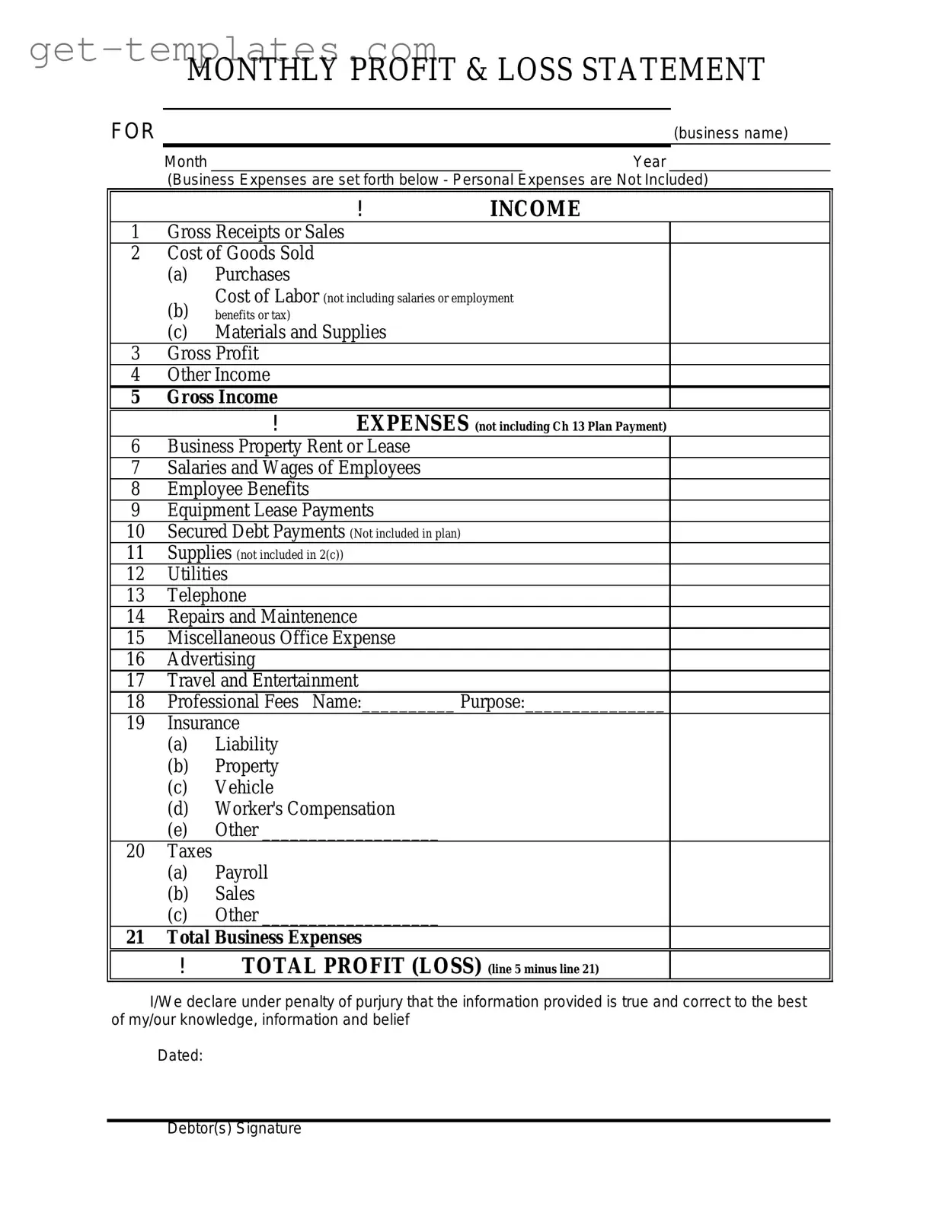

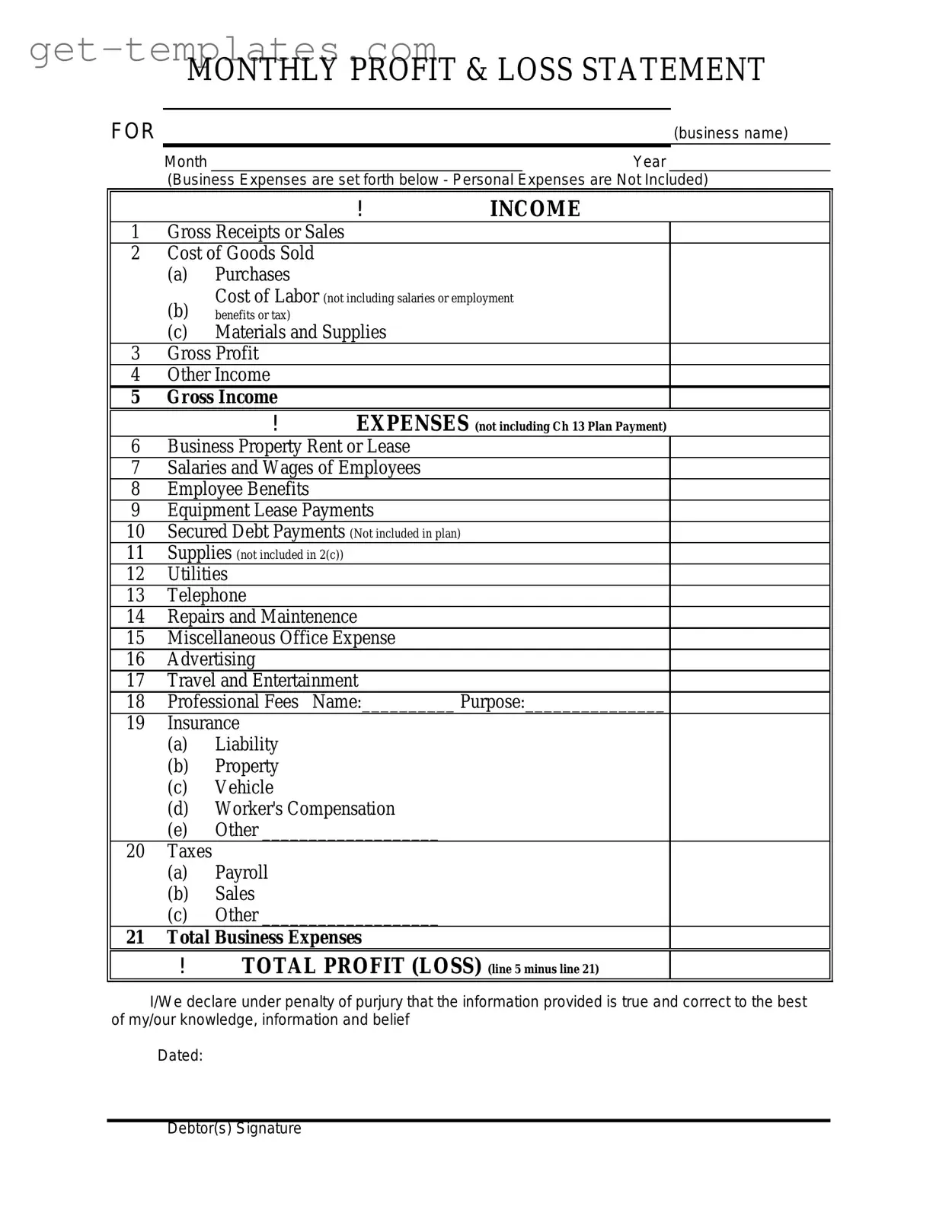

Fill in a Valid Profit And Loss Template

The Profit and Loss form, also known as an income statement, summarizes a company's revenues, costs, and expenses over a specific period. This essential financial document provides insights into a business's profitability and operational efficiency. Understanding how to read and interpret this form is crucial for business owners and stakeholders alike.

Get Document Online

Fill in a Valid Profit And Loss Template

Get Document Online

You’re halfway through — finish the form

Finish Profit And Loss online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form