Attorney-Approved Loan Agreement Document for Texas

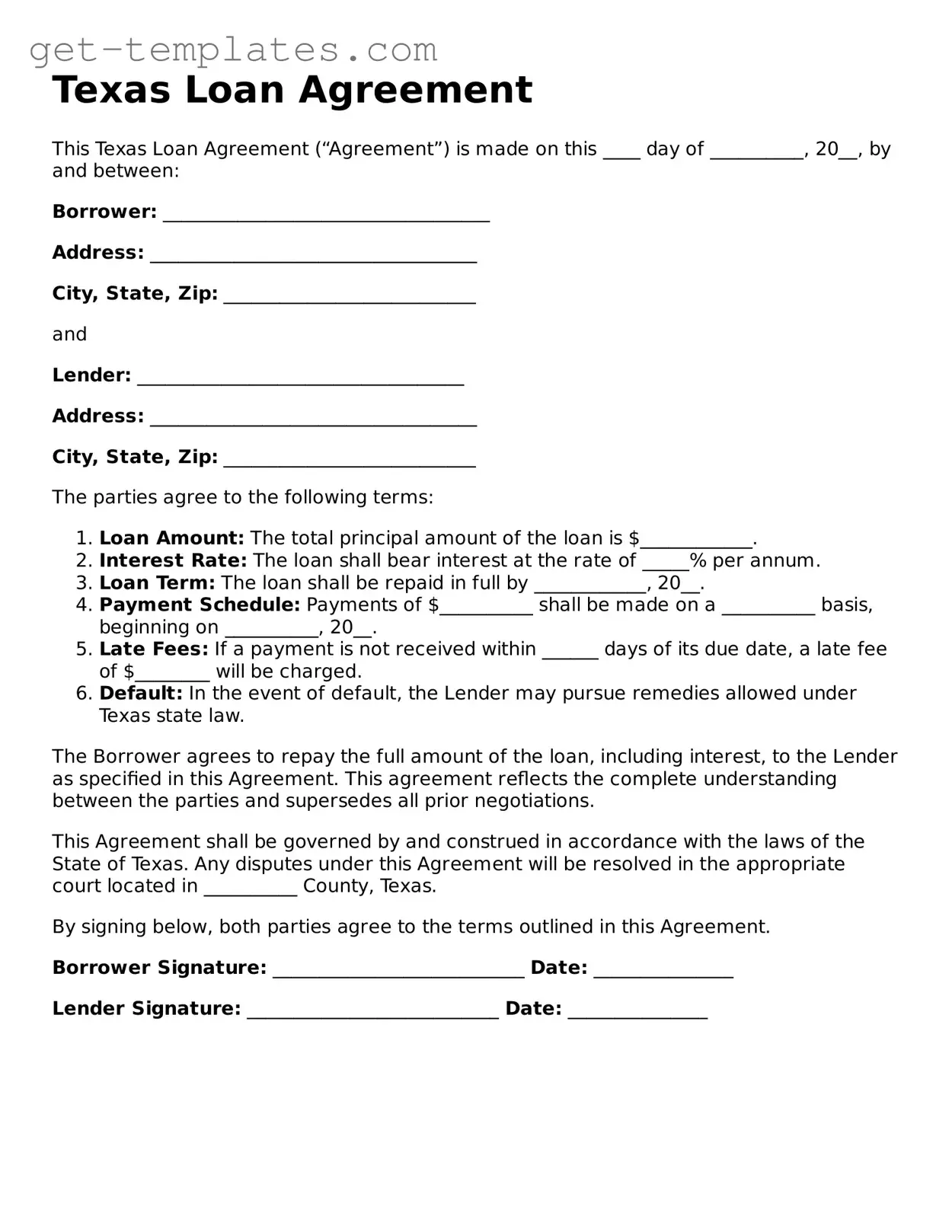

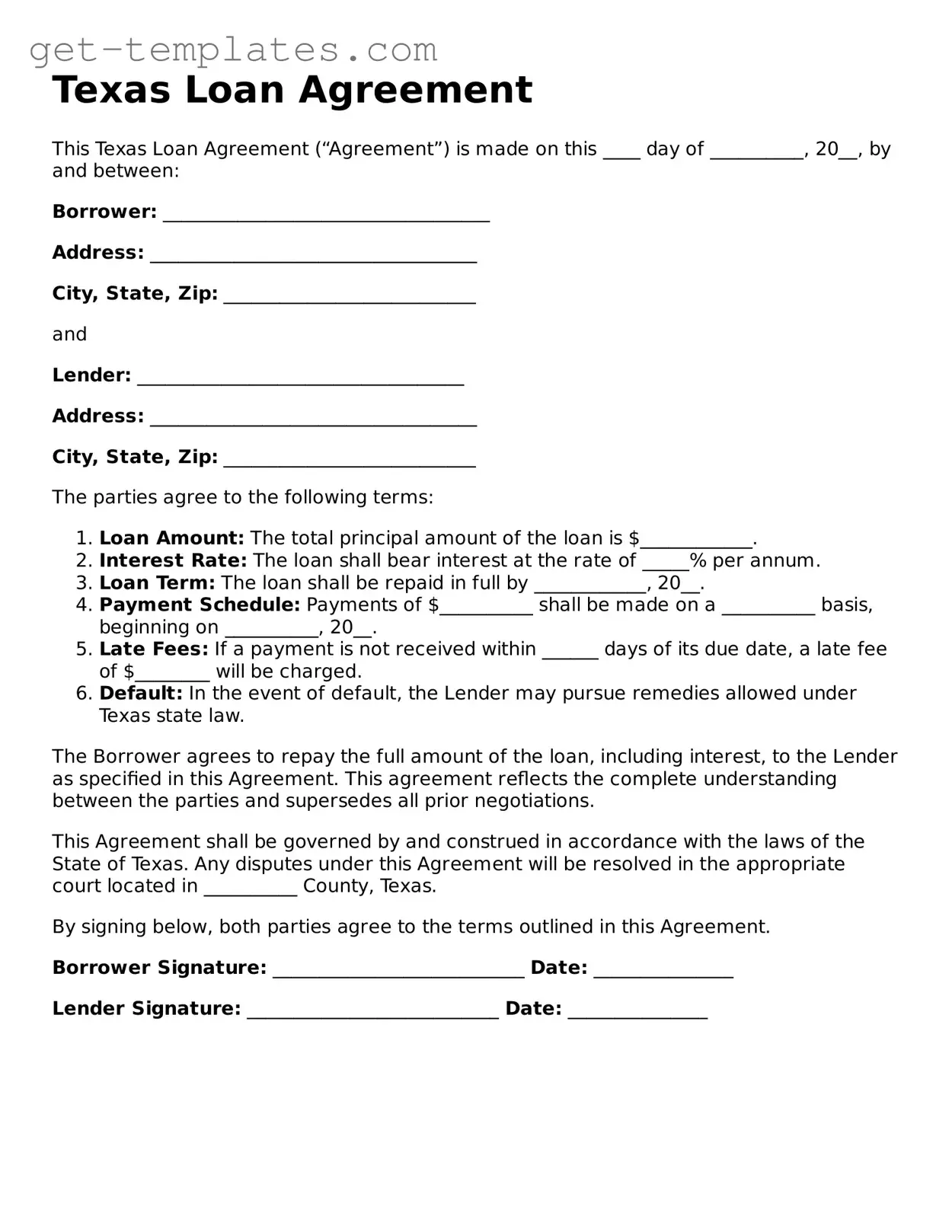

A Texas Loan Agreement form is a legal document outlining the terms and conditions of a loan between a lender and a borrower in Texas. This form establishes the obligations of both parties, including repayment terms, interest rates, and any collateral involved. Understanding this agreement is essential for ensuring a smooth borrowing process and protecting the interests of both the lender and borrower.

Get Document Online

Attorney-Approved Loan Agreement Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Loan Agreement online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form