Fill in a Valid P 45 It Template

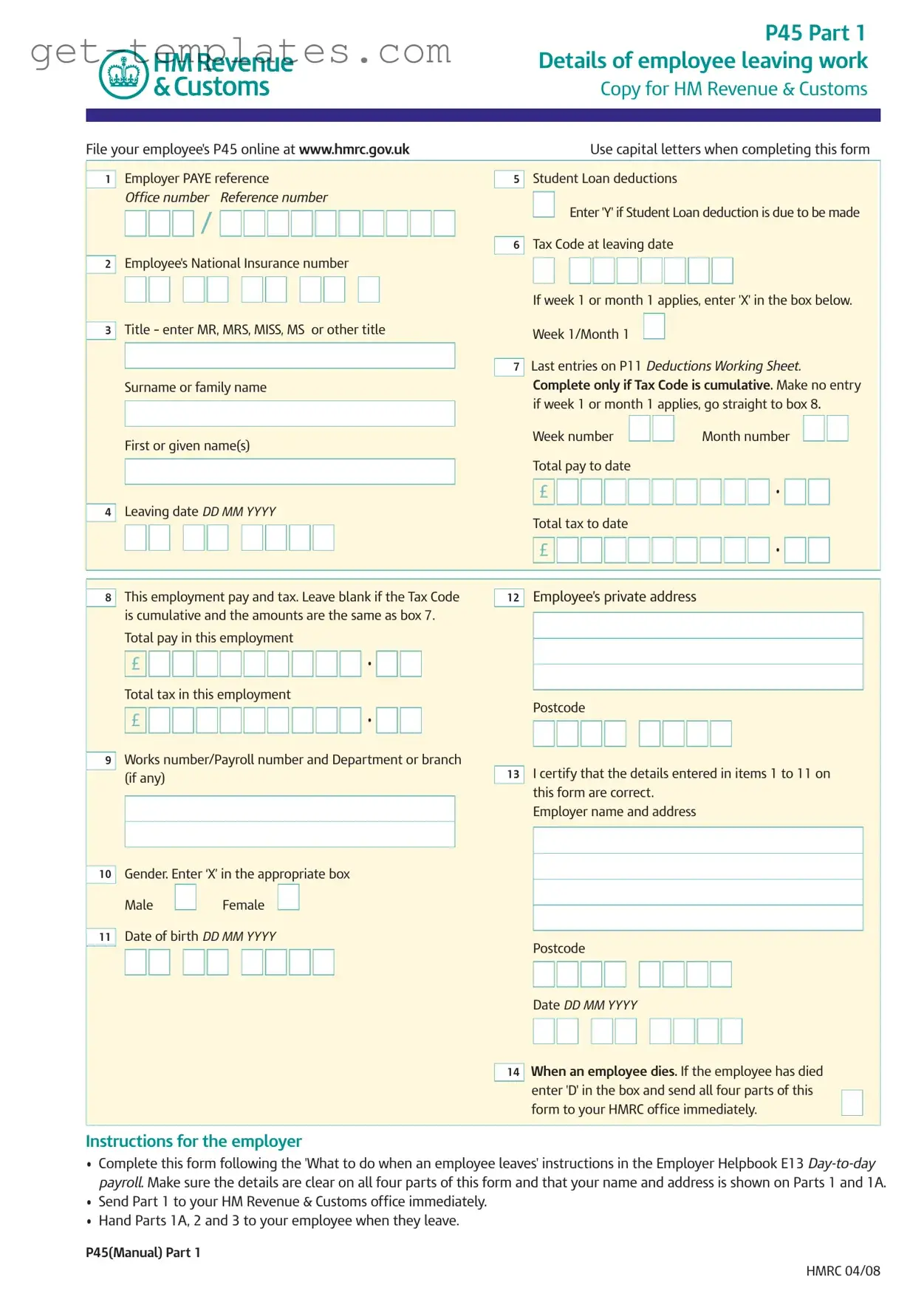

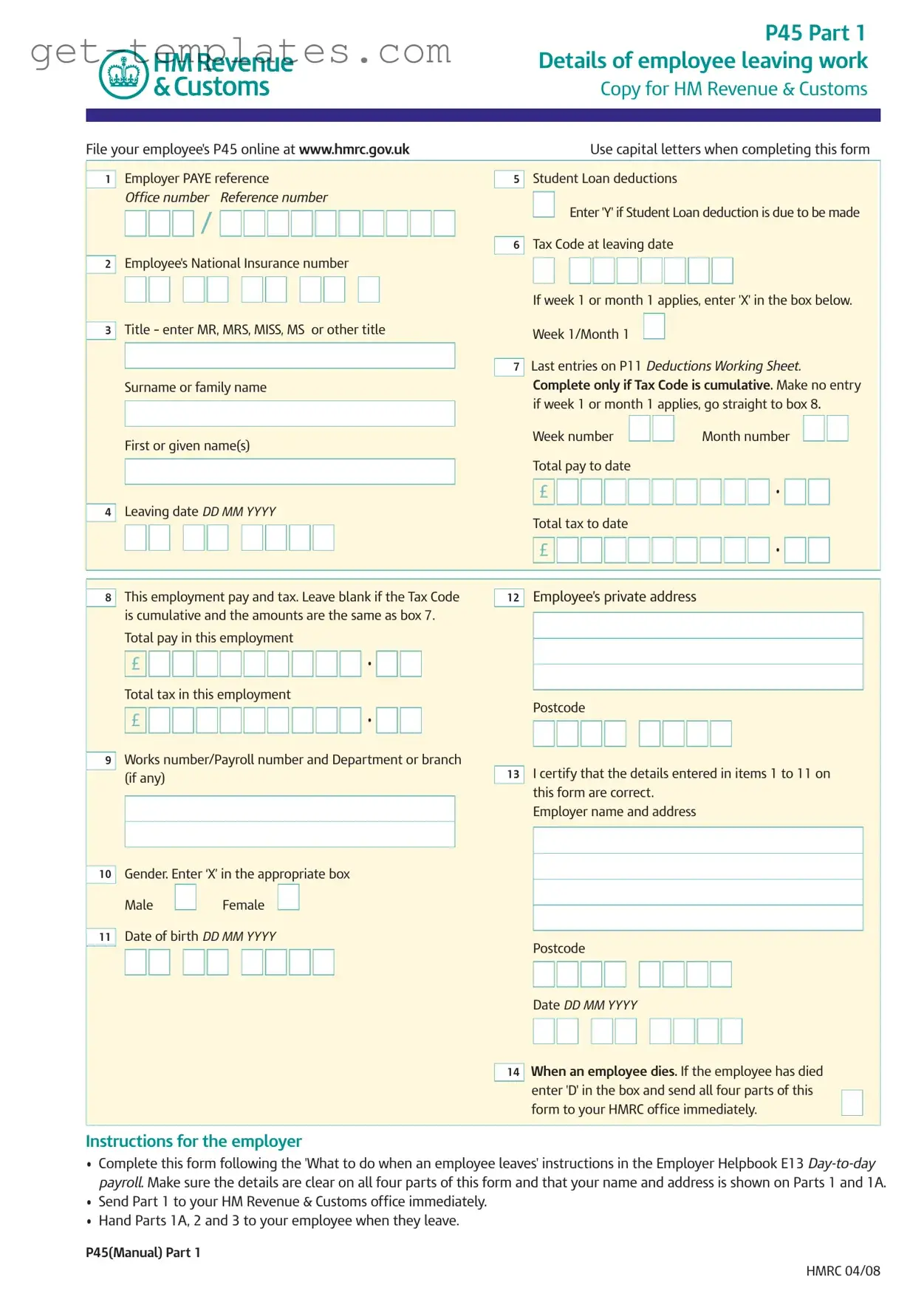

The P45 It form is a document that records details about an employee who has left their job. It is divided into three parts, providing essential information for both the employee and the employer. Completing this form accurately is crucial for ensuring proper tax handling and compliance with HM Revenue & Customs regulations.

Get Document Online

Fill in a Valid P 45 It Template

Get Document Online

You’re halfway through — finish the form

Finish P 45 It online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form

/

/

•

•

•

•

/

/

•

•