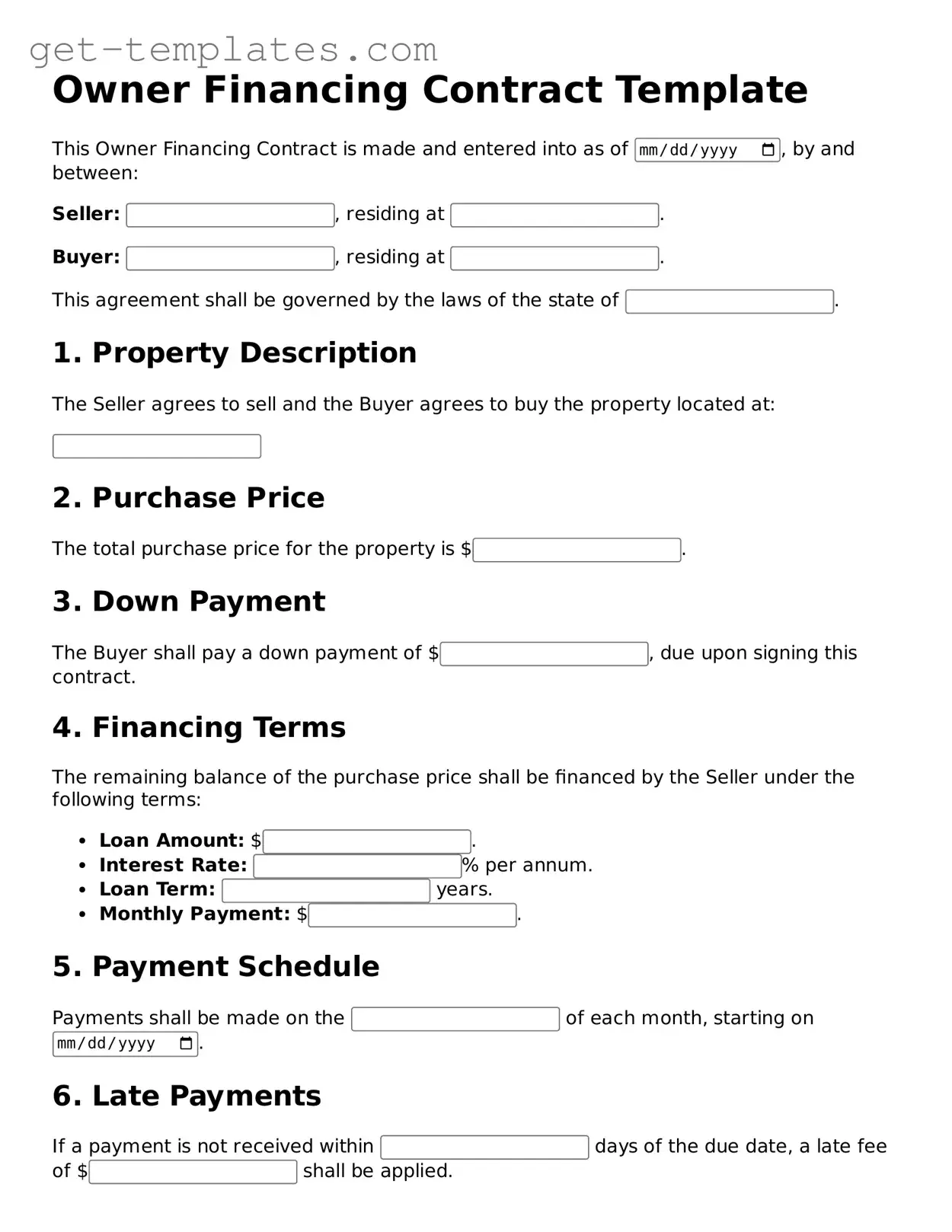

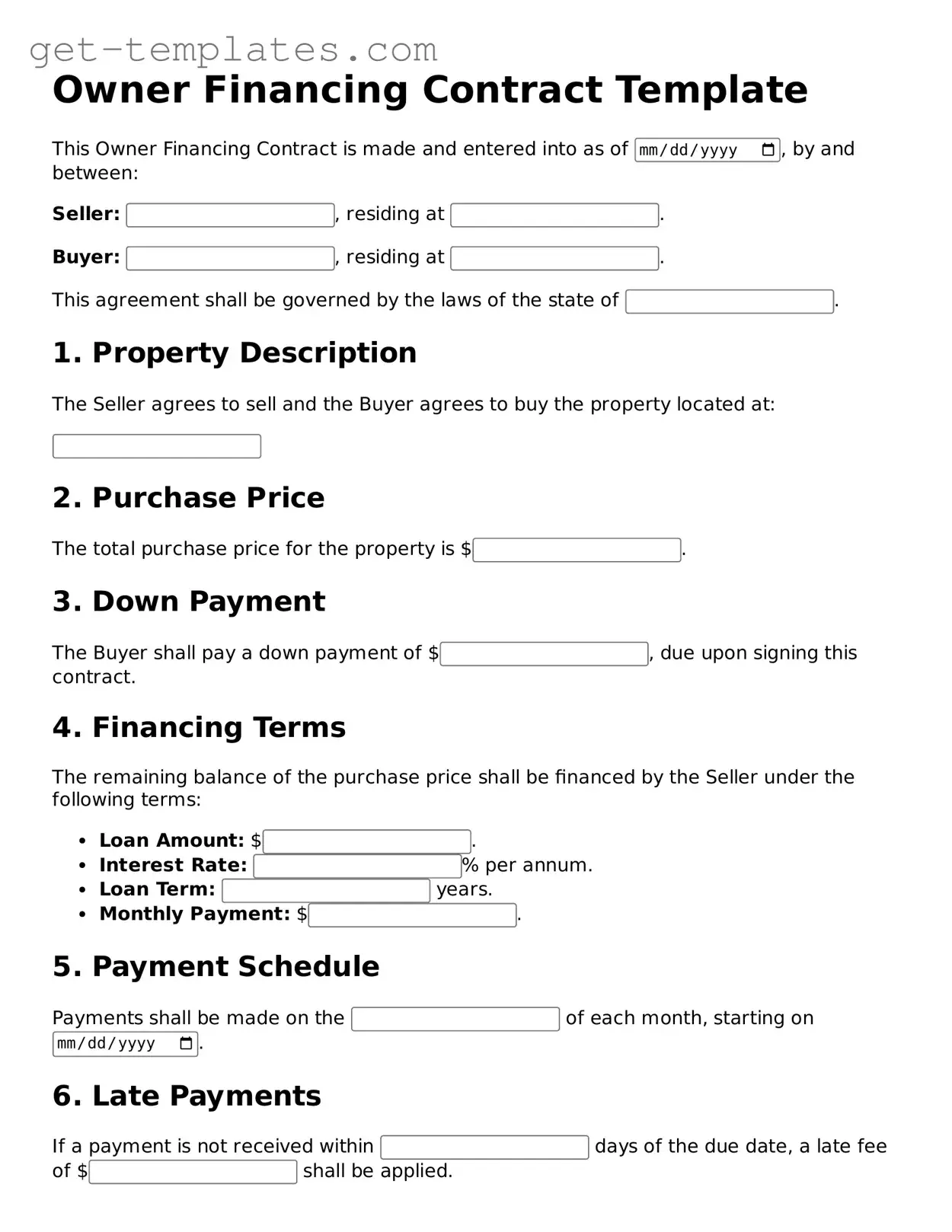

Attorney-Approved Owner Financing Contract Form

An Owner Financing Contract is a legal agreement that allows a seller to finance the purchase of their property directly to the buyer, bypassing traditional mortgage lenders. This arrangement can provide benefits for both parties, including flexible payment terms and the potential for a quicker sale. Understanding the details of this contract is essential for anyone considering this alternative financing option.

Get Document Online

Attorney-Approved Owner Financing Contract Form

Get Document Online

You’re halfway through — finish the form

Finish Owner Financing Contract online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form