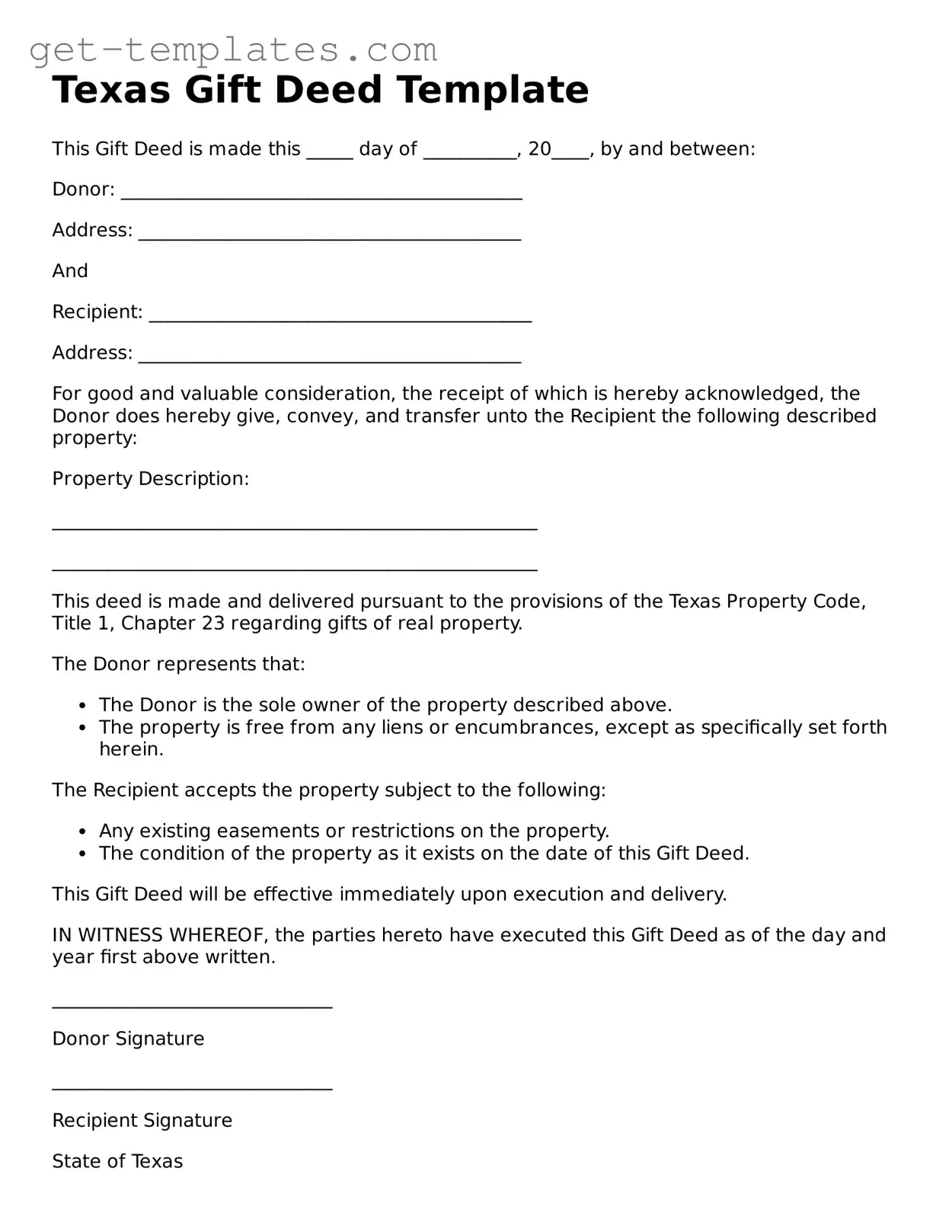

Attorney-Approved Gift Deed Document for Texas

A Texas Gift Deed is a legal document that allows a property owner to transfer ownership of real estate to another person without receiving payment in return. This form is often used to give property to family members or friends as a gesture of goodwill. Understanding how to properly execute a Gift Deed is essential to ensure the transfer is valid and recognized by the state.

Get Document Online

Attorney-Approved Gift Deed Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Gift Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form