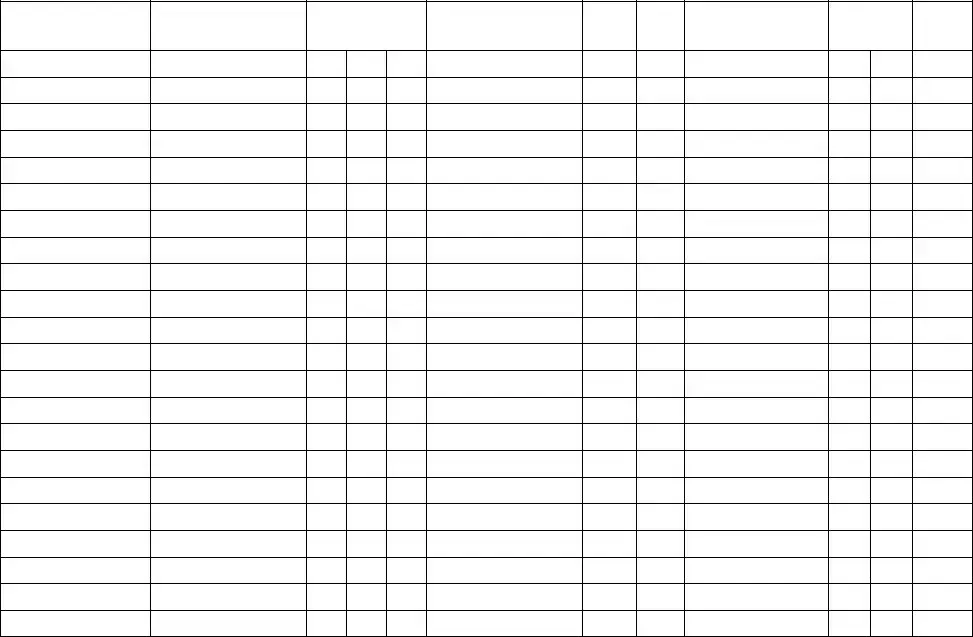

Fill in a Valid Stock Transfer Ledger Template

The Stock Transfer Ledger form is a crucial document that records the issuance and transfer of stock shares within a corporation. It captures essential details such as the names of stockholders, the number of shares issued, and the dates of transfers. This form ensures transparency and accuracy in maintaining a corporation's ownership records.

Get Document Online

Fill in a Valid Stock Transfer Ledger Template

Get Document Online

You’re halfway through — finish the form

Finish Stock Transfer Ledger online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form