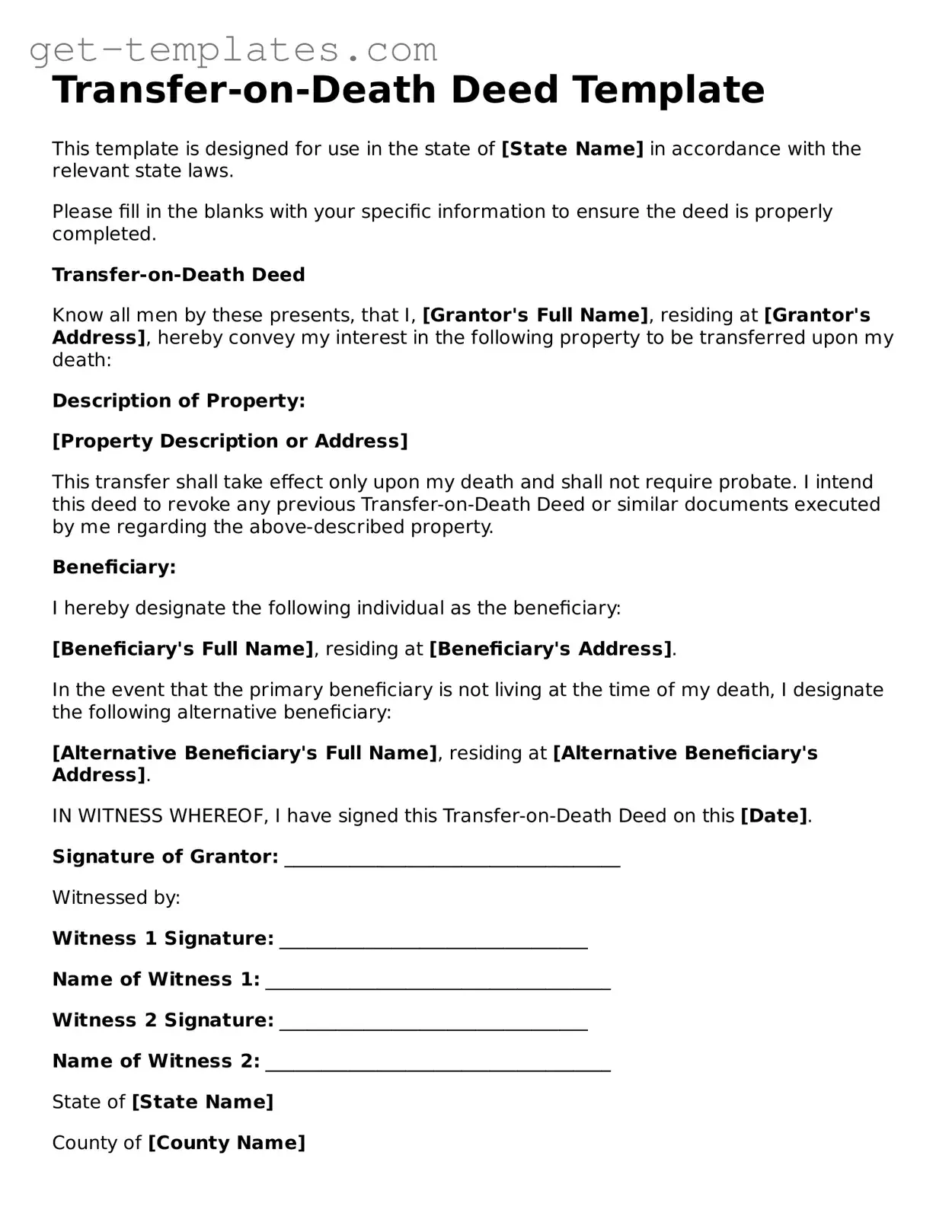

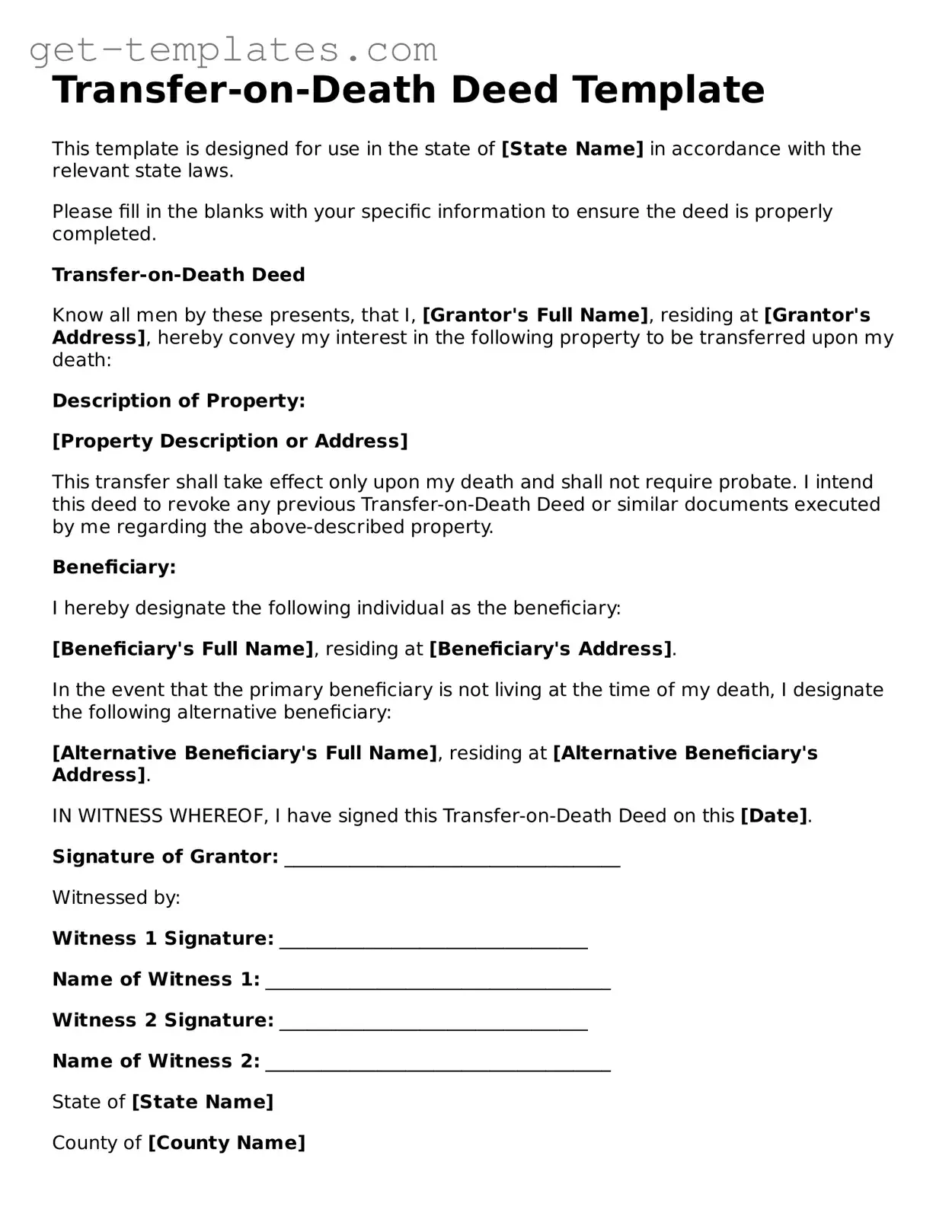

Attorney-Approved Transfer-on-Death Deed Form

A Transfer-on-Death Deed is a legal document that allows you to transfer real estate to a beneficiary upon your death, without going through probate. This simple tool can help streamline the process of passing on property and ensures that your wishes are honored. Understanding how this deed works can make a significant difference in estate planning.

Get Document Online

Attorney-Approved Transfer-on-Death Deed Form

Get Document Online

You’re halfway through — finish the form

Finish Transfer-on-Death Deed online — edit, save, download made easy.

Get Document Online

or

⇓ PDF Form