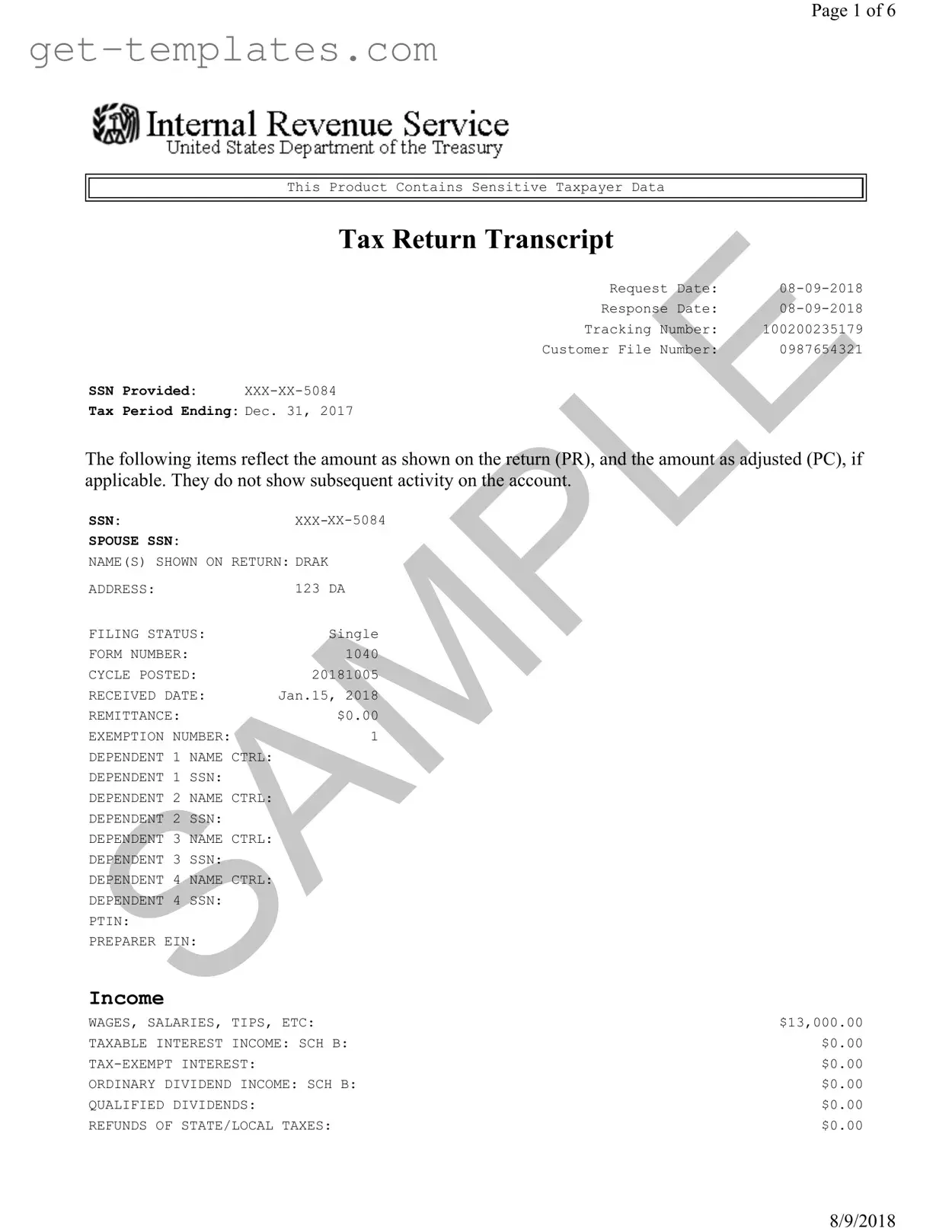

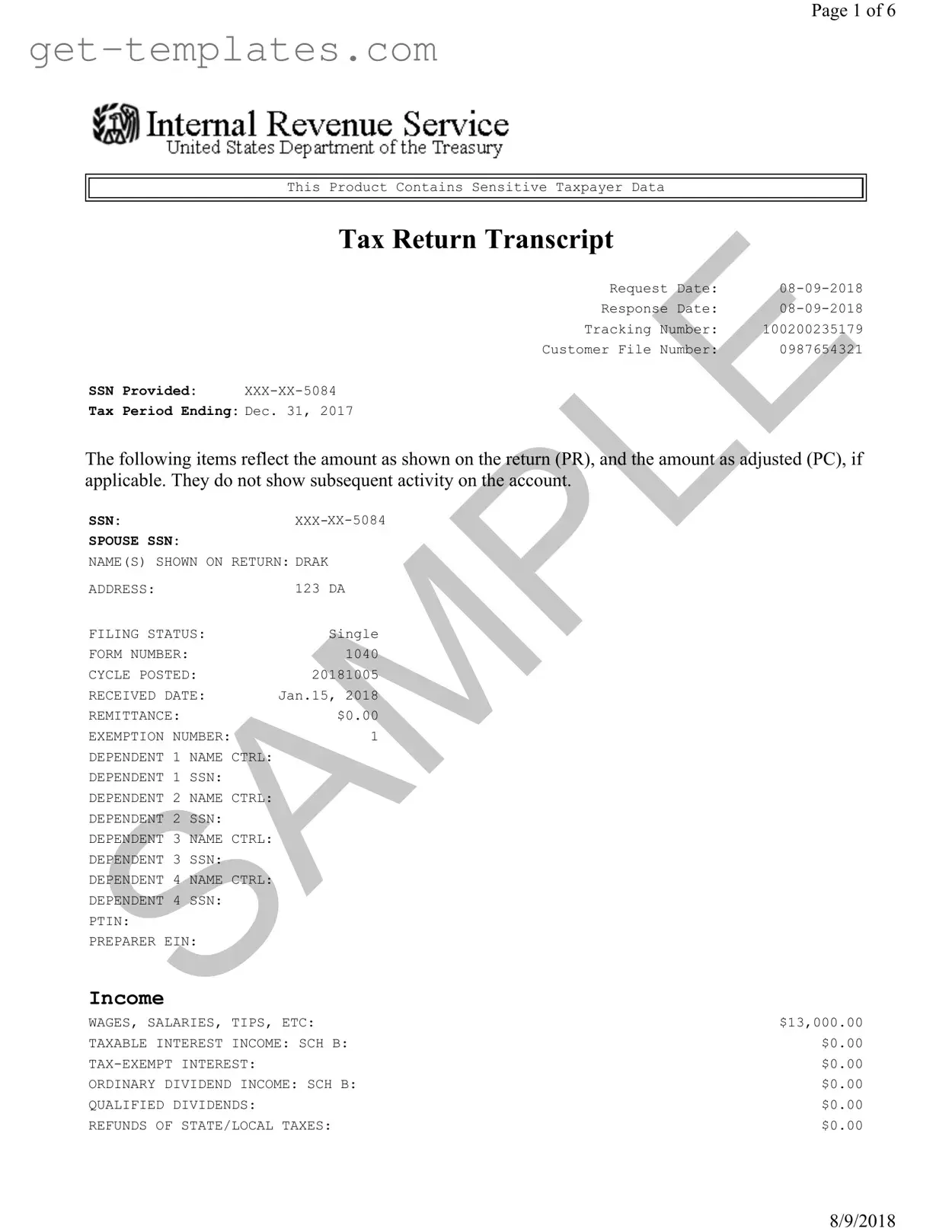

Fill in a Valid Sample Tax Return Transcript Template

The Sample Tax Return Transcript form is a document that provides a summary of a taxpayer's income, deductions, and tax liabilities as reported on their tax return. It is often used for various purposes, such as verifying income for loans or financial aid. Understanding this form can help taxpayers navigate their financial responsibilities more effectively.

Get Document Online

Fill in a Valid Sample Tax Return Transcript Template

Get Document Online

You’re halfway through — finish the form

Finish Sample Tax Return Transcript online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form