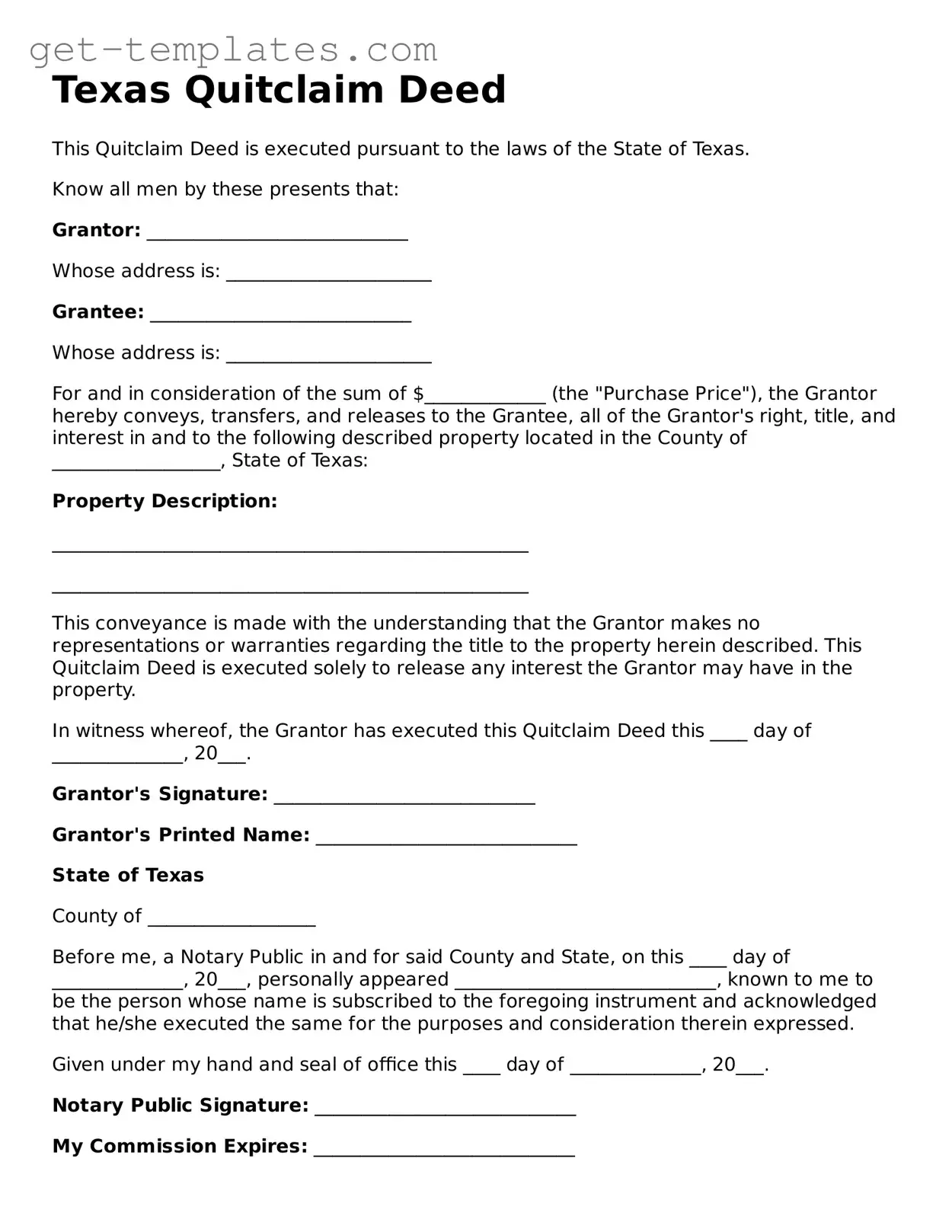

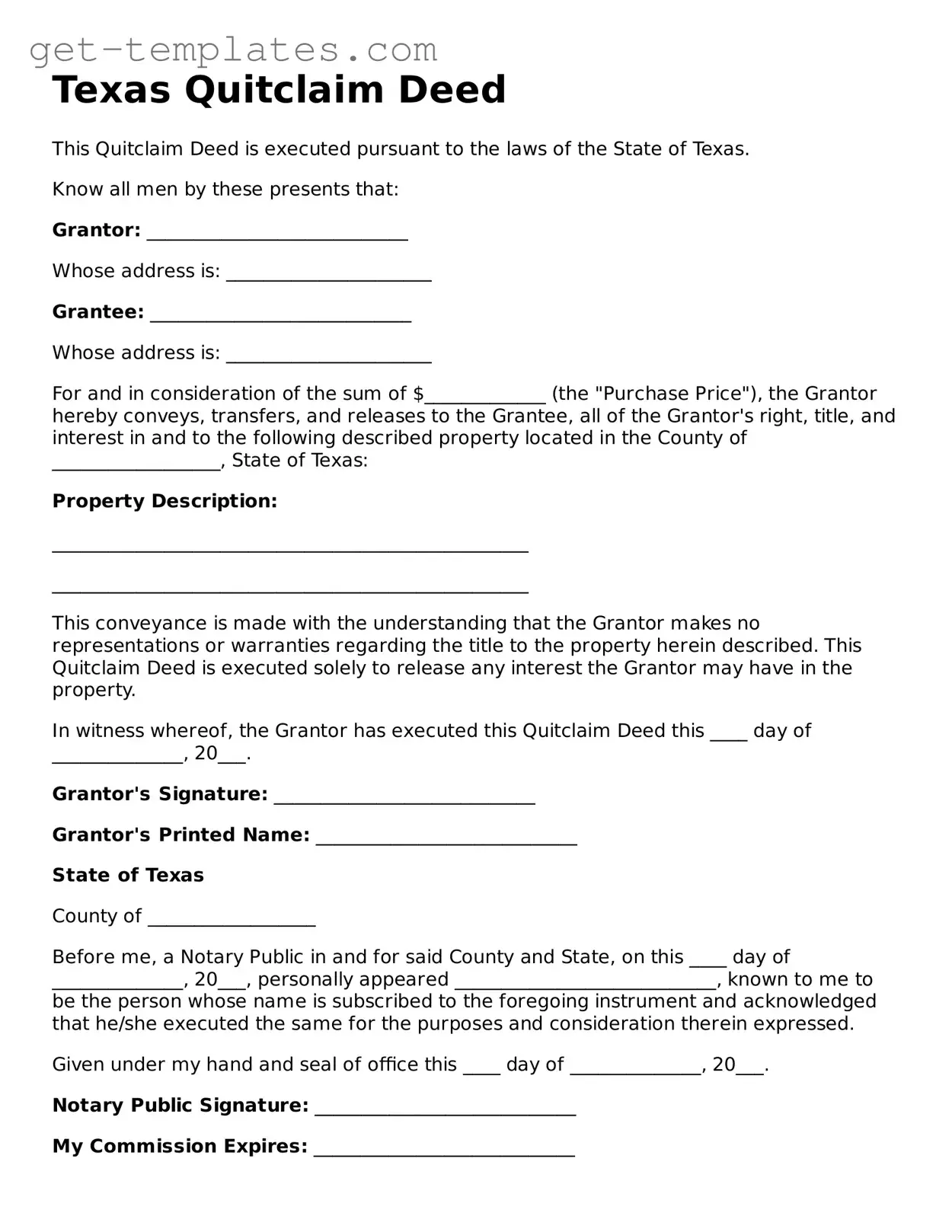

Attorney-Approved Quitclaim Deed Document for Texas

A Texas Quitclaim Deed is a legal document that allows a property owner to transfer their interest in real estate to another party without guaranteeing that the title is free of claims. This type of deed is often used in situations where the transfer is between family members or in other informal arrangements. Understanding its implications can help ensure a smooth property transfer process.

Get Document Online

Attorney-Approved Quitclaim Deed Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Quitclaim Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form