Attorney-Approved Articles of Incorporation Document for Texas

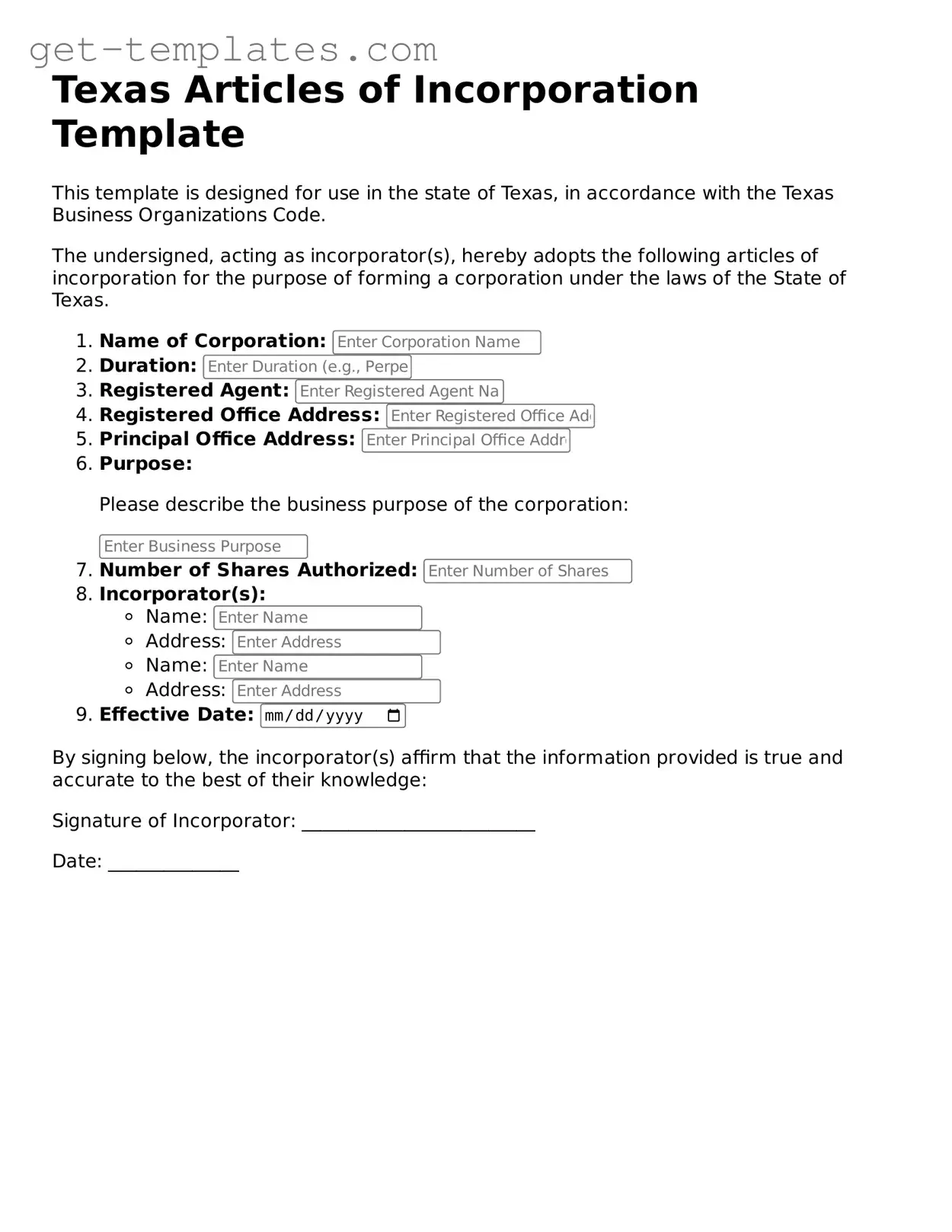

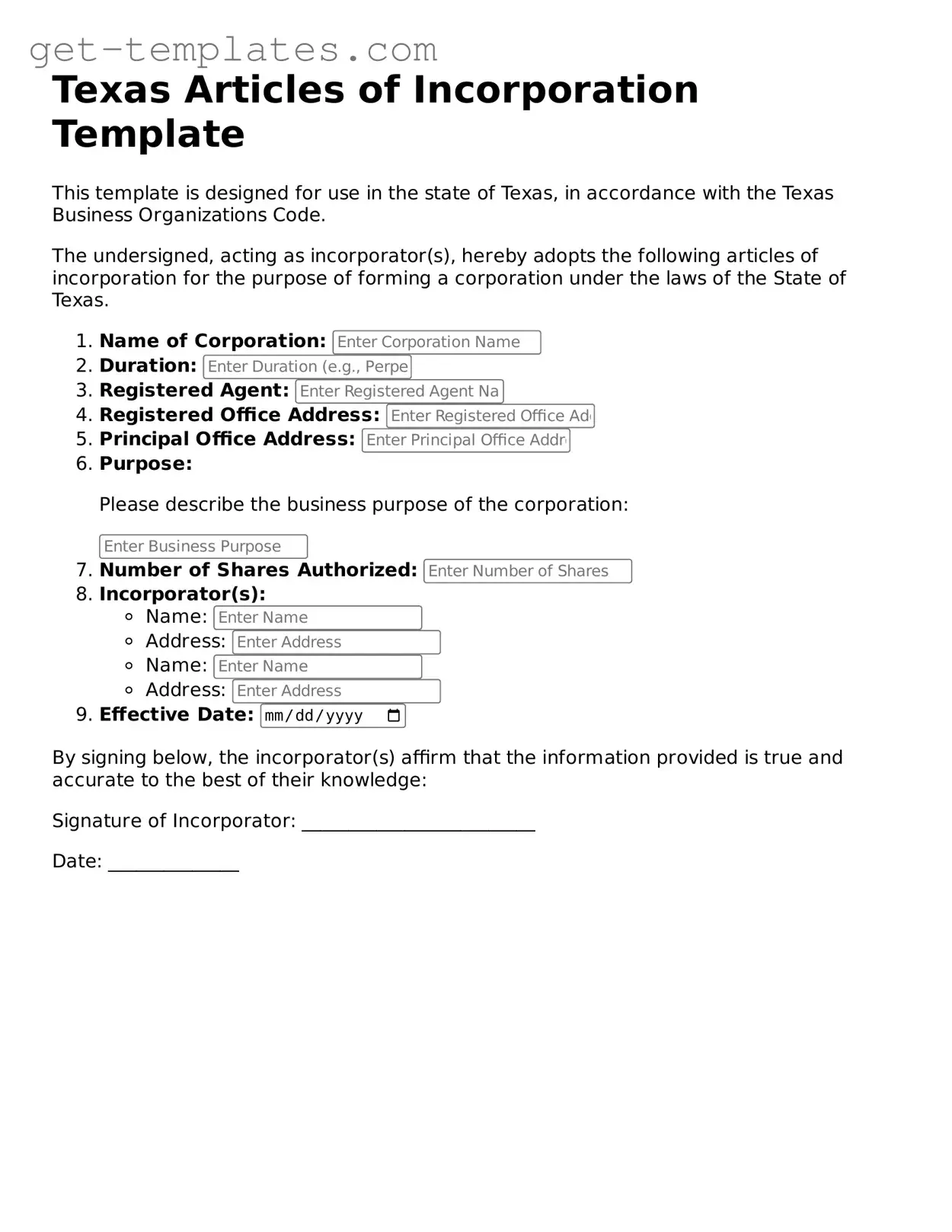

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. This form outlines essential details such as the corporation's name, purpose, and structure, serving as the foundation for the organization’s existence. By filing this document with the Texas Secretary of State, individuals can create a distinct legal entity that offers liability protection and other benefits.

Get Document Online

Attorney-Approved Articles of Incorporation Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Articles of Incorporation online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form