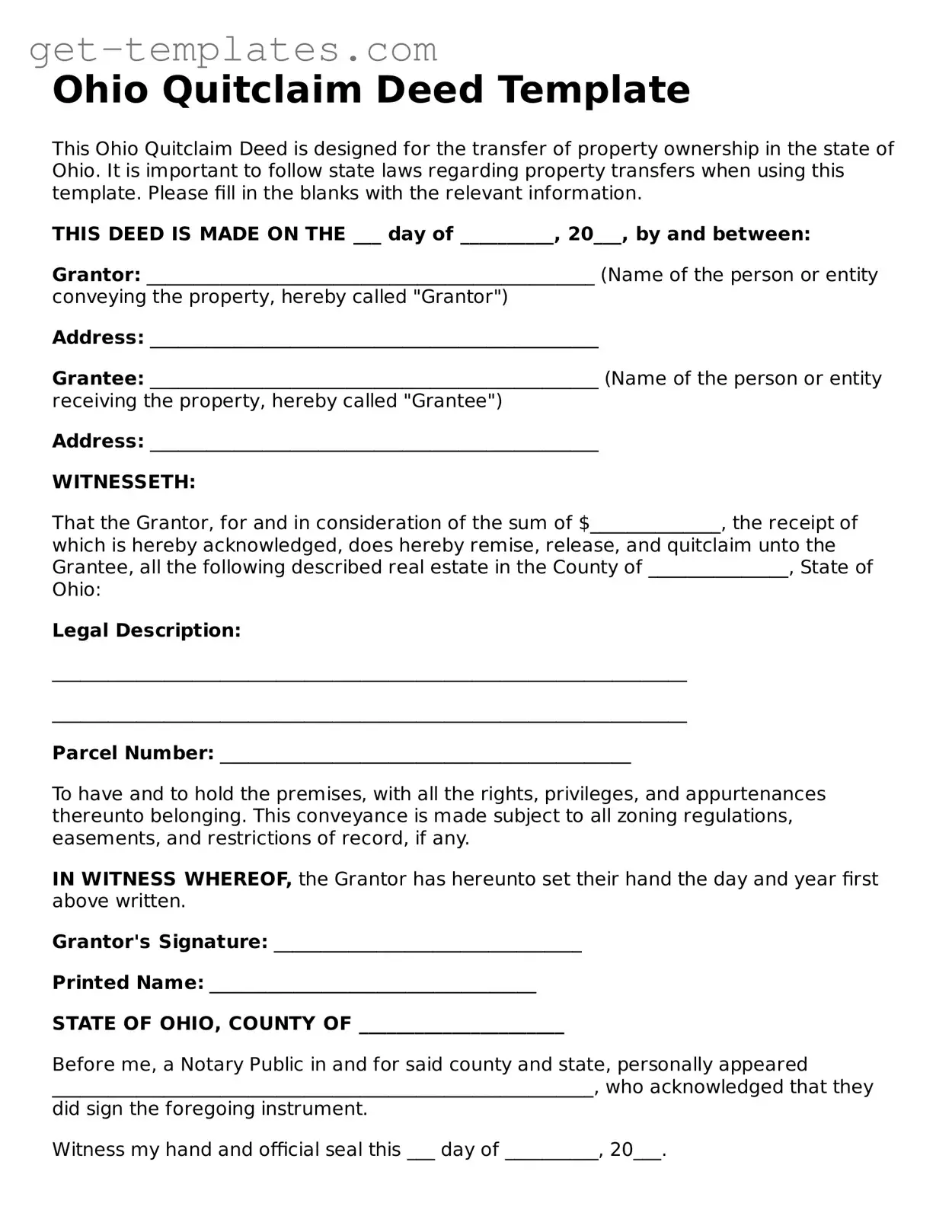

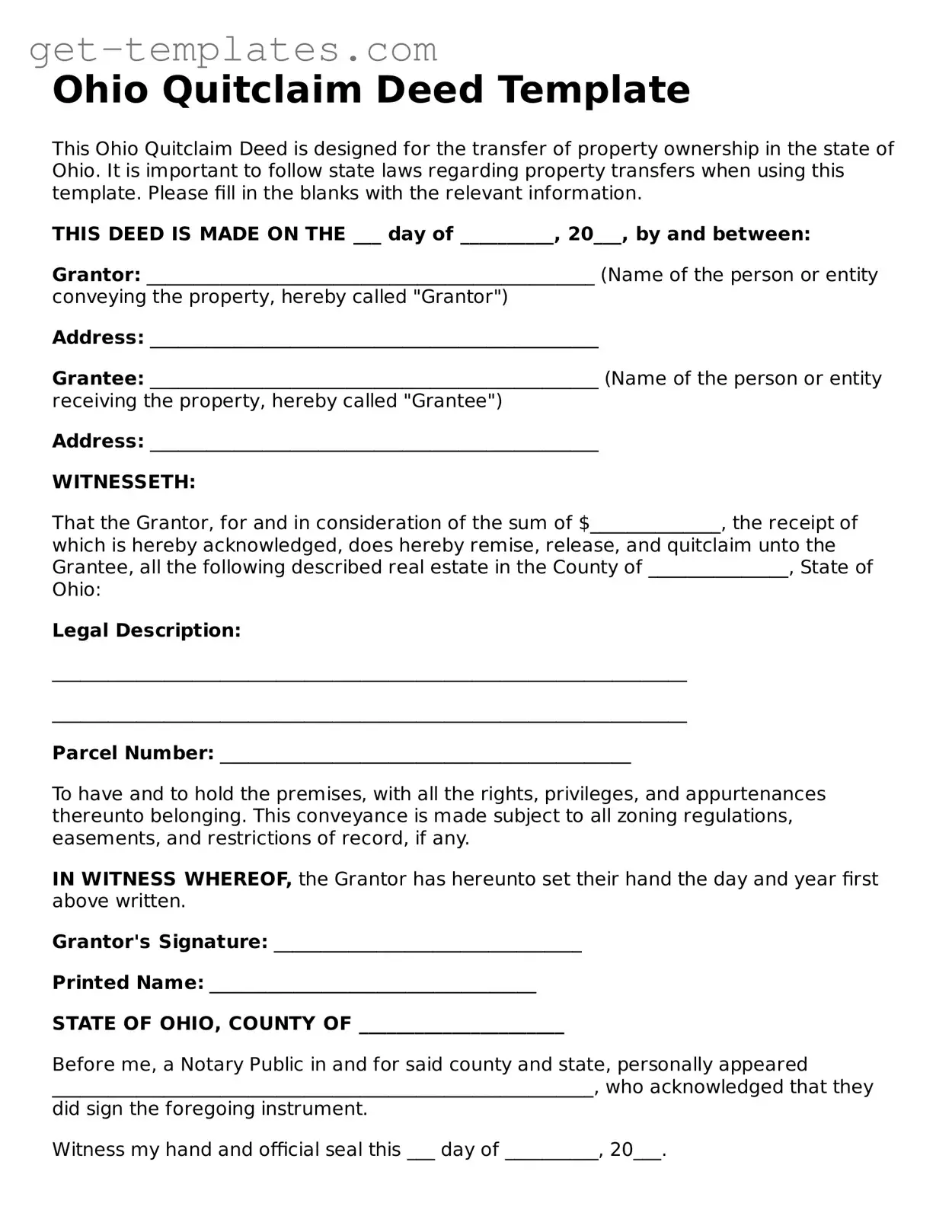

Attorney-Approved Quitclaim Deed Document for Ohio

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without making any guarantees about the property’s title. This form is particularly useful in situations such as transferring property between family members or resolving disputes. Understanding how to properly use and file a Quitclaim Deed in Ohio can simplify the process of property transfer and help avoid potential legal issues.

Get Document Online

Attorney-Approved Quitclaim Deed Document for Ohio

Get Document Online

You’re halfway through — finish the form

Finish Quitclaim Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form