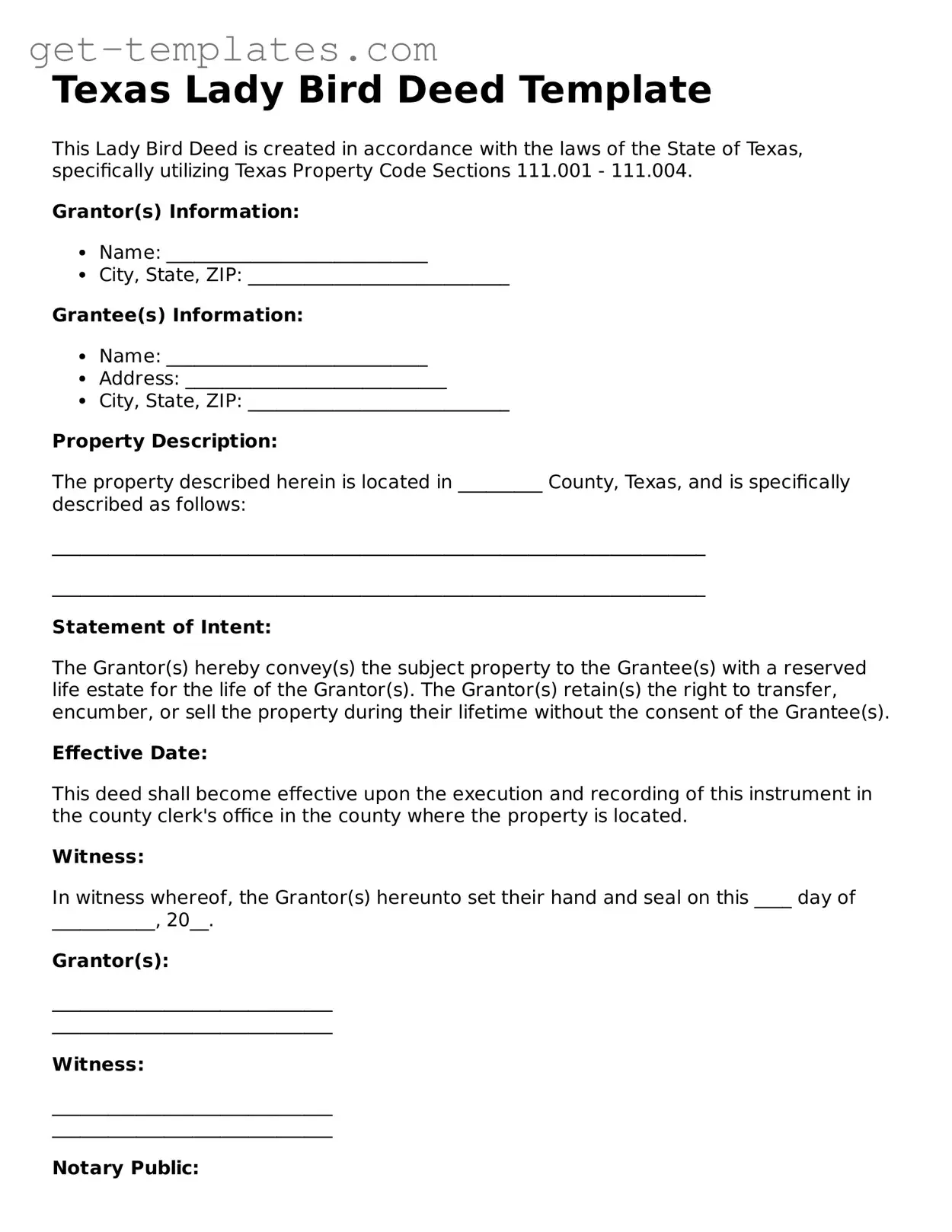

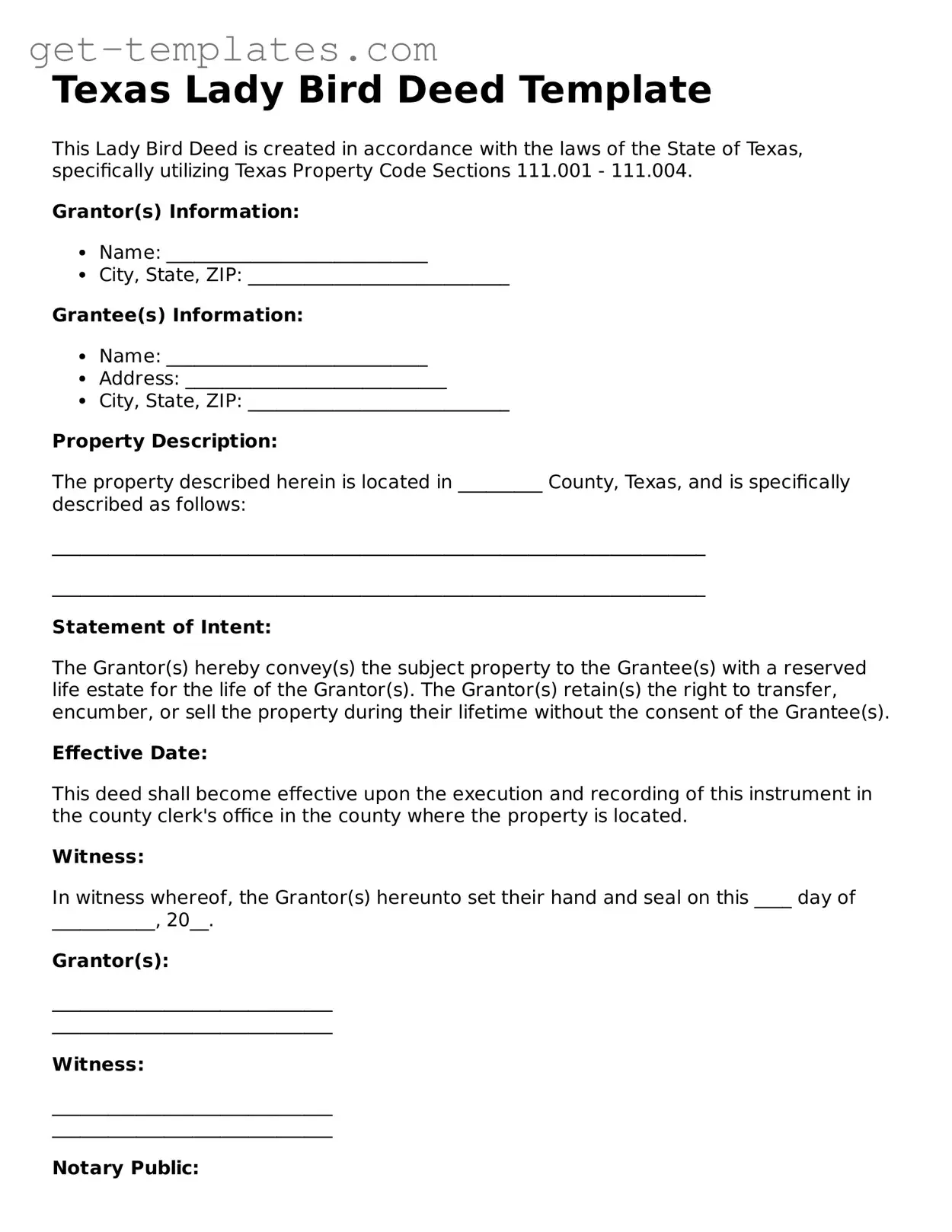

Attorney-Approved Lady Bird Deed Document for Texas

The Texas Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This form provides a way to avoid probate, ensuring that the property automatically passes to the designated individuals upon the owner's death. With its unique features, the Lady Bird Deed can offer flexibility and control in estate planning.

Get Document Online

Attorney-Approved Lady Bird Deed Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Lady Bird Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form