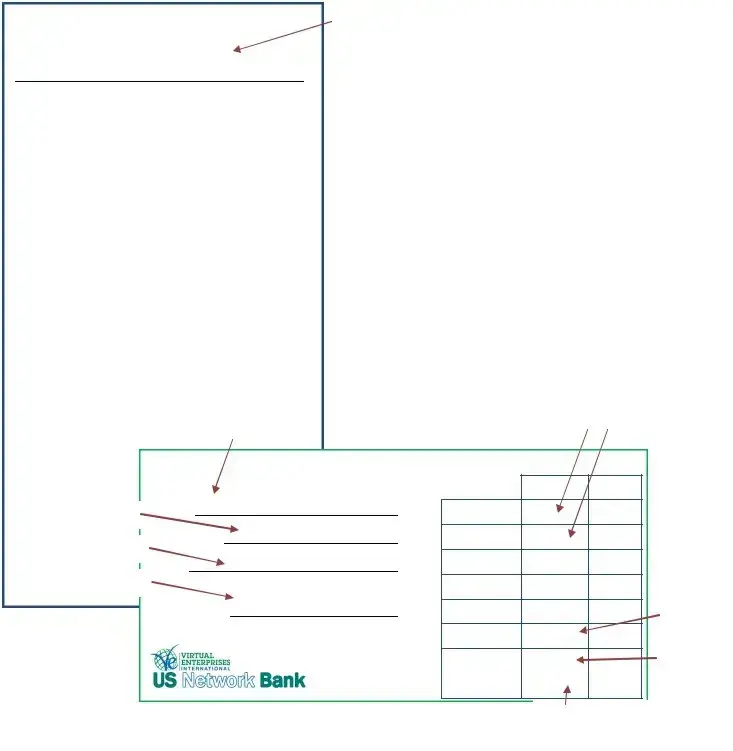

Fill in a Valid Payroll Check Template

The Payroll Check form serves as a crucial document in the employment process, detailing the payment made to employees for their work. This form not only outlines the amount earned but also includes necessary deductions such as taxes and benefits. Understanding its components is essential for both employers and employees to ensure accurate and timely compensation.

Get Document Online

Fill in a Valid Payroll Check Template

Get Document Online

You’re halfway through — finish the form

Finish Payroll Check online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form