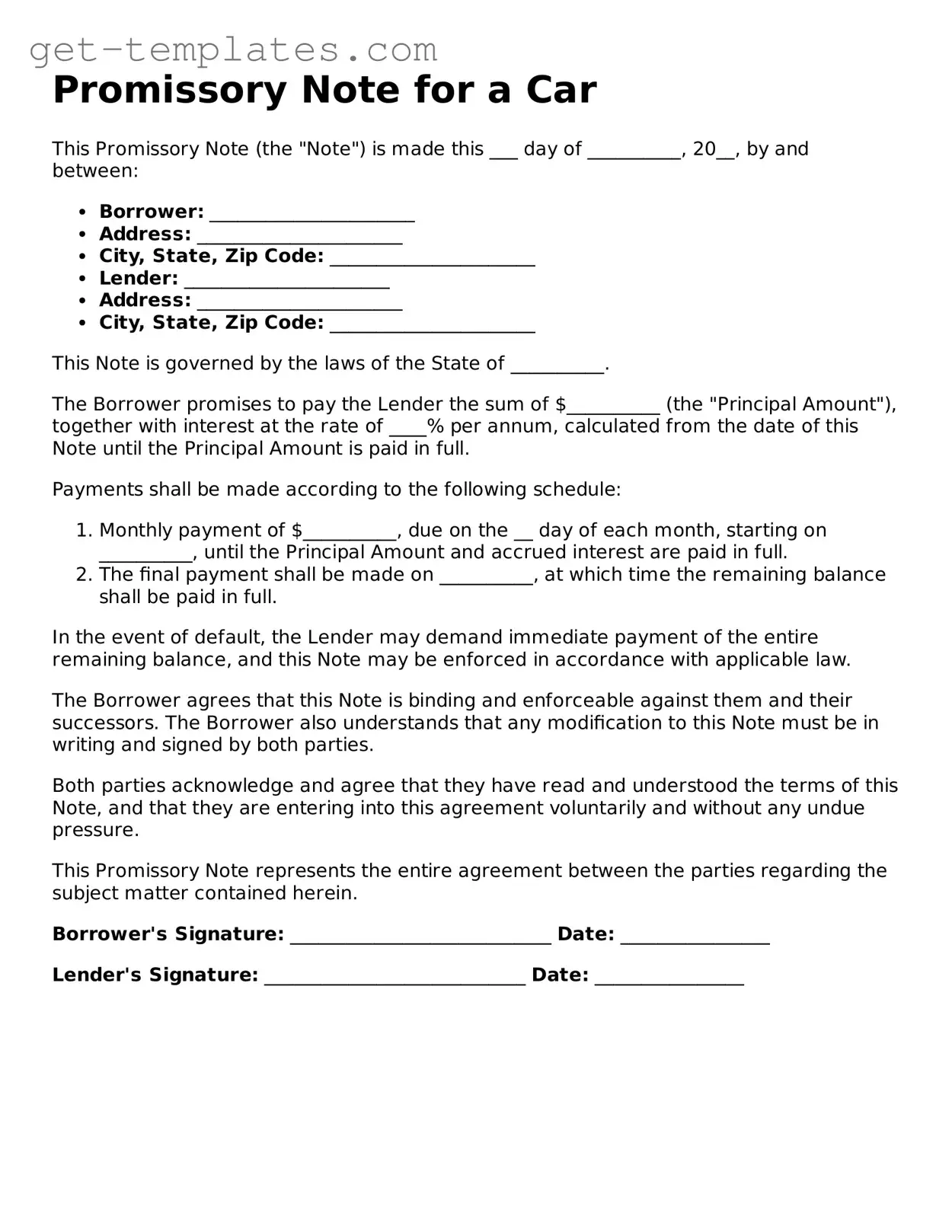

Attorney-Approved Promissory Note for a Car Form

A Promissory Note for a Car is a legal document that outlines the borrower's promise to repay a specified amount of money for the purchase of a vehicle. This note serves as a written agreement between the buyer and the seller, detailing the terms of the loan, including the interest rate and payment schedule. Understanding this form is crucial for both parties to ensure a smooth transaction and avoid potential disputes.

Get Document Online

Attorney-Approved Promissory Note for a Car Form

Get Document Online

You’re halfway through — finish the form

Finish Promissory Note for a Car online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form