Attorney-Approved Tractor Bill of Sale Document for Texas

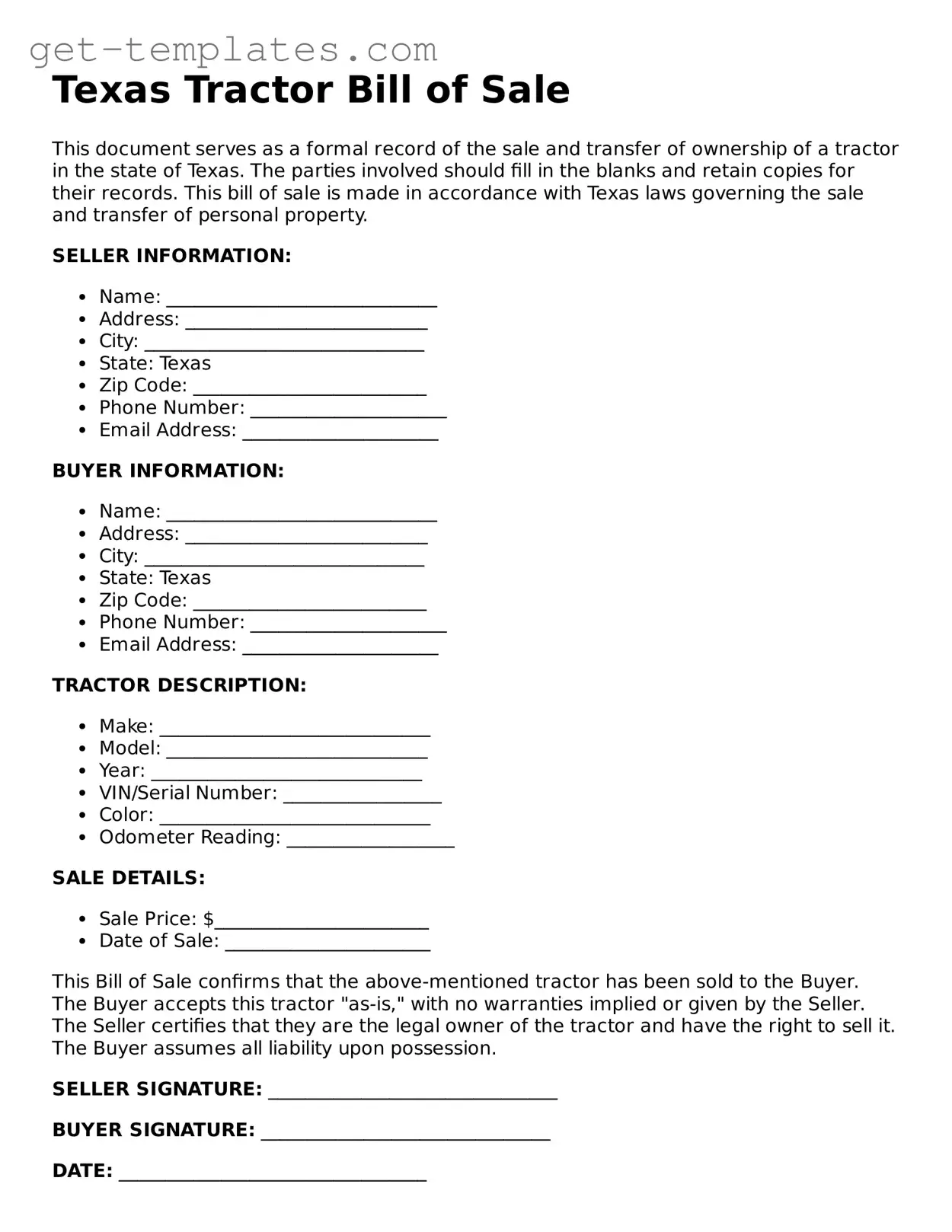

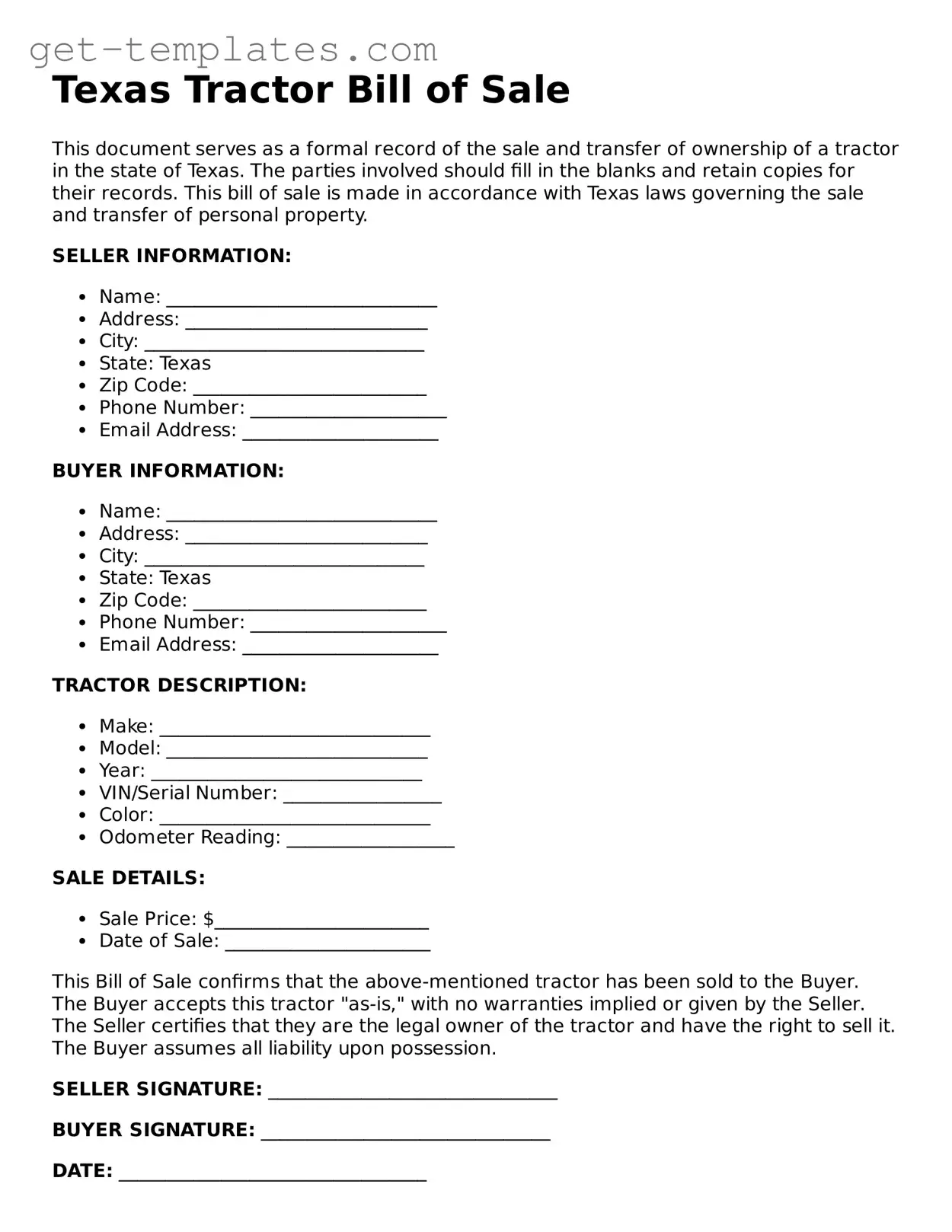

The Texas Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in Texas. This form provides essential details about the transaction, including the buyer, seller, and specifics of the tractor. Completing this document helps ensure a smooth transfer of ownership and protects the interests of both parties involved.

Get Document Online

Attorney-Approved Tractor Bill of Sale Document for Texas

Get Document Online

You’re halfway through — finish the form

Finish Tractor Bill of Sale online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form