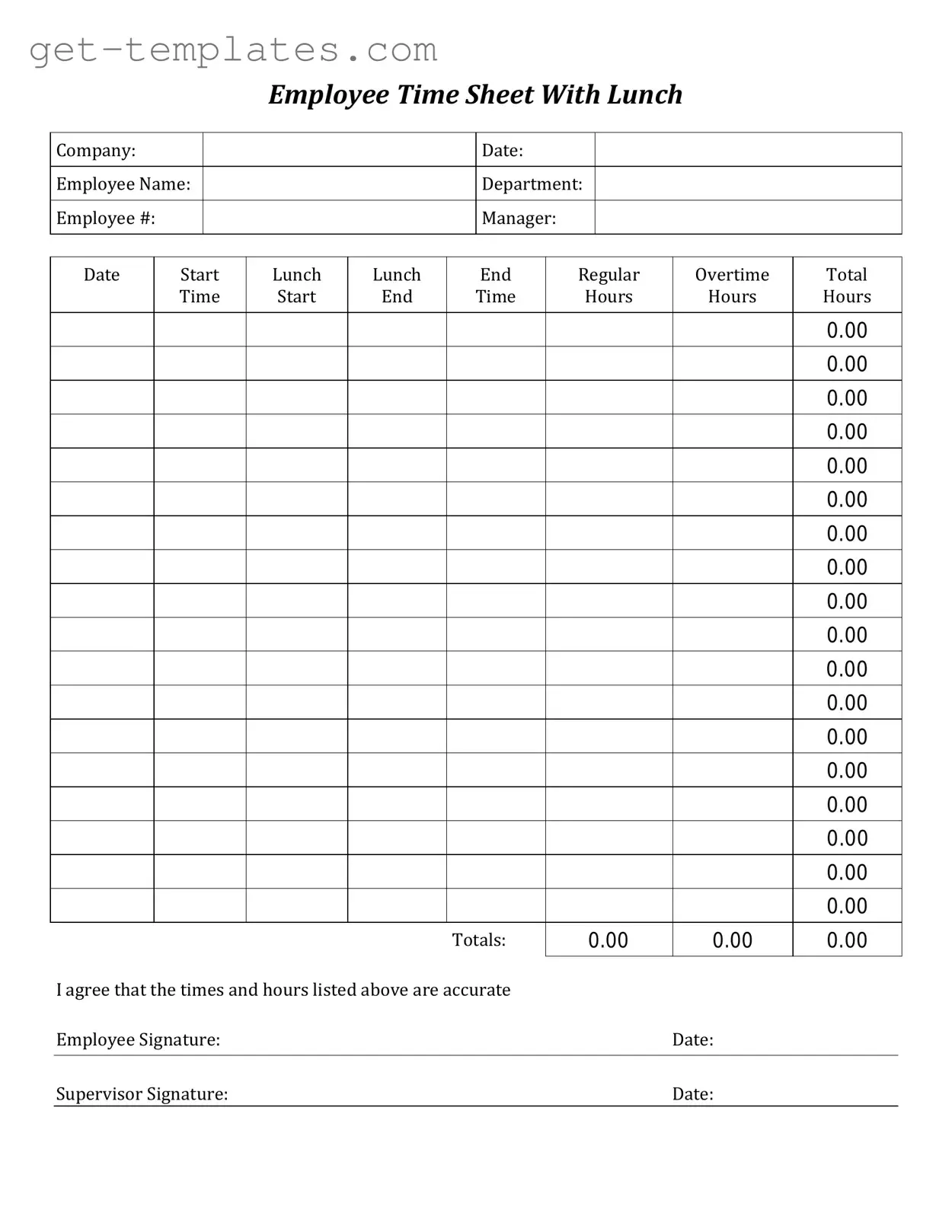

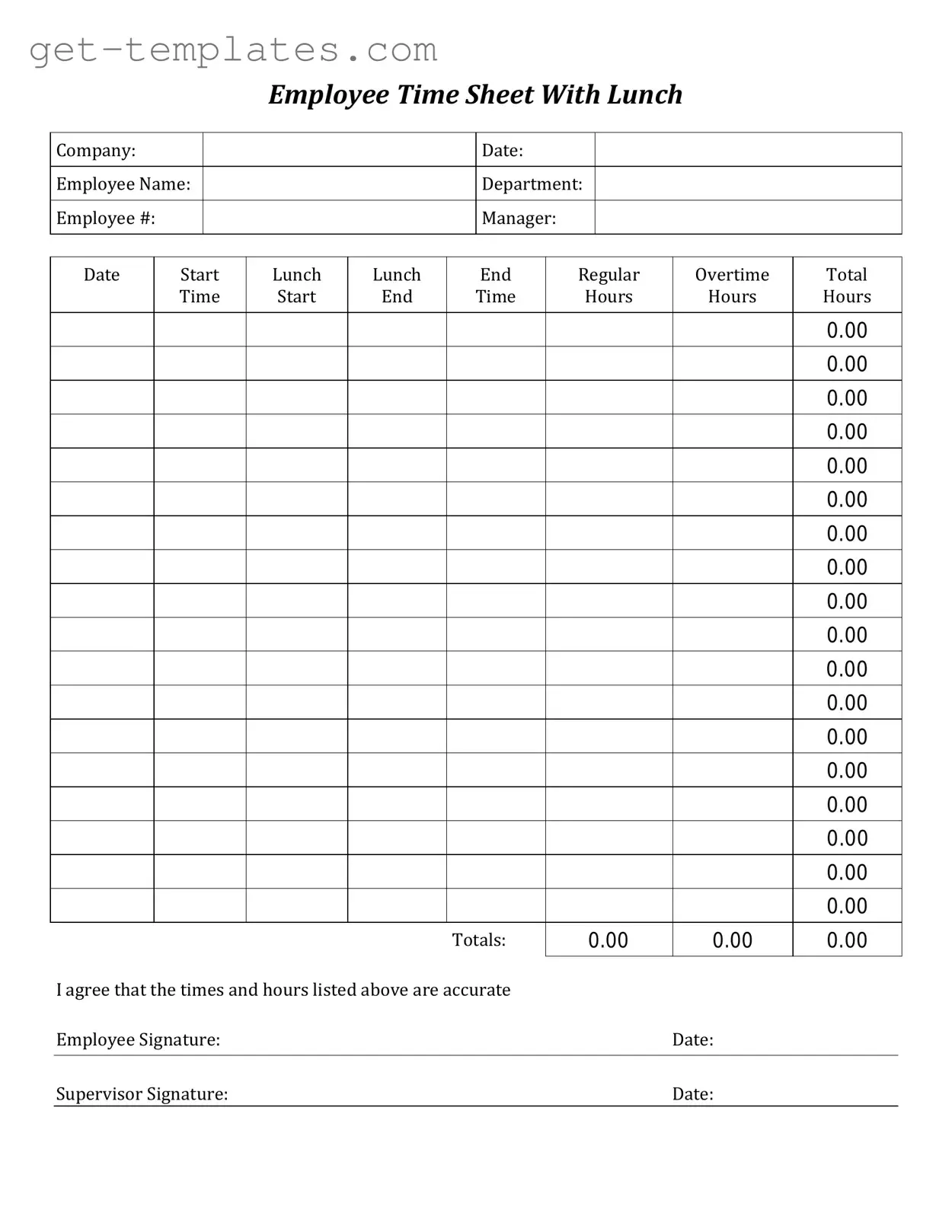

A Time Card form is a document used by employees to record the hours they work during a specific pay period. It helps track time spent on various tasks and ensures accurate payroll processing.

Why is it important to fill out the Time Card accurately?

Filling out the Time Card accurately is crucial for several reasons:

-

Ensures you are paid correctly for the hours worked.

-

Helps maintain compliance with labor laws and company policies.

-

Provides a record of your work hours for future reference.

To fill out the Time Card form, follow these steps:

-

Enter your name and employee ID at the top of the form.

-

Record the date and the hours worked each day.

-

Include any breaks taken during your shifts.

-

Sign and date the form at the end of the pay period.

What should I do if I make a mistake on my Time Card?

If you make a mistake, cross out the incorrect entry and write the correct information next to it. Initial the correction to indicate that it was made by you. If the mistake is significant, consider discussing it with your supervisor.

When is the Time Card due?

The Time Card is typically due at the end of each pay period. Check with your supervisor or the HR department for the specific deadlines, as they may vary by company.

What if I forget to submit my Time Card?

If you forget to submit your Time Card, notify your supervisor as soon as possible. They may allow you to submit it late, but be aware that this could delay your paycheck.

Can I submit my Time Card electronically?

Many companies now offer electronic submission options for Time Cards. Check with your HR department to see if this is available and to learn about the process for submitting electronically.

What happens if I work overtime?

If you work overtime, make sure to record those hours separately on your Time Card. Overtime hours are usually paid at a higher rate, so it's essential to document them accurately.

If you have questions about your Time Card, reach out to your supervisor or the HR department. They can provide guidance and clarify any uncertainties you may have.

What should I do if my Time Card is lost?

If your Time Card is lost, inform your supervisor immediately. You may need to fill out a new form or provide a verbal account of your hours worked to ensure you receive proper payment.